Table of Contents

Within the DeFi space, Uniswap is a well-known platform with a large trading volume. However, despite its popularity, people within the crypto world have been disappointed with the fact that Uniswap does not give users much say in matters of the protocol’s development direction. However, Sushiswap is a fork of Uniswap, which allows its native crypto SUSHI owners to participate in network governance.

With a TVL of over $4.5 billion, Sushiswap is one of the leading AMMs (automated market maker) within the DeFi world. In this post, we give you everything you would want to know regarding Sushiswap, as well as Sushiswap price details before you buy SUSHI in India.

All You Need to Know about Sushiswap

SushiSwap was founded in 2020 by the pseudonymous Chef Nomi. There were two other pseudonymous co-founders involved in the creation of Sushiswap, known as sushiswap and 0xMaki- who is also known as just Maki. While very little is known about the three of them or their reasons behind forking off from Uniswap, they are the ones handling the project development and business operations for Sushsiswap, and they are also in charge of the platform’s code.

Sushiswap adopts an automated market making (AMM) model for its DEX- or decentralized exchange protocol. Therefore, there is no order book on the platform; the acts of buying and selling crypto are facilitated by smart contracts, and the prices are decided by an algorithm.

Even though Sushiswap is primarily built upon the base code of Uniswap, there are some key distinctions between the two. Namely, all liquidity providers in Sushiswap pools are rewarded with SUSHI tokens, which doubles as a governance token. Plus, holders of the SUSHI crypto can continue to be rewarded even after they cease to provide liquidity on the platform.

How Does Sushiswap Work?

Sushiswap uses a number of liquidity pools to help users buy and sell various cryptocurrencies; for instance, there is a USDT/ETH pool on Sushiswap that aims to carry equal values of USDT and ETH coins. LPs or liquidity providers can contribute to these pools by locking two (or more) crypto assets into a smart contract.

Buyers can swap their crypto out for crypto stored in a certain liquidity pool. Smart contracts receive the tokens the buyer wants to trade out and send an equivalent amount of the tokens required back to them, continuously maintaining the balance of the crypto tokens in the liquidity pool.

Liquidity providers get a portion of the fees the Sushiswap platform acquires as reward for their deposits. Moreover, SushiBar is an application on Sushiswap that lets users stake their SUSHI to earn the xSUSHI token, which allows them to earn a 0.05% reward out of all the trading fees accumulated by the exchange.

Now that we are aware of the basics of how Sushiswap functions, let’s see why you should buy SUSHI before getting into Sushi price details, as well as the process of acquiring it in India.

Why Buy SUSHI?

Sushiswap’s native SUSHI crypto is an ERC-20 coin, and it has a total supply of 250 million tokens. As of November 2021, new SUSHI coins were being minted at a steady rate of 100 tokens per block. Its circulating supply had reached about 50% of the entire supply, numbering about 127 million circulating coins.

The SUSHI crypto is useful for a number of reasons. For starters, it has a significant role in managing and operating the Sushiswap network. Users who buy SUSHI can participate in platform governance and vote on proposals discussing its further development. In fact, anyone on Sushiswap can submit a SIP or a SushiSwap Improvement Proposal, which other SUSHI holders can then vote on.

Finally, SUSHI holders can earn a portion of the platform fees by staking these coins in the xSUSHI pool. So essentially, the Sushiswap community owns the platform and gets to have a real say in matters of future development just by owning SUSHI coins and helping the protocol run as it should.

How to Buy SUSHI in India?

