Table of Contents

New crypto assets enter the market regularly. Some become part of long-term infrastructure, while others fade quickly. Understanding how new crypto comes into existence offers useful context for how early market behavior develops.

How Creation Methods Affect Market Behavior

Different creation mechanisms introduce supply in different ways:

| Creation Method | Supply Introduction | Typical Volatility |

| Mining | Gradual, predictable | Medium |

| Staking | Controlled, incentive-based | Low to Medium |

| Token Launches | Front-loaded or scheduled | High |

| Airdrops | Sudden distribution | High |

| Forks | Mirrored supply | Medium |

| Token contracts | Variable, flexible | High |

These patterns help explain why new assets often behave differently in their early stages.

Why Crypto Creation Became Possible

Crypto did not rise gradually. It challenged global finance by proving a single idea: Value could move without permission.

Get WazirX News First

Bitcoin validated this concept by enabling peer-to-peer transfers without intermediaries.

Ethereum expanded it by allowing programmable logic to live directly on blockchains.

As crypto adoption grew, builders began exploring how to create new crypto assets to address gaps that traditional systems struggled to solve. These included faster settlement, transparent ownership, open access, and global coordination without centralized control. Each cycle brought more developers, capital, and experimentation into the ecosystem.

What It Means to Create New Crypto

“New crypto” refers to digital assets that have recently entered circulation. Unlike traditional currencies issued by central authorities, crypto assets are created through predefined rules embedded in blockchain systems.

From a market perspective, the most important questions are:

- How is new supply introduced?

- Who receives it first?

- How quickly does it reach open markets?

The answers to these questions shape early price discovery and volatility.

6 Ways New Crypto Comes Into Existence

New crypto assets are created through several distinct mechanisms. Each method affects supply dynamics differently.

- Mining: Gradual Supply Through Network Participation

Some blockchains create new coins through mining, a process most commonly associated with Proof-of-Work systems.

- How it works: Miners use powerful computers to compete for the right to mine the next block. The winner gets a block reward (e.g., 3.125 BTC per block as of post-2024 halving) plus transaction fees. This introduces new supply gradually.

- What traders watch for: Mining creates predictable inflation. Bitcoin’s halving every four years halves the reward, creating scarcity events that have historically influenced market cycles (e.g., BTC surged post-2024 halving).

- Examples: Bitcoin (BTC), Ethereum Classic (ETC), Dogecoin (DOGE).

This Bitcoin halving price chart shows historical cycles with reward reductions overlaid on price action.

- Staking: Issuance Through Network Validation

Post-Ethereum’s 2022 Merge, Proof-of-Stake (PoS) became huge. Here, new coins are minted by validators who “stake” existing coins as collateral to secure the network.

- How it works: Instead of mining hardware, you lock up coins. Validators are chosen based on stake size and randomness to create blocks. Rewards come from new issuance and fees. Ethereum currently mints about 1,600 ETH daily via staking, with net issuance varying based on network activity and burn mechanics.

- What traders watch for: PoS often means lower inflation than PoW, but staking locks up supply, reducing circulating tokens and influencing supply-demand dynamics. Yields (e.g., 4-6% APY on ETH) attract holders, creating buy pressure. However, slashing (penalties for bad behavior) can cause sudden dumps if big validators mess up.

- Examples: Ethereum (ETH), Cardano (ADA), Polkadot (DOT).

