Table of Contents

Through lending and trading services, the yearn.finance group of protocols, which is based on the Ethereum blockchain, enables users to maximize their revenues on crypto assets.

Yearn.finance is one of the new decentralized finance (DeFi) companies that offer its services entirely through code, doing away with the need for a middleman like a bank or a custodian. It has created a system of automated incentives around its YFI cryptocurrency to do this.

What is the YFi (YFI)?

A protocol called yearn.finance was created to deploy contracts to the Ethereum blockchain and various decentralized exchanges that run on it, like Balancer and Curve.

Users are putting their faith on YFI’s contracts, as well as those in linked contracts on Balancer and Curve, to deploy on Ethereum and deliver the promised services in this way. Earn, Zap, and APY are three of yearn.finance’s services that aim to make it possible for customers to lend or sell their cryptocurrencies.

Get WazirX News First

Users can use Earn to compare lending interest rates from several lending protocols, like Aave and Compound, in order to locate the best deals. In order to receive those interest rates, users must deposit their DAI, USDC, USDT, TUSD, or sUSD on the yearn.finance platform.

Similar to this, Zap lets people make multiple investments with only one click. For instance, a user just needs to perform one action to exchange DAI for yCRV (another DeFi coin), as opposed to three actions on the yearn.finance and Curve platforms. The user will also avoid transaction fees and lost opportunity costs.

Annual percentage yield, or APY, goes through the lending procedures that Earn employs and estimates how much interest a user may expect to earn, on an annually basis, for a specific amount of funds. Read about APY here.

How to Buy YFI Tokens in India?

By following a few simple steps, you can buy YFI tokens in India via WazirX, India’s most trusted and widely used cryptocurrency exchange.

Now, you can buy YFI tokens using P2P trade. Here are all your questions answered about P2P.

Step 1 – Sign-Up on WazirX

To start trading the YFI token, you should first create your account by signing up on the WazirX platform. Or you can directly Log-in if you already have an account with WazirX.

Here’s a guide explaining how to open an account on WazirX.

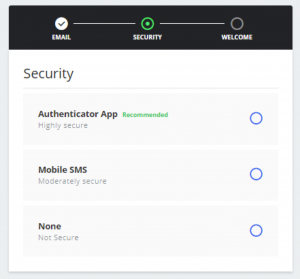

Step 2- Verify your email account and set up your account security.

The following step is to verify your email address. After signing up, you’ll receive a verification link on your email address by which you’ve just created your account.

On clicking on the link, you’ll have two options to assure the security of your account – the authenticator app and mobile SMS (as shown in the image below)

Note: The authenticator app is a more secure way to stay safe when compared to mobile SMS because there’s a risk of delayed reception or SIM card hacking.

Step 3 – Complete the KYC.

After selecting the appropriate country, complete the KYC process.

Note: Without completing your KYC, you will be unable to trade P2P or withdraw funds on the WazirX app.

Step 4 – Add funds to your WazirX account through P2P.

After linking your bank account to your WazirX account, you can buy USDT through P2P to the WazirX wallet. The USDT will work as funds to buy other coins.

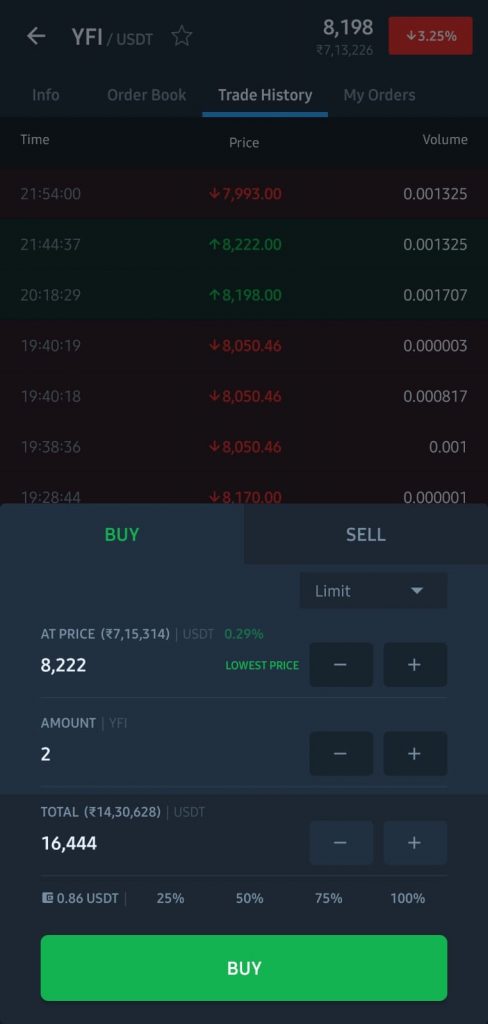

Step 5 – Buy YFI on WazirX

You can purchase YFI tokens using P2P trade through WazirX. Check the YFI to INR rate from here and YFI to USDT here.

