18 July 2024. Exactly a year ago, WazirX faced one of the biggest crises in Indian crypto history, which changed everything for us.

In the days that followed, questions arose. Criticism. Headlines. Backlash. And heartbreak. Some thought we wouldn’t survive, and this was our end. But one thought kept us going: to do right by everyone who placed their trust in us.

The cyberattack was the most challenging chapter of our journey. However, our aim has always been clear: We don’t just want to recover from the cyberattack; we want to rebuild trust and get the platform running again. We also want to focus on further recoveries for creditors and return to our original vision of making crypto accessible to everyone.

Over the last 365 days, every step we’ve taken has been guided by one principle: doing right by everyone who placed their trust in us. Hereby, we would like to share our progress so far.

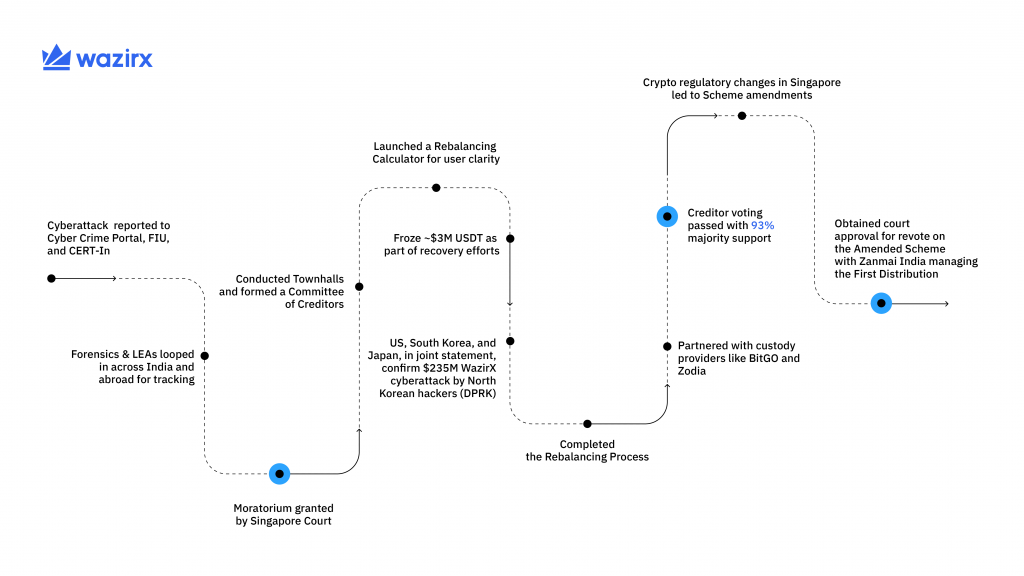

#1 Cyberattack reported to Cyber Crime Portal, FIU, and CERT-In

As soon as we detected the cyberattack, we took swift action. The incident was officially reported to key regulatory bodies, including the Cyber Crime Portal, the Financial Intelligence Unit (FIU), and CERT-In, to initiate formal investigations.

#2 Forensics & LEAs looped in across India and abroad for tracking

We also engaged top forensic and cybersecurity experts and collaborated with Law Enforcement Agencies (LEAs) across multiple countries, including the FBI, which traced the cyberattack to the North Korean Lazarus group. A joint statement was issued by the US, Japan, and South Korea, stating that the North Korean state-backed cybercriminal group was responsible for the cyberattack on WazirX. We have kept our mission simple: follow the trail, leave no stone unturned, and do everything possible to recover the stolen assets. We are working with zeroShadow and Kroll’s specialist crypto investigations team to trace the stolen assets and have already frozen an initial tranche of stolen assets worth USDT 3 million.

#3 Moratorium granted by the Singapore Court

While all this was going on, we wanted to ensure a fair and unbiased recovery process, so we approached the Singapore High Court. The moratorium we received allowed us to build a creditor-first restructuring plan via a Scheme of Arrangement.

#4 Conducted Townhalls and formed a Committee of Creditors

Instead of making decisions alone, we opened our doors to our creditors. We conducted eight creditor townhalls where we provided key updates, answered questions, and cleared their doubts. We also formed a Committee of Creditors that gave the community a direct voice in shaping a favourable restructuring plan for the creditors.

#5 Launched a Rebalancing Calculator

The WazirX team dedicatedly worked and created a Rebalancing Calculator that helped our creditors understand how Net Liquid Platform Assets are intended to be rebalanced and distributed. This tool was designed to simplify and give clarity to the creditors regarding the rebalancing process.

#6 Completed the Rebalancing Process

After months of rigorous planning and calculations, we completed the complex rebalancing process. We made sure every creditor had a clear and fair allocation, laying the groundwork for an organized return of assets once the restructuring received court approval.

#7 Partnered with custody providers like BitGO and Zodia

In the wake of the cyberattack, we doubled down on what mattered most: security. We partnered with globally respected custodians, BitGo and Zodia, to ensure that all assets are stored with institutional-grade protection going forward.

#8 Creditor voting passed with a 93.1% majority support

When the time came for creditors to decide on the future of WazirX, their message was loud and clear. With 93.1% of creditors voting YES for approval in March 2025, the community supported our proposed Scheme of Arrangement, reinforcing our belief that creditors want us to return stronger than ever.

#9 Crypto regulatory changes in Singapore led to Scheme Amendments

Following the creditor voting on our proposed Scheme of Arrangement, an announcement by the Monetary Authority of Singapore (“MAS”) in May 2025 confirmed the introduction of new cryptocurrency regulations from 1 July 2025. The MAS announcement came prior to our Sanction Hearing in front of the Singapore Court. The Court did not sanction our scheme application despite the majority approval from creditors. But instead of giving up, we swiftly filed a request for further arguments, which was held on 15th and 16th July 2025.

#10 Regained the Court’s approval for revote

The Court acknowledged our further submissions and granted approval for a revote while accepting the necessary disclosure amendments to our earlier proposed Scheme of Arrangement.

The upcoming revote will be critical, and we require a strong creditor vote in favor for the Court to consider approving the amended Scheme of Arrangement, enabling us to do the First Distribution via Zanmai India and officially restart operations.

We’ve Been Tested. And We’ve Grown.

This one year has truly tested everything: our systems, our spirit, and our ability to stay grounded during chaos. Through all this, our mission is to do what’s right, rebuild the right way, and distribute assets as soon as possible.

We’re proud of what we’ve survived. We’re prouder to know our community stood by us. Today, we mark one year since the cyberattack. We will not look back in defeat; we will look forward in determination.

The revote order by the Singapore High Court is the turning point. Let’s stand together and make the biggest comeback ever.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.