Table of Contents

BTC surged 10% in the last seven days, from $54,000 on July 5 to $63,000 on July 12.

Is Bitcoin finally recovering? Let’s find out in this article.

Bitcoin’s price fluctuations have always been a topic of intense discussion in the financial world. Recently, Bitcoin has been trading above $63,000, marking a significant surge. Several factors contribute to this rise, and one of the more intriguing elements involves former U.S. President Donald Trump.

Related Read: The Story Of A Crypto Atheist Turned Crypto Lover!

Get WazirX News First

In this blog, let’s see the driving forces behind Bitcoin’s recent price movements and Trump’s surprising connection.

Key Reasons Behind Recent Bitcoin Price Surge

#1 Market Sentiment and Technical Analysis

| Market Sentiment + Technical Indicators = Impact on Bitcoin Price |

Bitcoin’s price is influenced by market sentiments and technical indicators. Over the past few weeks, Bitcoin has shown a strong bullish trend, along with high price volatility. Technical analysis reveals that Bitcoin recently broke through a critical resistance level, which has historically acted as a strong barrier. Once this resistance was breached, it paved the way for a rapid price increase.

The current market sentiment around Bitcoin is predominantly positive. This optimism is fueled by several factors, including institutional interest, macroeconomic conditions, and the increasing acceptance of cryptos as legitimate investment assets (Spot Crypto ETFs). Combining these elements has created a conducive environment for Bitcoin’s price to rise.

#2 Institutional Investment

Institutional investment plays a crucial role in driving Bitcoin’s price. Large financial institutions, hedge funds, and publicly traded companies have accumulated Bitcoin in their investment portfolios. This inflow of institutional money provides stability to the market and signals confidence in Bitcoin’s long-term potential.

But why do institutions ❤️ Bitcoin?

Institutions are attracted to Bitcoin for several reasons, including its potential to hedge against inflation, its limited supply, and its growing acceptance as a store of value. As more institutions enter the market, the demand for Bitcoin increases, pushing its price higher.

#3 Macro-Economic Factors

Global economic conditions also influence Bitcoin’s price. In times of economic uncertainty or inflation, investors often look for alternative assets to protect their wealth. With its decentralized nature and limited supply, Bitcoin has become an attractive option for many.

Recent economic developments, including inflation and concerns about geopolitical tensions, have prompted investors to consider Bitcoin a safe-haven asset. This shift in investment strategy has strongly contributed to the upward trend in Bitcoin’s price.

Can Donald Trump also have an impact on Bitcoin’s price? Let’s find out in the following section.

Trump’s Unexpected Connection to Bitcoin

Trump’s Public Statements and Bitcoin

Donald Trump’s relationship with Bitcoin has been a hot topic since his presidency. Earlier, Trump was critical of cryptos, expressing concerns about their use in illegal activities. However, recent events suggest a huge shift in his stance.

Trump recently survived an assassination attempt, an incident that garnered significant media attention. Following the incident, Trump made public statements about Bitcoin, indicating a more favorable view of the crypto. He even mentioned the possibility of backing the U.S. dollar with Bitcoin if he were re-elected, a statement that sent ripples through the financial markets.

The Impact of Trump’s Statements

Trump’s comments have had a noticeable impact on Bitcoin’s price. His endorsement of Bitcoin, albeit conditional on his re-election, has bolstered market sentiment. Investors perceive this as a potential shift in U.S. regulatory stance towards cryptos, which could lead to more favorable conditions for Bitcoin and other digital assets.

Moreover, Trump’s influence extends to his supporters, who will likely take his statements seriously. This can lead to heightened buying activity in the market, further driving up Bitcoin’s price.

How excited are you?

The Nashville Bitcoin Conference

Another significant event linking Trump to Bitcoin is his scheduled appearance at the Nashville Bitcoin Conference. Trump is expected to make a major announcement regarding Bitcoin, which has generated considerable anticipation in the market. Speculation about his announcement has already contributed to positive market sentiment and price movements.

Investors are keenly watching this event, hoping for news that could further validate Bitcoin’s position in the financial ecosystem. A positive announcement from Trump could potentially trigger another surge in Bitcoin’s price, solidifying its upward trajectory.

The Road Ahead for Bitcoin

Key Technical Levels to Watch

As Bitcoin continues its upward journey, several key technical levels must be monitored. The next significant resistance level is around $70,000. Breaking this level could allow Bitcoin to reach new all-time highs.

On the downside, support levels around $55,000 and $50,000 are crucial. These levels have previously acted as strong support zones, and any breach below them could indicate a potential reversal in the trend.

Long-Term Outlook

Source: Trading View

The long-term outlook for Bitcoin remains optimistic. With increasing institutional adoption, favorable macroeconomic conditions, and potential regulatory support, Bitcoin is well-positioned for continued growth. However, investors should remain cautious of the inherent volatility in the cryptocurrency market.

Navigating the Volatile Market

Investors who want to navigate this volatile market must stay informed and make data-driven decisions. Monitoring market trends, technical analysis, and key news events can provide valuable insights into potential price movements.

Additionally, diversifying investments and setting realistic expectations can help manage risks. While Bitcoin offers significant growth potential, it is crucial to approach it with a balanced investment strategy.

What do crypto experts have to say about the recent Bitcoin price surge? Let’s find out below!

Crypto Veteran Peter Brandt’s take on Bitcoin Price Surge

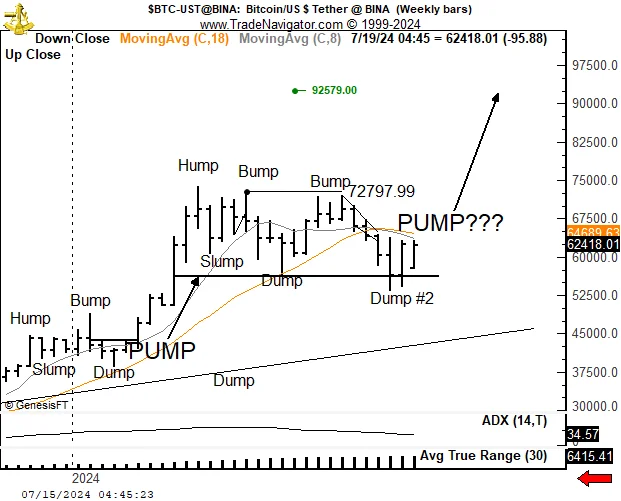

Veteran trader Peter Brandt recently commented on Bitcoin’s bullish price movement, which saw the crypto reach $63,000. Brandt noted that Bitcoin might be unfolding its “Hump Slump Bump Dump Pump” chart construction. This pattern involves:

- a “Hump” (price increase), followed by

- a “Slump” (price drop),

- a “Bump” (price rise),

- a “Dump” (another dip), and finally

- a “Pump” (major upward movement).

He identified a bear trap around July 5, when Bitcoin attempted to form a double top at $53,499 but rebounded positively on July 13. Brandt believes the bears are now trapped, suggesting a continued upward trajectory for Bitcoin. However, he cautions that a close below $56,000 would negate this bullish outlook, making it a crucial level for traders to watch.

Conclusion

A combination of market sentiment, institutional investment, and macroeconomic factors drives Bitcoin’s recent price surge to $63,000. Donald Trump’s unexpected connection to Bitcoin, through his public statements and upcoming appearance at the Nashville Bitcoin Conference, has added an intriguing dimension to the narrative.

As Bitcoin continues to grab the attention of investors and the general public, staying informed and active is key to making the most of this dynamic and rapidly evolving market.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.