The Finance Bill of 2022 introduced a new section called 194S in the Income-Tax Act, 1961, to levy 1% TDS on any consideration paid for the transfer of Virtual Digital Assets (VDA). Simply put, when you buy any Crypto (Crypto is considered a VDA), you (or the Exchange facilitating this transaction) will have to deduct and withhold 1% of the transaction value as TDS. This withheld Tax will have to be further paid to the Government.

Before we go into the details, here is a piece of good news for you: The Central Board of Direct Taxes (CBDT) has clarified that when someone is buying Crypto via an Exchange (even in the case of P2P transactions), Tax can be deducted under section 194S by the Exchange.

Making it simple; technically, you as a buyer or seller will not have to do anything. WazirX will do the needful. However, your support to make the process smooth might be expected. We at WazirX are upgrading our systems to support this mechanism and will keep you posted.

To help you understand these provisions better, here are a few explanations with examples:

- TDS provisions are applicable from 1 July 2022. These provisions will not affect any trades executed before 1 July 2022. As per these provisions, TDS would be deducted on each trade where a Crypto asset is exchanged for INR or another Crypto asset.

Please Note: If you have placed orders before the 1st of July 2022, but the trade happens on or after the 1st of July 2022, the TDS provisions will apply.

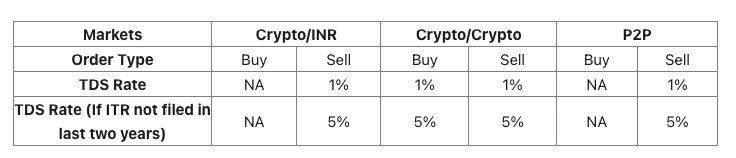

- No TDS would be deducted from the buyer on buying Crypto using INR, while the seller of the Crypto asset would be liable to pay TDS. However, when a Crypto asset is bought by paying with another Crypto asset, i.e., trading one Crypto asset for another, the TDS would be payable by both sides.

- Wherever applicable, 1% TDS will be deducted from the receivable INR or Crypto amount. However, as per Section 206AB of the Income-Tax Act, 1961, if the user has not filed their Income Tax Return in the last 2 years and the amount of TDS is ₹50,000 or more in each of these two previous years, then the TDS to be deducted (for Crypto-related transactions) will be at 5%. For simplicity, in the rest of this blog, we will use 1% as the rate of TDS.

- The TDS collected needs to be paid to the Income Tax Department in the form of INR. For this, any TDS collected in the form of Crypto has to be converted to INR. For ease of conversion and to reduce price slippage, in Crypto to Crypto transactions, the TDS for both sides would be deducted in the quote (or primary) Crypto asset. WazirX markets have 4 quote assets- INR, USDT, BTC, and WRX. For example, in the following markets: MATIC-BTC, ETH-BTC, and ADA-BTC, BTC is the quote Crypto asset, and hence the TDS of both the buyer and seller trading in these markets would be deducted in BTC.

- Examples:

- INR markets: 1 BTC traded for 100 INR. BTC seller receives 99 INR (after 1% TDS deduction). BTC buyer receives 1 BTC (no TDS deducted).

- Crypto-Crypto markets: 1 BTC sold for 10 ETH. BTC seller receives 10 ETH by paying 1.01 BTC (after 1% TDS addition). BTC buyer receives 0.99 BTC (after 1% TDS deduction).

- Examples:

- In P2P trades. 1% TDS would be deducted before a USDT sell order is placed. No TDS has to be paid by the P2P USDT buyer.

- Examples:

- Seller places an order for selling 100 USDT. Post 1% TDS deduction, a sell order would be placed for 99 USDT. The buyer would pay for 99 USDT, and the corresponding INR would be transferred to the seller’s bank account by the buyer.

- If the entire 99 USDT is not successfully sold, 1% TDS would be deducted only in proportion to the amount sold, and the remaining of the 1 USDT locked for TDS would be released back to the seller on order cancellation.

- Examples:

- The TDS will be calculated on the ‘net’ consideration payable after excluding GST/charges levied by the Exchange.

- Any TDS collected in Crypto would be periodically converted into INR, and the INR value received would be updated against the respective trades.

- To make things more transparent, the TDS deducted would be specified on the order details page immediately after trade execution. In cases where the TDS is deducted in the form of any crypto asset, the corresponding INR value of the TDS deducted can be found in the trading report after 48hrs.

- TDS would not be applicable on the trades performed on WazirX by a broker platform if the broker is deducting the TDS itself and it has an appropriate written agreement with WazirX specifying the same.

Please Note: For consistency and simplicity of implementation, the above-described approach of deducting tax on Crypto trades would be applicable to all users irrespective of their trading volume during the financial year.

Summary

We hope this article helped you understand the TDS mechanism. We will keep sharing more reading and learning material to make your journey seamless. In case you have any questions, please feel free to drop them in the comments section below.

Do keep supporting us like you always do.

Happy Trading.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.

When will TDS deducted appear in For 26AS incometax in India…