After logging in to your WazirX account, you can select USDT from the “Exchange” tab. You can see all the price charts, order book data, and an order input form on the right side of the screen.

Click “Buy” after entering the amount and checking the total USDT amount to be paid.

Your order will be placed according to the price you have input. A seller willing to sell at a price will be notified, and then you can exchange the tokens using P2P.

It might take a few minutes for the order to be completed, but as soon as it is executed, you will receive the YFI coins you purchased in your WazirX wallet.

Happy Trading!

Frequently Asked Questions

Is Cryptocurrency Safe To Invest In?

Cryptocurrency investments are subject to market risks, but if sufficient security measures are not taken, trading accounts can be maliciously accessed. Investments come with risks and uncertainties, and we cannot claim that any digital currency investment is risk-free. Buying and selling cryptocurrencies can be risky even if the trader is knowledgeable about the market and treats their coins carefully.

How To Invest In Cryptocurrency?

There are two ways of investing in cryptocurrency, mining and via exchanges. Cryptocurrency mining is considered the procedure of verifying and adding transactions to the blockchain public ledger. Another option is via cryptocurrency exchanges. Exchanges generate money by collecting transaction fees, but there are alternative websites where you can interact directly with other users who want to trade cryptocurrencies.

How Safe Are Cryptocurrencies?

Cryptocurrencies can be safe, but your crypto wallets can be hacked if proper security steps are not performed.There are also dangers and uncertainties associated with investments, and we cannot declare any virtual currency investment risk-free. Buying and selling cryptocurrencies does not have to be dangerous if the trader is well-versed in the market and treats his coins with care.

Is crypto legal?

Crypto is legal in most countries, including India. While nations like the U.S. and many in Europe have regulatory frameworks, others like China have strict bans.

Can I Invest In Cryptocurrency?

Yes, with exchanges like WazirX, you may invest in cryptocurrency in India. To begin, go to the WazirX website and register. After that, you will receive a verification email. The link received by verification mail will only be available for a few seconds, so make sure you click it as quickly as possible. This will successfully verify your email address. The following step is to set up security, so choose the best solution for you. After you've set up the security, you'll be given the option of continuing with or without completing the KYC process.

Is Cryptocurrency Legal In India?

In India, cryptocurrencies are legal; anyone can purchase, sell, and trade cryptocurrencies. They are currently unregulated; India does not have a regulatory framework in place to regulate its functioning. According to the Ministry of Corporate Affairs (MCA), companies must now declare their crypto trading/investments during the financial year, according to the Ministry of Corporate Affairs (MCA). Cryptocurrency transactions have been taxable in India when people receiving such gains are Indian tax residents or where the crypto is considered to be domiciled in India

What Is The Safest Cryptocurrency To Invest In?

Bitcoin has had the highest market capitalization, has been around the longest, has the most experienced development team, and has enormous network impact and brand recognition. As a result, while trading cryptocurrencies, the rate of return on Bitcoin is commonly used as a benchmark. However, the risks associated with cryptocurrencies remain, and the safest cryptocurrency for you depends on your analysis.

Is Cryptocurrency Banned In India?

No, cryptocurrency is not banned in India. India has seen its ups and downs in the crypto sector concerning its legal status. The Reserve Bank of India (RBI) issued a circular in April 2018 advising all organizations under its jurisdiction not to trade in virtual currencies or provide services to assist anyone in dealing with or settling them. A government committee proposed outlawing all private cryptocurrencies in mid-2019, with up to ten years in prison and severe penalties for anyone dealing in digital currency. The Supreme Court overruled the RBI's circular in March 2020, allowing banks to undertake cryptocurrency transactions from dealers and exchanges.

Is Bitcoin And Cryptocurrency The Same Thing?

Bitcoin is a cryptocurrency that was designed to facilitate cross-border transactions, eliminate government control over transactions, and streamline the entire process without third-party intermediaries. The absence of intermediaries has resulted in a significant reduction in transaction costs. Satoshi Nakamoto, the creator of Bitcoin, created the first cryptocurrency in 2008. It began as open-source software for money transfers. Since then, plenty of cryptocurrencies have emerged, with some focusing on specific fields.

What Are The Best Cryptocurrencies To Invest In?

The best cryptocurrencies to invest in would be the ones you study and analyze in detail. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and many altcoins such as Tron, Ripple, Litecoin, etc.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.