Table of Contents

Bitcoin’s inception in 2009 spurred the growth of the cryptocurrency market. Litecoin was one of the frontrunners of that growth.

Positioned as ‘the silver to bitcoin’s gold’, the Litecoin protocol was released two years later in 2011. Litecoin and Bitcoin’s source code are almost similar with a few differences.

Essentially, it started the ‘alternative cryptocurrency’/altcoin trend. and soon after went on to become one of the top 10 valuable crypto assets in the market.

It’s main value proposition was and still is faster transaction processing times than Bitcoin, while still being completely decentralized.

Get WazirX News First

Litecoin’s purpose is not to overthrow Bitcoin but to complement it. However, there are a few fundamental differences between the two. We will look at them later, but first, let’s understand the Litecoin ecosystem in detail.

Who Created Litecoin?

Litecoin is the brainchild of Charles Lee, a graduate of the prestigious Massachusetts Institute of Technology (MIT). Lee boasts of an illustrious tech career as an ex-Googler, and Coinbase’s ex-Director of Engineering.

Fascinated by Bitcoin in the year 2011, Lee started working on Litecoin during his spare time, while still working at Google.

In October that year, Charlie released Litecoin’s code publicly on Bitcointalk after pre-mining 150 coins.

In July 2013, the Litecoin creator began working at Coinbase after a long stint at Google. During his tenure at Coinbase, Lee was largely disconnected from the development of his cryptocurrency system.

At the height of the cryptocurrency market’s bull run in late 2017, Lee exited Coinbase to give his full time and attention to Litecoin. Currently, he is the managing director of the Litecoin Foundation, a non-profit dedicated to the development of the project.

How Does Litecoin Work?

While talking about Litecoin’s working, it is essential to bring Bitcoin in the picture since both share a similar protocol infrastructure.

Similar to Bitcoin, Litecoin employs a proof-of-work consensus algorithm to verify LTC cryptocurrency transactions. Like Bitcoin, transfers on the Litecoin network are cryptographically secured.

Miners participate in the verification process with dedicated computing power and catalyze the addition of blocks to the Litecoin blockchain. In return, they get rewarded with an appropriate number of litecoins.

What Is The Difference Between Litecoin and Bitcoin?

Although both cryptocurrency systems need mining to propagate their respective blockchains, it happens a bit differently on Litecoin, as compared to Bitcoin.

Miners on Litecoin churn out new blocks by using the Scrypt mining algorithm. Although it leverages a hashcash hash function, unlike Bitcoin, Scrypt intends to suppress the use of dedicated mining equipment to mine coins.

While it takes roughly 10 minutes to add a block to the Bitcoin blockchain, in the case of Litecoin, the time is 2.5 minutes.

Bitcoin and Litecoin both have a pre-programmed limited coin supply. But BTC‘s supply cap is 21 million, whereas LTC’s supply cap is 84 million.

Halving, a technical event that slashes block rewards into half happens on Bitcoin after every 210,000 blocks. Whereas, Litecoin block rewards are halved after every 840,000 blocks.

How to Buy Litecoin (LTC) With INR in India?

With WazirX you can avail the best LTC to INR exchange rates in India. Also what you get is unmatched crypto transacting experience.

To buy LTC through WazirX, you need to register on the platform first, then finish a super quick KYC process and finally deposit funds for the purchase. Here’s how it goes:

Step 1: Account Creation

- Download the WazirX app or visit the website. Then hit the Sign Up button

- Fill in your email address (one that you use frequently), and your desired password

- Click on the Terms of Service checkbox, but go through it once before checking

- Then press the Sign Up button

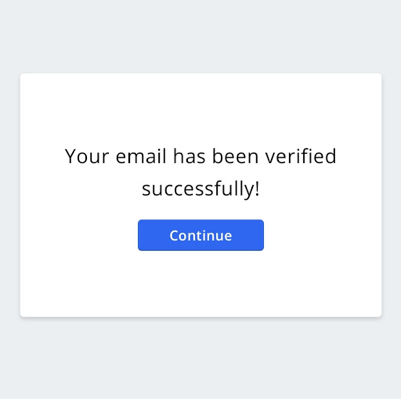

- You will be sent a verification email after hitting the sign-up button. If you have received it, click on Verify Email to complete the process.. If you haven’t, check your spam folder. Or hit Resend Here. On successful verification, you should see this message:

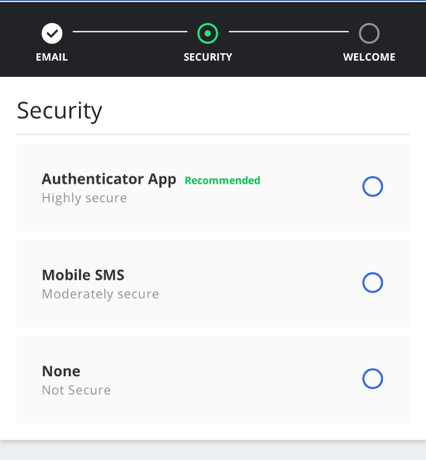

Securing Your Account

For security purposes, we highly recommend enabling 2-factor authentication (2FA). You can do so by downloading the Google Authenticator app and connecting it to your account.

