Table of Contents

Cryptocurrency markets are up more than 90 percent since the beginning of the year. And along with the consolidated growth in digital asset markets, two cryptocurrencies – Ether (ETH) and XRP have also appreciated 215 percent and 58 percent respectively.

They are quite popular amongst traders,investors and application seekers. Which probably explains their rankings on the crypto market leaderboards. ETH is no.2 and XRP is no.3.

Get WazirX News First

ETH is the native cryptocurrency token of Ethereum, and XRP of Ripple. Both have a strong community supporting their investment and application case.

But despite their sky-high popularity in the digital currency realm, Ethereum and Ripple are vastly different wrt protocol use cases and token utility. Their differences are worth exploring, and why?

Because only by knowing their distinguishing factors, we can truly know what makes them so popular.

Protocol Differences

Ripple: The Blockchain Payments Firm

Ripple is actually an enterprise blockchain payments company based in San Francisco, California. RippleNet and On-Demand Liquidity (ODL) are it’s two unique offerings.

Ripple’s objective is to enable banks, payment processors, and other financial institutions, to conduct super fast and efficient international payments. And how?

Through real-time settlement of monetary transactions with adequate transparency and security. RippleNet and ODL both help Ripple spread the ‘no-sweat borderless transactions’ message.

Take a look at the video below to understand RippleNet’s design and it’s working:

While RippleNet is directly under the operational control of Ripple, XRP Ledger (XRPL) is an independant decentralized open-source platform.

XRPL is a distributed ledger to track all XRP transactions. Ripple’s customers sign up to use RippleNet for real-time settlement of transactions. But these transfers happen on XRPL, with the help of XRP

XRPL participants function as independent validating nodes and compare transaction records to ascertain the authenticity of transactions.

As per updated records, the network of active validators stands at 147 and include universities, exchanges, and financial institutions.

Ripple has constantly impressed upon the fact that XRPL is an independent platform and free from any kind of commercial association.

This implies that even if Ripple shuts down, the XRP Ledger will continue to operate normally.

Ethereum: The Smart Contract and dApp Building Platform

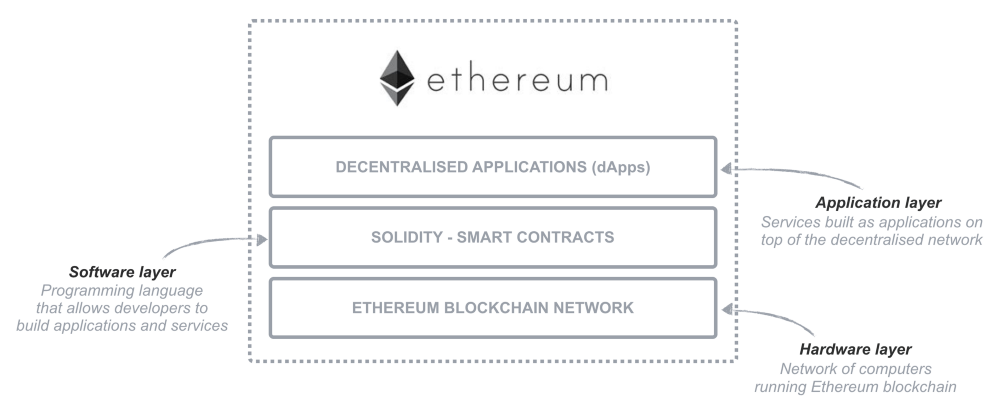

Contrary to Ripple, Ethereum is an open-source blockchain platform that comprises of three layers. Ethereum Foundation is the platform’s governing body responsible for its development.

The first layer is the public ledger. Second is the ‘smart contracts layer’ where developers use Solidity to write code for dApps. This layer also executes the designed dApps.

And the last layer is the ‘dApps layer’ where decentralized applications interact with users.

Anyone from any part of the world can write and develop applications on Ethereum involving some digital value – lending, borrowing, investing, trading, etc.

These applications self-execute whenever a specific set of conditions are fulfilled. Ethereum’s technical capability to support the growth of such programs has led to the rise of the decentralized finance (DeFi) space.

All DeFi protocols are based on Ethereum and have the following features:

- Interoperable

- Programmable – smart contracts drive decision making in the DeFi ecosystem, not humans

- Composable – the entire system is like a box of Lego blocks — there is absolutely no limit to what can be built

DeFi is a swiftly growing space with solid potential to move the needle in finance and commerce. The total value of funds locked in has already surpassed the $6 billion mark.

Cryptocurrency Differences

Cryptocurrency Supply and Circulation

The total XRP supply stands at 100 billion coins. Currently, the circulation is nearing the 45 billion mark. An escrow system releases 1 billion coins every month in the ‘open market’. All unused XRPs go back in the escrow after the month to avoid oversupply or misuse.

There is no supply limit for ETH. A little over 112 million Ethers are now in circulation.

Transaction Statistics

XRP Ledger can process transfers in 3-5 seconds. Data from the XRP metrics website, XRPSCAN reveals that the decentralized ledger has processed around 1 million transactions per day in 2020.

Ethereum can process 12-15 transactions per second. The world’s most valuable blockchain has gone from processing around 500,000 to 1.3 million transactions per day this year.

Gas and Transaction Fees

The fulfillment of financial transactions on Ethereum involves payments of ‘gas’. Measured in Gwei, a subunit of ether, the value of gas to be charged to process a transaction is determined by Ethereum miners. They can choose to forego a transaction if the gas prices are not satisfactory.

XRP transactions on the XRP ledger results in ‘destruction’ of Ripple’s cryptocurrency token. This according to the official website is to protect the XRP network from spams and denial-of-service attacks.

