Dear Tribe! 👋

As you know, we recently launched a ‘Rebalancing Calculator’ with the aim to demonstrate how the rebalancing will affect the distribution of Liquid Assets under the Scheme.

Based on community feedback, we have made some major enhancements to it. These updates are aimed at improving usability and transparency:

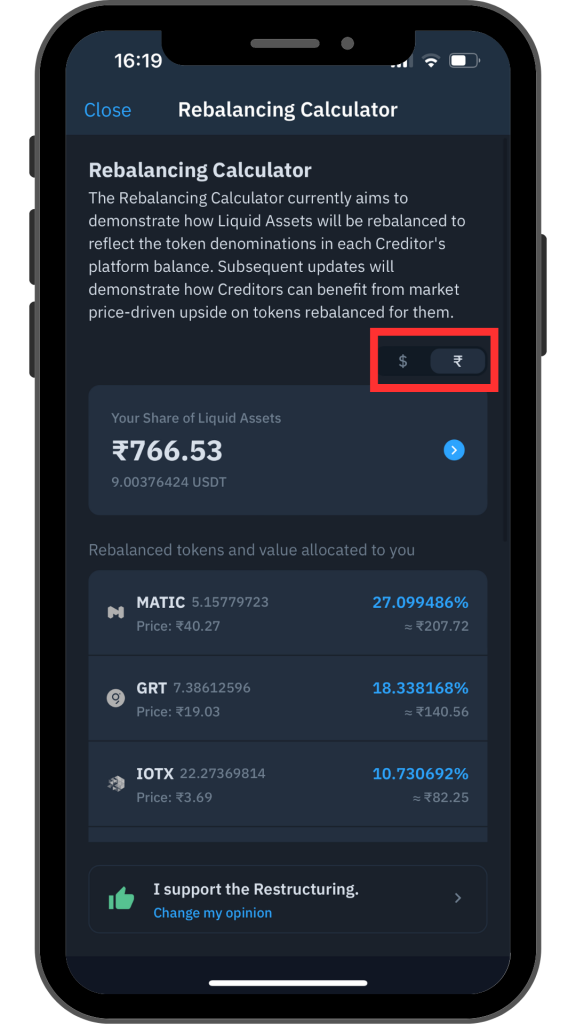

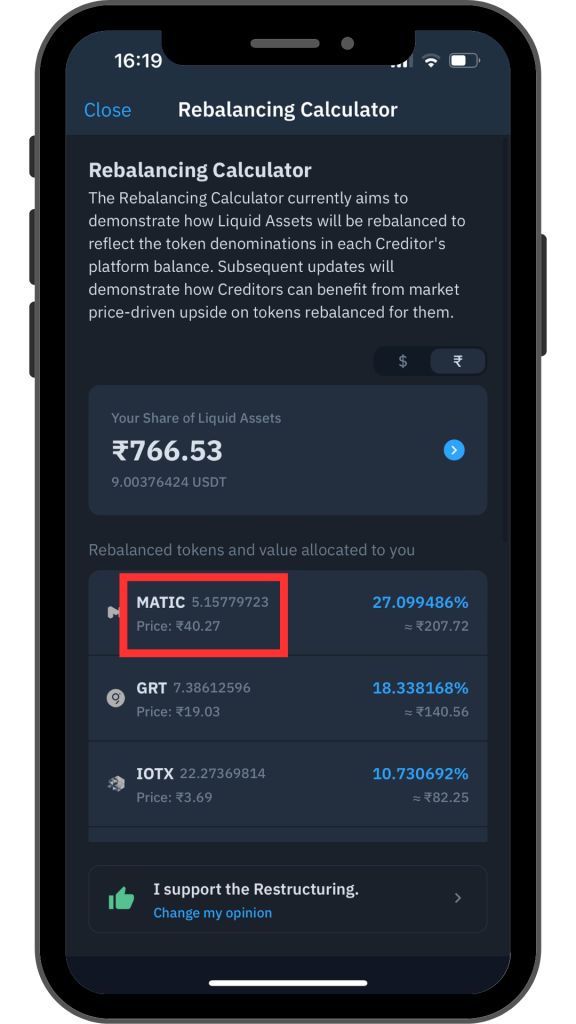

- Currency Preference: Users can now choose their preferred currency – INR or USDT (previously limited to USDT).

