Table of Contents

The crypto market comes with its own language. If you spend time reading market commentary, browsing community forums, or following crypto news, you’ll quickly come across short terms like HODL, FOMO, FUD, and DYOR. These are not just casual expressions; they are among the most widely used crypto acronyms and reflect how people respond to fast-moving, uncertain markets.

Understanding crypto acronyms is less about memorizing definitions and more about recognizing patterns in behavior, sentiment, and communication. These terms offer insight into how market participants think, react, and make sense of constant change.

Importance of Acronyms And Slang in Crypto

Crypto markets operate continuously, across time zones, and often without centralized narratives. Information moves quickly, opinions shift rapidly, and emotions can change within hours. In this environment, acronyms and slang make communication more efficient.

Many of the most used crypto acronyms describe emotional states or social behavior, not technical instructions. They help communities express conviction, caution, optimism, or doubt, often before those feelings are visible in price data.

Get WazirX News First

Crypto Acronyms That Reflect Market Behavior And Community Sentiment

This group includes acronyms that respond directly to price action and those that reflect the community’s engagement or confidence during different market phases.

HODL (Hold On For Dear Life)

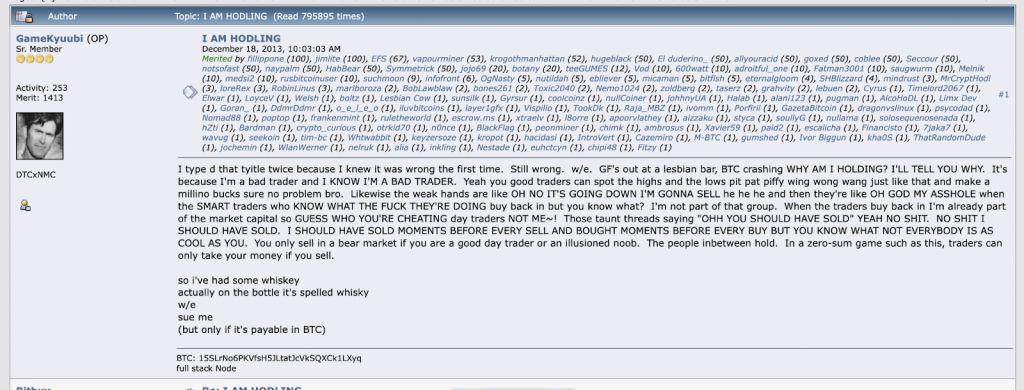

Hold On For Dear Life (HODL) is one of the most widely used crypto acronyms and has an unusual origin. The term first appeared in 2013 as a misspelling of the word “holding” in a Bitcoin forum post titled “I AM HODLING”, written during a period of sharp market volatility. The misspelling resonated with the community and quickly became part of crypto culture.

Over time, HODL was given a backronym, “Hold On for Dear Life”, which aligned with the mindset it came to represent. Today, the term reflects the idea of holding crypto assets through market swings rather than reacting to short-term price movements. More than a strategy, HODL captures how participants cope with uncertainty and volatility in crypto markets.

(Source)

FOMO (Fear Of Missing Out)

Fear Of Missing Out (FOMO) describes the anxiety that arises when prices rise quickly, and others appear to be benefiting. In crypto markets, FOMO often appears during periods of strong momentum and widespread attention.

Examples of FOMO include:

- Feeling pressure to participate because prices are rising rapidly

- Increased excitement driven by headlines or social media activity

- Decisions influenced by what others seem to be doing rather than by understanding

FOMO reflects how social signals and collective excitement can shape behavior in fast-moving markets.

FUD (Fear, Uncertainty, And Doubt)

Fear, Uncertainty, And Doubt (FUD) refers to negative sentiment that spreads during periods of uncertainty or stress. It can stem from misinformation, genuine concern, or heightened emotional reactions to news and market moves.

Common examples of FUD include:

- Broad claims that a project or the market is “over” after a sharp price drop

- Speculation around regulation or policy changes before details are confirmed

- Heightened focus on isolated negative events during otherwise stable conditions

The acronym reflects how quickly narratives can influence perception, especially when confidence is fragile. FUD often becomes more visible during market corrections or prolonged sideways phases (long periods where prices move very little), when uncertainty is already high.

WAGMI (We’re All Gonna Make It)

We’re All Gonna Make It (WAGMI) expresses shared optimism and belief in long-term outcomes. It is commonly used during positive market phases or moments of renewed confidence, especially after periods of uncertainty.

Examples of WAGMI in context include:

- Community members are encouraged to be patient after a market recovery

- Expressions of confidence when long-term developments or upgrades are announced

- Messages emphasizing collective progress rather than short-term price movement

The phrase reinforces a sense of community and shared outlook. WAGMI reflects how optimism spreads socially in crypto markets, often helping counter periods of doubt or fatigue.