WazirX has already established itself as one of the top crypto exchange platforms. SUSHI is one among the many altcoins they offer; therefore you can buy SUSHI in India through WazirX by following these few simple steps listed below:

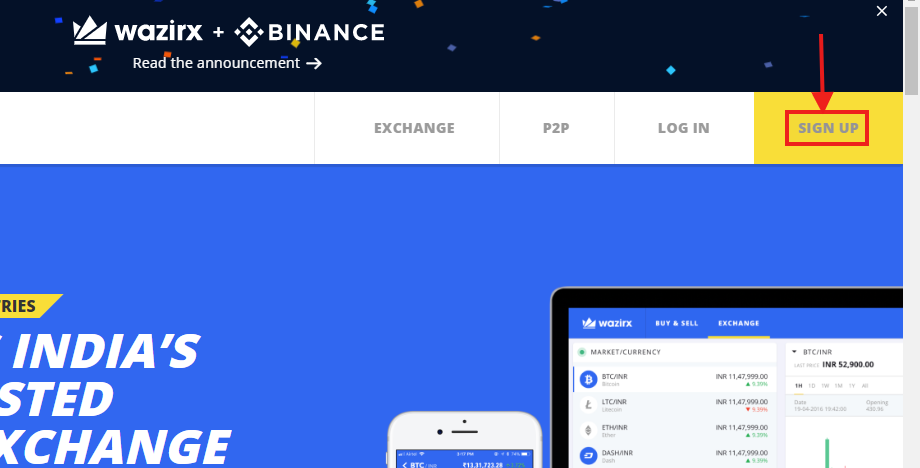

- Sign Up on WazirX

To begin with, you can create an account on WazirX by clicking here.

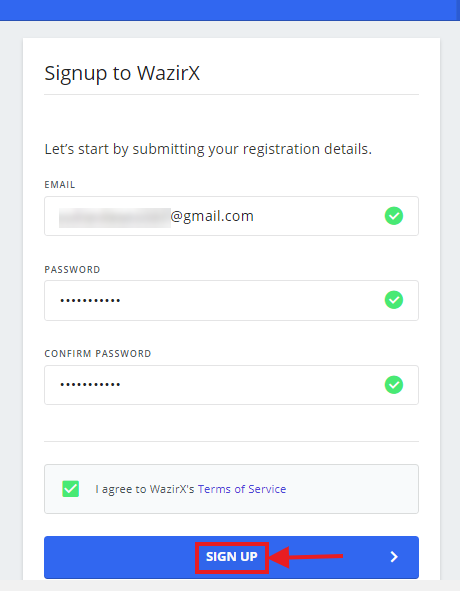

- Fill in the Required Details

Put in your email address and choose a secure password.

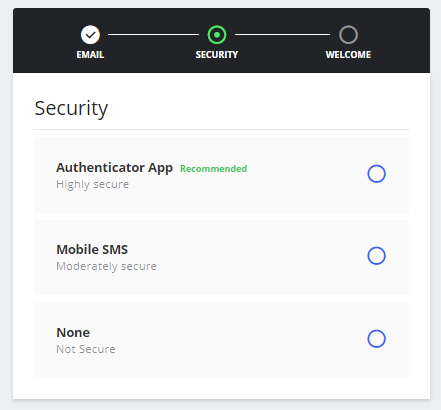

- Email Verification and Account Security Setup

Proceed with account creation after verifying the email address added, proceed with account creation by clicking on the verification link sent to the email address. Next, to ensure the security of your account, WazirX would provide you with two choices as you can see in the image below. While selecting an option, keep in mind that the authenticator app is more secure than mobile SMS, since delayed reception or SIM card hacking is a risk.

- Choose Your Country and Complete KYC

Once you have selected the country, it’s recommended you go through the KYC process since without having completed KYC, you can not trade peer-to-peer or withdraw funds.

To complete KYC, you must submit the following details:

- Your full name as it appears on your Aadhaar or equivalent document,

- Your birth date as stated on your Aadhaar or equivalent document,

- Your address as it appears on your Aadhaar or equivalent document,

- A scanned copy of the document,

- And finally, a selfie to finish the procedure.

And you are done creating your account! Within 24 to 48 hours, the account is usually validated.

