Table of Contents

Bitcoin (BTC) experienced a notable decline on February 23, 2026, falling approximately 4–5.5% over the past 24 hours, to around $65,000 from approximately $67,000 at the close of the previous weekend.

TLDR: Why Bitcoin fell sharply on Feb 23, 2026

- Forced liquidations and ETF outflows blocked a quick recovery: The rapid drop triggered around $240 million in leveraged long liquidations, adding automatic sell pressure. At the same time, continued outflows from U.S. spot Bitcoin ETFs meant institutional demand was not strong enough to stabilize prices quickly.

- Macro shock triggered risk-off selling: News around U.S. President Donald Trump proposing higher global tariffs increased fears of slower growth and tighter financial conditions, pushing investors to cut exposure to volatile assets like Bitcoin.

- Large holders moved to reduce risk: On-chain data showed whales sending unusually large amounts of BTC to exchanges, a pattern typically associated with selling or hedging. This added real supply to the market just as sentiment weakened.

- Low weekend liquidity amplified the move: With fewer market makers active, order books were thin. As selling began, prices dropped roughly $2,500 within about an hour because there were not enough buyers to absorb sell orders smoothly.

Below is a step-by-step explanation in simple terms.

Reasons Behind Bitcoin’s 23 February Price Drop

1. Trump’s Tariff Announcement

The primary catalyst for the drop seems to be the U.S. President Donald Trump’s announcement of plans to raise global tariffs to 15%.

The announcement heightened macroeconomic uncertainty. This seems to have triggered risk-off sentiment in broader markets, and prompted investors to reduce exposure to high-volatility assets such as cryptocurrencies.

2. Risk-Off Sentiment Across Global Markets

After the tariff announcement, traditional financial markets showed clear signs of risk aversion. U.S. stock futures fell:

- the Dow Jones was down about 0.6%

- S&P 500 futures down 0.7%

- Nasdaq-100 futures down 0.9% soon after the news, which is typical of a risk-off shift.

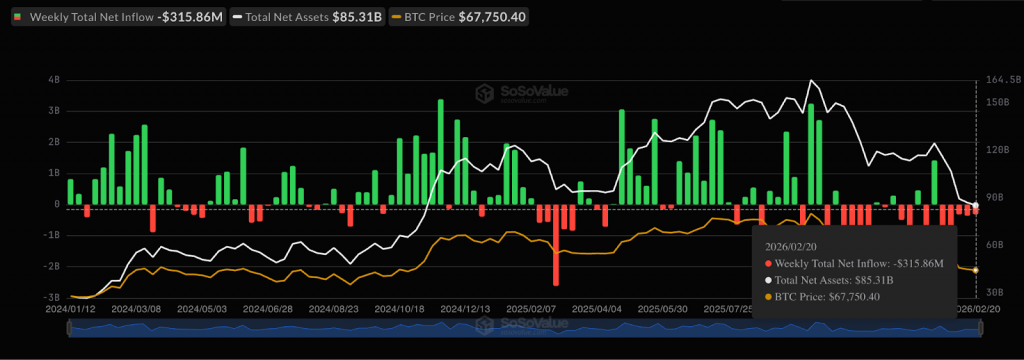

Spot Bitcoin ETFs also saw net outflows of around $315.9 million last week, reinforcing the idea that institutional demand was weakening and contributing to broader selling pressure.

Get WazirX News First

3. Whale Selling and Short-Term Profit Taking

On-chain data showed increased selling from large holders, commonly called whales. Some were booking profits from earlier moves, while others were cutting losses to avoid further downside.

Most long term Bitcoin holders keep coins in private wallets. Coins usually move to exchanges for one reason: to be sold, hedged, or used as collateral.

What On-Chain Data is Saying

Here is what on-chain signals seems to be suggesting:

| On-chain signal | What the number shows | What this usually means | Why it implies selling pressure |

| Exchange whale ratio at 0.64 | 64 percent of all BTC flowing into exchanges came from the top 10 largest wallets | Large holders dominated exchange inflows rather than many small retail users | Coins are typically sent to exchanges to be sold or hedged. When whales lead inflows, it suggests deliberate risk reduction or distribution, not casual movement |

| Average BTC deposit size at 1.58 BTC | Each deposit into exchanges was much larger than usual and the highest since mid 2022 | Fewer wallets moving larger amounts | Retail panic usually creates many small deposits. Large average deposits point to institutional or whale driven transfers, which are commonly linked to selling activity |

| Single transfers of 5,000 BTC and 6,317 BTC to exchanges | Very large, concentrated transfers occurred within a short time window | Strategic positioning of inventory close to market liquidity | Such large transfers are rarely for storage. Even partial selling from these balances can move price, especially during low liquidity periods |

| All signals occurring together | Whale led inflows, large deposits, and massive transfers aligned in time | Coordinated shift by large holders | When these indicators appear simultaneously, historical patterns show they often precede or accompany price declines driven by sell side pressure |