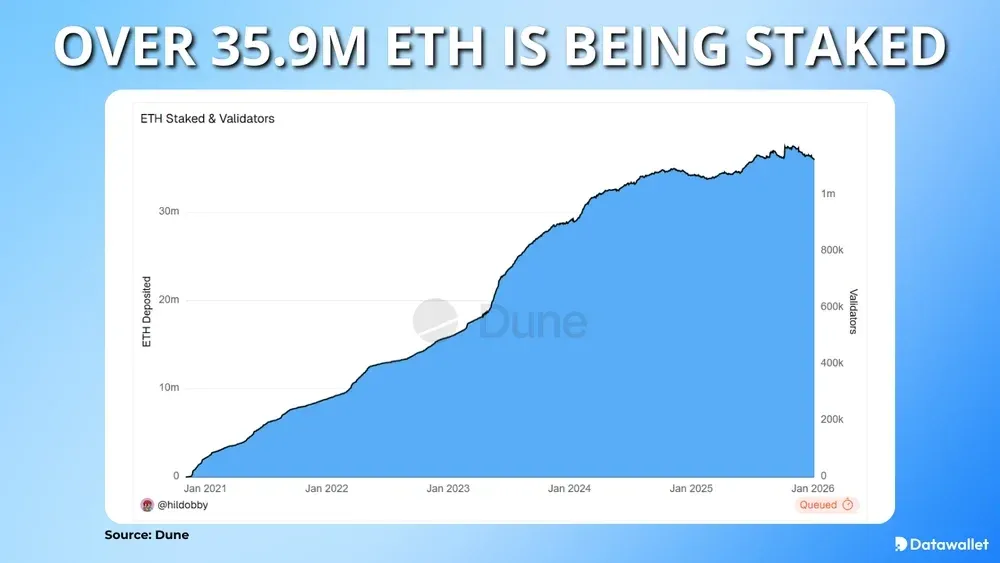

Ethereum staked ETH growth chart (up to 2026 data) shows the massive lock-up trend, higher staked % often correlates with reduced sell pressure and upside potential.

- Token Launches: Initial Distribution Events

This is where most “new” tokens enter the scene. Projects raise funds by selling tokens before or during launch.

- How it works:

- ICO (Initial Coin Offering): Direct sale via project website.

- IEO (Initial Exchange Offering): Via centralized exchanges

- IDO (Initial DEX Offering): On DEXs like Uniswap.

- Tokens are minted and distributed, often with vesting.

- What traders watch for: These launches often experience high volatility. Early participation may involve significant price movement, but many projects struggle to sustain activity beyond their initial phase.

- Examples: Solana (SOL) via private sales, many meme coins.

From a trading standpoint, understanding allocation structures and unlocking timelines is essential. Supply entering the market over time often influences volatility more than the initial launch itself.

- Airdrops and Fair Distribution Models

Airdrops distribute new tokens to promote adoption or reward early users.

- How it works: Projects typically take a snapshot of eligible wallets and distribute tokens based on predefined criteria, such as past usage or participation. Some networks also use fair launch models, where tokens are issued through community participation rather than pre-allocation.

- What traders watch for: Airdrops often introduce a large amount of supply into the market at once, which can lead to increased trading activity and short-term volatility. Outcomes vary depending on how recipients choose to engage with the asset over time.

- Examples: Arbitrum (ARB), Uniswap (UNI), and several Decentralized Finance (DeFi) protocol launches.

- Forks: When Networks Split

New crypto can also emerge when an existing blockchain splits into two separate networks. In these cases, holders of the original asset typically receive an equivalent balance on the new chain.

- How it works: Holders get mirrored balances on the new chain.

- What traders watch for: Free coins, but new forks often dump. Assess community support.

- Examples: Bitcoin Cash (BCH), Ethereum forks.

It is important to note that forks do not create value automatically. Markets assess community support, development activity, and long-term viability after the split. Over time, one chain may dominate, or both may continue independently.

You can read more about Bitcoin’s hard fork, here.

- Tokens Built on Existing Blockchains

The majority of new crypto assets today are tokens created on existing blockchains using smart contracts.

- How it works: Deploy smart contract to mint tokens, no new chain needed.

- What traders watch for: Floods market with tokens, but gems emerge. Low barriers increase both experimentation and risk.

- Examples: USDT, meme coins.

This approach allows teams to deploy assets quickly while relying on established infrastructure for security and execution. As a result, the pace of new token creation is much faster than that of new blockchains.

For traders, this abundance explains why markets see frequent new listings and heightened short-term volatility. It also reinforces the importance of understanding supply mechanics rather than focusing solely on novelty.

Conclusion

Understanding how new crypto comes into existence provides context, not signals.

Creation mechanisms do not predict performance. They explain supply behavior, distribution timing, and early liquidity conditions. Markets still respond to broader factors such as adoption, development progress, regulation, and overall sentiment.

Separating structure from speculation helps traders interpret market activity without assuming outcomes.

Frequently Asked Questions

How are new crypto coins created?

New crypto is created either by launching a new blockchain or by deploying tokens on existing blockchains using smart contracts. Each method follows defined technical and governance rules.

Who creates new crypto?

Developers, research teams, and organizations create new crypto. While technical tools are accessible, sustaining a project requires ongoing coordination, security, and governance.

How do you make a new crypto?

Technically, new crypto can be created using open-source blockchain frameworks or smart contracts. However, long-term viability depends on design choices, incentives, and ecosystem support.

What if I put $1,000 in Bitcoin five years ago?

Bitcoin’s historical performance reflects past market conditions and adoption trends. Past outcomes do not predict future results, and learning how crypto works is more useful than focusing on hypothetical scenarios.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.