KYC Verification

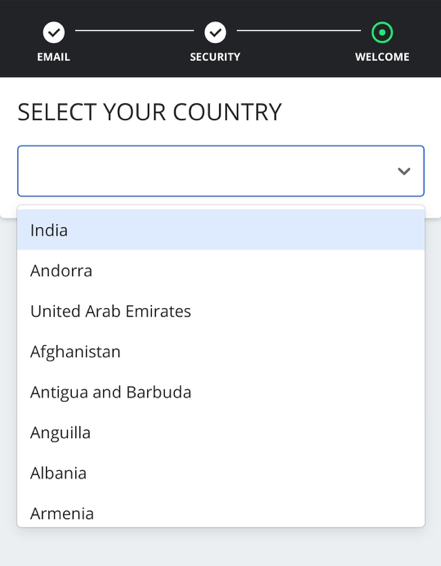

The last stage in the account set up process is KYC verification. Select your country from the list:

Then verify your KYC and finish the process. After that, you are all set to buy LTC with INR from WazirX!

Step 2: Depositing Funds

Depositing INR

You can deposit INR funds from your bank account to your WazirX account via UPI/IMPS/NEFT/RTGS.

Just submit details like bank name, account number, IFSC code, etc of the bank account with which you wish to transact, and then you are good to go.

In case the INR deposit is rejected, check out the WazirX support page for such issues.

Depositing Cryptocurrency

Depositing cryptocurrencies into your WazirX account, either from your wallet or another exchange is an effortless process. It’s also free – with no fees charged on any deposit!

Start by obtaining your deposit address from your WazirX wallet. Then, share this address on the ‘Send Address’ section of your other wallet for transferring your cryptocurrencies.

For more details, check out the WazirX Support page on depositing cryptocurrencies.

Step 3: Buy LTC with INR

With all the necessary steps covered, you are now ready to buy LTC with your deposited funds. Here’s the process:

Log on to the WazirX app or website to view the latest LTC/INR prices.

On the app, press the LTC/INR price ticker. After that, scroll down a bit, and you will find the BUY/SELL button amongst the ‘Charts’, ‘Orders’, ‘Trades’, and ‘My Orders’ options at the bottom.

Enter the INR amount with which you want to buy LTC. Note that this amount should be less than or equal to the INR funds deposited in your WazirX account.

Hit BUY, and wait for the order to execute.

Once the transaction is executed, you should find the LTC bought added to your WazirX wallet.

Also you can download the app and Start Trading Now!

Android App – WazirX – Buy Sell Bitcoin & Other Cryptocurrencies

iOS App – WazirX

Frequently Asked Questions

How To Invest In Cryptocurrency Stocks?

Cryptocurrency can be purchased in two ways: through mining or exchanges. The process of confirming and adding transactions to the blockchain public ledger is known as cryptocurrency mining. Cryptocurrency exchanges are another option. Exchanges make money by charging transaction fees, but there are alternative platforms where you may communicate directly with other cryptocurrency traders.

What Is Crypto?

Crypto or a cryptocurrency is a digital currency protected by cryptography, making counterfeiting and double-spending nearly impossible. Blockchain technology is used to produce cryptocurrencies (a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a government does not issue them. The word "cryptocurrency" refers to the encryption methods employed to keep digital currencies and the network secure.

How Cryptocurrency Works?

Cryptocurrencies use cryptography technology to keep transactions and their units (tokens) secure. Cryptocurrency works via a technology called the blockchain. A blockchain is a decentralized technology that handles and records transactions across numerous computers. The security of this technology is part of its value.

Is Crypto Legal In India?

Cryptocurrencies are legal in India, and anyone can purchase, sell, and exchange them. It is currently uncontrolled, as India lacks a regulatory structure to oversee its operations. Per the Ministry of Corporate Affairs, companies must now record their crypto trading/investments within the financial year. In cases where a person receiving the gains is an Indian tax resident, or the cryptocurrency is regarded as domiciled in India, cryptocurrency transactions have been taxable in India

Is Mining Cryptocurrency Legal?

Cryptocurrency mining can be time-consuming, expensive, and sporadically profitable. Mining has an appeal for many cryptocurrency enthusiasts as miners are paid directly with crypto tokens for their efforts. The legality of cryptocurrency mining is dependent on where you live. In India, there is no restriction on crypto mining.

How To Invest In Cryptocurrency In India?

There are two ways of investing in cryptocurrency, mining and via exchanges. Cryptocurrency mining is the process of verifying and adding transactions between users to the blockchain public ledger. Purchasing cryptocurrency in India is a straightforward procedure where investors simply participate by registering with a crypto exchange such as WazirX. After registering for an account, citizens can trade multiple cryptocurrencies, store cryptocurrency in wallets, and more.

Is Cryptocurrency Safe To Invest In?

Cryptocurrency investments are subject to market risks, but if sufficient security measures are not taken, trading accounts can be maliciously accessed. Investments come with risks and uncertainties, and we cannot claim that any digital currency investment is risk-free. Buying and selling cryptocurrencies can be risky even if the trader is knowledgeable about the market and treats their coins carefully.

Are Cryptocurrencies A Good Investment?

Cryptocurrency has the potential to make you extremely wealthy, and the potential to cause you to lose your money. Crypto assets, like any other investment, come with many risks and potential rewards. Fundamentally, cryptocurrency is an excellent investment, particularly if you want to gain direct exposure to the demand for digital currency.

Is Cryptocurrency Legal In India?

In India, cryptocurrencies are legal; anyone can purchase, sell, and trade cryptocurrencies. They are currently unregulated; India does not have a regulatory framework in place to regulate its functioning. According to the Ministry of Corporate Affairs (MCA), companies must now declare their crypto trading/investments during the financial year, according to the Ministry of Corporate Affairs (MCA). Cryptocurrency transactions have been taxable in India when people receiving such gains are Indian tax residents or where the crypto is considered to be domiciled in India

What Is The Meaning Of Crypto?

A cryptocurrency is a digital currency that is secured by the process of cryptography, making counterfeiting and double-spending almost impossible to happen. Blockchain technology is used to produce cryptocurrencies ( a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a centralized authority does not issue them.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.