When large wallets sell, it suddenly increases supply in the market. Smaller traders tend to notice these moves and react emotionally, leading to panic selling that further pushes prices down in a short time.

4. Low Weekend Liquidity and Forced Liquidations

Fewer active traders and market makers mean there are not enough buyers to absorb sudden selling, so even moderate sell orders can cause outsized price moves.

During weekends, especially long weekends, many institutional desks, proprietary trading firms, and market makers reduce activity or go offline. This leads to thinner order books on major exchanges, meaning there are fewer buy orders stacked at each price level. When selling begins in such conditions, prices fall faster because there is less demand to slow the move.

As Bitcoin dropped by roughly $2,500 within about 60 minutes, the thin order books could not absorb the sell pressure smoothly. Each sell order pushed the price down multiple levels at once. This rapid movement triggered stop losses and margin calls across derivatives markets.

Once those thresholds were breached, around $240 million in leveraged long positions were forcibly liquidated. These liquidations are automatic market sells executed by exchanges, which added even more selling into an already illiquid market.

In a liquid weekday market, this amount of selling might have been absorbed gradually. During a long weekend, it instead cascaded, turning a sharp move into a sudden crash.

Summary: Why Bitcoin Price fell on February 5, 2026

The earlier decline on February 5 formed part of a larger deleveraging cycle that began in late 2025. Key drivers identified in contemporaneous analyses were

1. Rapid unwinding of leveraged positions

In simple terms, many traders were betting on Bitcoin’s price using borrowed money through futures and margin trading. When prices started falling, exchanges automatically forced these traders to close positions to prevent further losses.

This caused a chain reaction of selling. As more positions were liquidated, Bitcoin futures activity dropped sharply, and the extra selling pressure pushed prices down faster than normal spot market moves.

2. Spill-over from AI stocks and miner balance sheet stress

Bitcoin miners do not just mine coins, they also run capital intensive businesses tied to data centers, chips, and AI related infrastructure. When AI and high performance computing stocks fell, miner valuations dropped too.

To cover expenses, repay loans, or reduce financial risk, some miners sold part of their Bitcoin holdings. These spot sales added real supply to the market, weighing on prices beyond pure trader speculation.

3. Risk-off mood from gold, equities, and global uncertainty

At the same time, global markets were unsettled by geopolitical tensions and uncertainty around U.S. interest rate decisions. When investors feel nervous, they usually reduce exposure to risky assets like stocks and crypto.

Even gold and silver showed unusual volatility, signaling stress. In this environment, investors moved money into cash or safer instruments, pulling capital out of Bitcoin and amplifying the downward price movement.

4. Structural pressures from stablecoins and institutions

Bitcoin trading depends heavily on stablecoins and large institutional players for liquidity.

During this period, the growth of stablecoin supply slowed, meaning less fresh money was entering crypto markets. At the same time, some institutions reduced exposure on U.S. exchanges, either to lock in profits or cut risk. With fewer buyers and steady selling, Bitcoin prices faced sustained pressure rather than a quick rebound.

Final Thoughts

Taken together, these episodes reflect an extended “crypto winter” phase in early 2026, with Bitcoin down more than 20–25% year-to-date at various points and trading well below its late-2025 highs. While short-term rebounds remain possible, the combination of policy uncertainty, leveraged position resets, and macro headwinds continues to weigh on sentiment.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and prices can change rapidly. Readers should do their own research and consult a financial advisor before making any investment decisions.

Frequently Asked Questions

Bitcoin is declining due to reduced risk appetite, lower demand, ETF outflows, and increased forced liquidations.

BTC fell due to equity market weakness, economic uncertainty, interest rate concerns, ETF outflows, and liquidations.

Bitcoin has recovered from past corrections, but future price movements depend on economic conditions and investor confidence.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.