Transaction costs for XRP are programmed to increase gradually over time to make it costly to overload the XRPL with spurious transactions. The current transfer processing cost is 0.00001 XRP (10 drops).

How to Buy Ripple (XRP) and Ethereum (ETH) on WazirX

WazirX is the only cryptocurrency exchange that offers the best Ripple (XRP) to INR and Ethereum(ETH) to INR rates in India.

To buy XRP, and ETH through WazirX, you need to register on the platform first, then finish a super quick KYC process and finally deposit funds for the purchase. Here’s how it goes:

Step 1: Account Creation

- Download the WazirX app or visit the website. Then hit the Sign Up button

- Fill in your email address (one that you use frequently), and your desired password

- Click on the Terms of Service checkbox, but go through it once before checking

- Then press the Sign Up button

- You will be sent a verification email after hitting the sign-up button. If you have received it, click on Verify Email to complete the process.. If you haven’t, check your spam folder. Or hit Resend Here. On successful verification, you should see this message:

Securing Your Account

For security purposes, we highly recommend enabling 2-factor authentication (2FA). You can do so by downloading the Google Authenticator app and connecting it to your account.

KYC Verification

The last stage in the account set up process is KYC verification. Select your country from the list:

Then verify your KYC and finish the process. After that, you are all set to buy XRP from WazirX!

Step 2: Depositing Funds

Depositing INR

You can deposit INR funds from your bank account to your WazirX exchange account via UPI/IMPS/NEFT/RTGS.

Just submit details like bank name, account number, IFSC code, etc of the bank account with which you wish to transact, and then you are good to go.

In case the INR deposit is rejected, check out the WazirX support page for such issues.

Depositing Cryptocurrency

Depositing cryptocurrencies into your WazirX account, either from your wallet or another exchange is an effortless process. It’s also free – with no fees charged on any deposit!

Start by obtaining your deposit address from your WazirX wallet. Then, share this address on the ‘Send Address’ section of your other wallet for transferring your cryptocurrencies.

For more details, check out the WazirX Support page on depositing cryptocurrencies.

Step 3: Buy XRP

With all the necessary steps covered, you are now ready to buy XRP and ETH with your deposited funds. Here’s the process:

Log on to the WazirX app or website to view the latest XRP/INR and ETH/INR prices.

On the app, press the XRP/INR price ticker. After that, scroll down a bit, and you will find the BUY/SELL button amongst the ‘Charts’, ‘Orders’, ‘Trades’, and ‘My Orders’ options at the bottom. Follow the same for your ETH purchase.

Enter the INR amount with which you want to buy XRP and ETH. Note that this amount should be less than or equal to the INR funds deposited in your WazirX account.

Hit BUY, and wait for the order to execute.

Once the transaction is executed, you should find the XRP and ETH bought added to your WazirX wallet.

Also you can download the app and Start Trading Now!

Android App – WazirX – Buy Sell Bitcoin & Other Cryptocurrencies

iOS App – WazirX

Frequently Asked Questions

How Ripple Coin Works?

Ripple is a blockchain that records transactions on its electronic ledger XRP. It is embedded with key pairs and only private key holders can validate transactions. For any transaction to be validated, Ripple uses the Ripple Protocol Consensus Algorithm where majority of operators need to approve the move.

Is Ripple Coin A Good Investment?

Ripple coin can be a good investment option due to its potential to revolutionize cross-border payments and its partnerships with major financial institutions.

Can XRP Reach $100 Dollars?

To reach $100, XRP must climb 270 times. At $100, the market capitalization of XRP would be $5.1 trillion. If XRP rose at a 25% annual pace, it would take at least 26 years to hit $100.

Should I Buy Ripple Coin?

Based on your personal circumstances and investment plan, you should conduct your own research to determine whether the Ripple (XRP) crypto is a suitable asset for your portfolio.Always keep in mind that previous performance is no guarantee of future profits, and never buy XRP or any other Crypto with money you cannot afford to lose.

How To Mine Ripple Coins?

Ripple (XRP) cannot be mined in the traditional sense like other cryptocurrencies such as Bitcoin or Ethereum. One of the most efficient techniques for mining XRP is to mine Bitcoin (BTC) and Ethereum (ETH) and then exchange the mined coins for Ripple (XRP) via Crypto exchanges.

How To Buy Ripple Coin In India?

Here are the common steps by which you can buy Ripple (XRP) tokens in India at your trusted Crypto exchange, like WazirX.

- Select a trusted Crypto exchange, like WazirX, that supports the Ripple token.

- Create an account: You can create your account by providing personal information and complying with the KYC verification.

- Add funds to your account: Exchanges support various ways by which you can add funds to your account. You can do a bank transfer or a debit/ credit card.

- Buy Ripple (XRP): You can now easily trade Ripple (XRP).

Is It A Good Time To Buy XRP?

The future of Ripple XRP is uncertain due to ongoing legal issues and regulatory challenges. However, its value and potential will depend on how successfully these issues are resolved.

Should I Invest In XRP 2023?

XRP is a virtual currency that was created by Ripple Labs. It is used to facilitate cross-border payments and is often referred to as a "bridge currency." XRP is one of the top Cryptos by market capitalization and is traded on many Crypto exchanges. You can consider investing in XRP in 2023, but it is also advisable to conduct your own research before making any investment decision.

Where To Buy Ripple Coin In India?

XRP, the native token of Ripple can be purchased through any licensed Crypto exchange by creating an account. It can be bought with Fiat or traded in exchange of other tokens on exchanges such as WazirX

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.