- Price Display: The price used for calculations is now displayed, providing greater clarity on the data used in the calculator.

As a reminder, please note that the Rebalancing Calculator is designed to help you understand how the intended rebalancing will affect the distribution of Liquid Assets under the Scheme.

It will demonstrate how Zettai intends to rebalance the tokens to reflect the token denominations in each Creditor’s platform balance. This will help you understand your potential recovery under the restructuring.

Please note that the Rebalancing Calculator is for demonstration purposes only and will update daily with the latest market prices at 10 AM IST.

You can access the Rebalancing Calculator here

Important Note:

- The Rebalancing Calculator is only for demonstrative purposes and allows users to visualize their proportionate distribution of the Liquid Assets in token denominations that generally correspond to Creditors’ platform account balances under a potential restructuring plan, which is still subject to approval by the requisite majority of creditors and the sanction of the Singapore Court.

- The Rebalancing Calculator is designed for experimentation and understanding the proposed restructuring approach.

- The Rebalancing Calculator aims to demonstrate the restructuring approach towards Liquid Assets only. The amounts shown under the Rebalancing Calculator are indicative only and do not constitute a commitment by Zettai to any specific level or amount of recovery.

- Rebalancing Calculator is subject to update and improvement, and we will inform Creditors as and when these updates occur.

Frequently Asked Questions

Q 1. What is the purpose of the Rebalancing Calculator?

A: To help you understand how Liquid Assets are intended to be rebalanced once the restructuring is implemented, we have designed a ‘Rebalancing Calculator,’ which currently aims to demonstrate how the rebalancing will affect the distribution of Liquid Assets under the Scheme.

Q 2. Will the market prices be updated regularly on the Rebalancing Calculator?

A: The Rebalancing Calculator updates market prices every day at 10 AM IST and will represent what the rebalancing would look like if it happened on that very day; there is no continuity with the Rebalancing Calculator output from any prior day.

Q 3. Will the Rebalancing Calculator guarantee specific recovery amounts?

A: The Rebalancing Calculator aims to demonstrate the restructuring approach towards Net Liquid Assets only. The amounts shown under the Rebalancing Calculator are indicative only and do not constitute a commitment by Zettai to any specific level or amount of recovery.

Q 4. Will I receive the exact tokens shown in the Rebalancing Calculator?

A: The amounts shown are indicative only and do not constitute a commitment by Zettai to any specific level or amount of recovery.

Q 5. Are there some assets that will not be included in the Rebalancing Calculator?

A: The Rebalancing Calculator does not cover Illiquid Assets or any other potential recoveries that we are working towards, such as resuming operations of the WazirX platform, white knight collaborations, and recovery of stolen tokens, all of which are being worked on to improve recoveries to creditors.

Q 6. For actual rebalancing, which token prices will be taken into account?

A: The actual rebalancing will occur in the near future, and details will be disclosed to creditors following the rebalancing. For now, the Rebalancing Calculator will help you understand what the rebalanced Liquid Assets will look like according to Your Claim.

Q 7. Why is there a difference between the investment value and the rebalancing calculator value?

A: The Rebalancing Calculator displays Your Claim as of 18 July at 1 PM IST, which represents the total value of your WazirX platform crypto account balance.

Your initial investment value will vary as cryptocurrency prices can fluctuate widely due to a number of market factors. Investing in cryptocurrencies involves significant risk and may result in losses.

Q 8. Why are tokens increasing and decreasing daily?

A: Cryptocurrencies are just like any other investment, and their value can fluctuate widely due to a number of market factors, including:

Market Demand and Supply: Like any asset, the price of cryptocurrencies is influenced by the balance between buyers and sellers. High demand with a limited supply can drive prices up, while low demand can cause prices to fall.

Investor Sentiment: News, social media, and public perception can significantly impact investor sentiment. Positive news can lead to increased buying, while negative news can trigger selling.

Regulatory News: Announcements from governments and regulatory bodies about the legal status and regulation of cryptocurrencies can cause price fluctuations. For example, news of a country banning or restricting cryptocurrency use can lead to a drop in prices.

Technological Developments: Innovations, upgrades, or security breaches in the underlying blockchain technology can affect the value of cryptocurrencies. Successful upgrades can boost confidence and prices, while security issues can lead to declines.