NGMI (Not Gonna Make It)

Not Gonna Make It (NGMI) is used to express skepticism or concern, often during difficult or uncertain periods. It may be directed at behaviors, decisions, or broader market narratives.

Examples of NGMI include:

- Warnings against overly optimistic assumptions during uncertain conditions

- Frustration with repeated mistakes or unrealistic expectations

- Expressions of doubt when sentiment shifts from confidence to caution

NGMI reflects how quickly confidence can turn into skepticism in changing market environments.

DYOR (Do Your Own Research)

Do Your Own Research (DYOR) encourages individuals to verify information independently rather than relying on opinions or hype. It reflects awareness that crypto information varies widely in quality.

Rather than offering certainty, DYOR emphasizes responsibility and critical thinking. The phrase highlights the importance of learning and understanding before forming conclusions.

GM (Good Morning)

Good Morning (GM) is a greeting widely used across crypto communities, regardless of time zone. While simple, its usage often signals participation, presence, and morale. GM activity tends to increase during optimistic or rebuilding phases and fade during periods of disengagement. It reflects the market’s social pulse.

Crypto Acronyms Related To Market Structure And Infrastructure

CEX (Centralized Exchange)

A Centralized Exchange (CEX) is a platform where users can buy, sell, and store crypto through a company that manages trading and custody. These platforms often provide higher liquidity and customer support but require trust in the operator. CEXs reflect the extent to which crypto participation still occurs through centralized systems.

DEX (Decentralized Exchange)

A Decentralized Exchange (DEX) allows users to trade directly from their wallets using smart contracts. Users retain control over their assets without a central intermediary. DEX usage often increases when self-custody and transparency become priorities. The term reflects crypto’s push toward decentralization.

DeFi (Decentralized Finance)

Decentralized Finance (DeFi) refers to financial services built on blockchains without traditional intermediaries. These systems enable activities like lending and trading through code-based protocols. DeFi is often associated with experimentation and innovation. The term reflects crypto’s ambition to rethink financial infrastructure.

DAO (Decentralized Autonomous Organization)

A Decentralized Autonomous Organization (DAO) is an organization governed by rules written into smart contracts rather than managed by a central authority. Decisions are typically made through community voting. DAOs represent new experiments in collective ownership and governance.

Crypto Acronyms Related to Analysis, Time, and Strategy

ALT (Altcoin)

Altcoin (ALT) refers to any crypto that is not Bitcoin. The term now covers thousands of assets. Discussions around altcoins often reflect changing risk appetite. “Alts” are commonly mentioned during experimentation or diversification phases.

ATH (All-Time High)

All-Time High (ATH) refers to the highest price an asset has ever reached. In crypto, ATHs often become emotional reference points. Conversations around ATHs can shape expectations during both rising and falling markets.

DCA (Dollar-Cost Averaging)

Dollar-Cost Averaging (DCA) is the practice of investing a fixed amount at regular intervals, regardless of price. It is often discussed as a way to manage volatility and emotion. In crypto culture, DCA reflects consistency over timing.

EV (Expected Value)

Expected Value (EV) is a probability-based concept used to evaluate outcomes over time. In crypto discussions, it encourages thinking beyond single outcomes. EV reflects a more analytical mindset.

HTF (High Time Frame)

High Time Frame (HTF) refers to viewing charts over longer periods, such as daily or weekly intervals. It is used to understand the broader market structure. The term emphasizes perspective and noise reduction.

LTF (Low Time Frame)

Low Time Frame (LTF) refers to charts viewed over shorter periods, such as minutes or hours. It often arises in discussions of rapid price movements. The term highlights short-term focus.

UTC (Coordinated Universal Time)

Coordinated Universal Time (UTC) is the standard time reference used across crypto markets. It ensures consistency in global charting and event timing. The term reflects crypto’s borderless nature.

Why Understanding the Most Used Crypto Acronyms Matters

Crypto language often changes before markets do. Shifts in commonly used terms can signal changes in sentiment, confidence, or caution. Acronyms act as shorthand for how people interpret events in real time.

Understanding crypto terminology does not provide certainty; it provides context in markets shaped by both technology and psychology.

Bottomline Thoughts

The most used crypto acronyms, from HODL to FUD, offer insight into how people experience crypto markets. They compress complex emotions into simple expressions and help communities communicate shared experiences.

Learning this language is not about prediction or strategy. It’s about understanding how narratives form, spread, and evolve.

In a market driven as much by sentiment as by data, that understanding is valuable.

Frequently Asked Questions

What is the abbreviation for crypto?

“Crypto” is a shortened form of “cryptocurrency” or “cryptographic.” Beyond that, the ecosystem uses many acronyms to describe market behavior, technology, and culture.

What is crypto slang?

Crypto slang includes informal terms and acronyms such as HODL, FOMO, FUD, WAGMI, and DYOR. These expressions reflect market sentiment, community behavior, and shared experiences rather than technical instructions.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.