Macroeconomic Factors: Broader economic trends, such as inflation rates, interest rates, and economic stability, can also influence cryptocurrency prices.

Q 9. Will I get USDT or my token?

A: The Rebalancing Calculator displays Your Claim on 18 July 2024 at 1 PM IST in both USD and INR, and Your Share of Liquid Assets will be made available for distribution to you upon the Restructuring Effective Date.

Your Share of the Liquid Assets USD value will be distributed to you in cryptocurrency tokens available, in accordance with the token denominations that represent Your Claim, as displayed on the Restructuring Calculator. The quantity of tokens will vary depending on the individual price movements of the tokens that represent Your Claim when the rebalancing occurs.

Q 10. I should get approximately x/2 (52% of) tokens, but I am getting fewer tokens. Why is the number of tokens decreasing daily with increasing in market price?

A: The Rebalancing Calculator displays Your Claim on 18 July 2024 at 1 PM IST in both USD and INR and Your Share of Liquid Assets, which will be made available for distribution to you upon the Restructuring Effective Date.

Your Share of the Liquid Assets USD value will be distributed to you in cryptocurrency tokens available, in accordance with the token denominations that represent Your Claim, as displayed on the Restructuring Calculator. The quantity of tokens will vary depending on the individual price movements of the tokens that represent Your Claim when the rebalancing occurs.

Q 11. Can you share a simple example to explain the whole rebalancing?

Ans. Here’s a simplified example to explain:

– On July 18, total claims were $500 million, split as:

$300 million (60%) in 10,000 BTC (1 BTC: $30,000)

$200 million (40%) in 500,000 ETH (1ETH: $400)

– Unfortunately, all $200 million worth of ETH was stolen, leaving only BTC, which represents 60% of the total claims. However, the remaining BTC now needs to be rebalanced so that we can distribute back cover both BTC and ETH in accordance with creditors’ claims.

– If the value of the remaining 10,000 BTC increases to $400 million (33%) (now covering 80% of the total claims), rebalancing becomes necessary because we don’t have ETH to distribute.

– To rebalance, some BTC must be sold to purchase ETH. The $400 million will then be split proportionately based on the original BTC and ETH values from July 18.

– Based on the 60%/40% split from 18 July, the $400m will be split according to the proportionate value of the BTC and ETH at 18 July.

$400m*60% = $240 BTC

$400m*40% = $160 ETH

So we would sell $160m BTC and buy $160m ETH.

If the price of ETH has also increased by 25%, then after rebalancing, we would have:

$240m (60%) as 6,000 BTC (1 BTC: $40,000)

$160m (40%) as 320,000 ETH (1 ETH: $500)

This process ensures creditors receive their claims in the correct proportions of BTC and ETH, even after the loss.

Here are simplified examples of how the rebalancing and initial distribution will affect three different Creditors:

1. Creditor 1 has a $50,000 Claim, which, at 18 July 2024, 1 PM IST, was represented by a platform balance of 1.6666667 BTC

2. Creditor 2 has a $250 Claim, which at 18 July 2024, 1 PM IST, was represented by a platform balance of 0.625 ETH

3. Creditor 3 has a $100,000 Claim, which at 18 July 2024, 1 PM IST, was represented by a platform balance of 3 BTC (90%) and 25 ETH (10%).

Per the example, following the rebalancing, the Liquid Assets to distribute are worth $400m (80%) of Total Claims per 18 July 2024, represented by 6,000 BTC and 320,000 ETH tokens.

Creditor 1

Creditor 1’s Share of the Liquid Assets in USD terms is 0.01% of $400m. Creditor 1 will be entitled to an initial distribution of $40,000, which will be distributed in the form of 1 BTC.

Creditor 2

Creditor 2’s Share of the Liquid Assets in USD terms is 0.00005% of $400m. Creditor 2 will be entitled to an initial distribution of $200, which will be distributed in the form of 0.4 ETH.

Creditor 3

Creditor 3’s Share of the Liquid Assets in USD terms is 0.02% of $400m. Creditor 3 will be entitled to an initial distribution of $80,000, which will be distributed in the form of 1.44 BTC (90%) and 16 ETH (10%).

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.