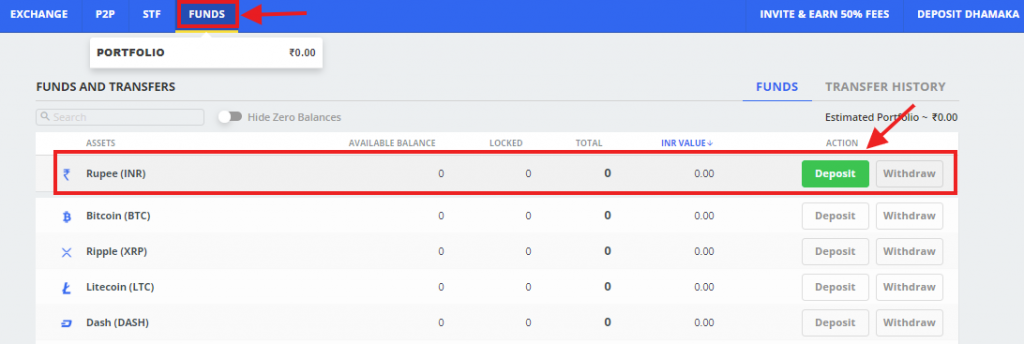

- Now Transfer Funds to Your WazirX Account

After you have linked your bank account to your WazirX account, you can deposit funds into your WazirX wallet. The platform accepts deposits in INR using IMPS, UPI, RTGS, and NEFT. You can deposit a minimum of Rs. 100 in your WazirX account, and there is no maximum limit.

To deposit funds, log in to your WazirX account and select “Funds”, as seen in the image below. Then simply select “Rupee (INR)”, and then click “Deposit”.

- Buy SUSHI on WazirX after Checking SUSHI Crypto Price in India

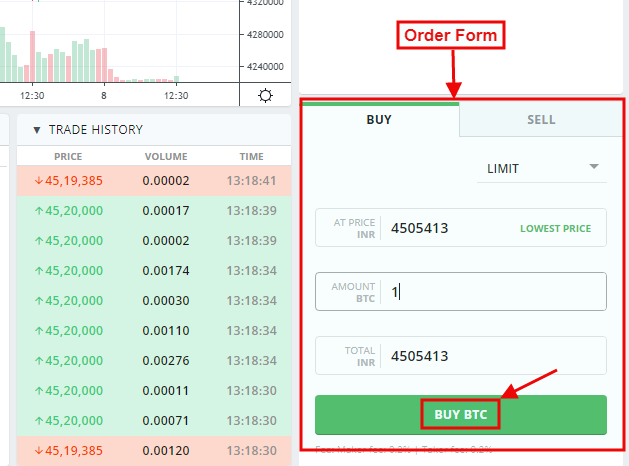

You can buy SUSHI with INR through WazirX. Just log in to your WazirX account and select INR from the “Exchange” option. You will be redirected to a spot market for all cryptos matched against the Indian Rupee. On the right side of the screen, you will see all price charts, order book data, and an order input form.

Make sure to look at the SUSHI crypto price in India at the moment before you fill out the buy order form and click on “Buy SUSHI”. The form should look the same as the one shown for a BTC order in the image below.

It will take some time for the order to be carried out. But as soon as the order is executed, you will receive the SUSHI coins you purchased in your WazirX wallet.

What Does the Future of Sushiswap Look Like?

Despite entering the market only recently in 2020, Sushiswap already has a market cap of nearly $545 million as of the beginning of 2022. Sushiswap price reached an all-time high of $23.38 on March 13, 2021. Even though the coin ended 2021 on not exactly as high note, experts harbor bullish sentiments regarding the SUSHI crypto’s future.

According to the algorithm-based forecasting site Wallet Investor, the Sushi price could go up to $8.4 by the start of January 2023 and near $25 in five years from now. On the other hand, DigitalCoin suggests that the Sushiswap price could average around $6 in 2022, be about $10 by 2025, and then go up to $18.18 by 2029.

Despite being a Uniswap fork, Sushiswap brings new features to the AMM model, with a larger scope for community governance. With the latest addition of an NFT platform called Shoyu- suggested by a member of the Sushi community- Sushiswap shows its commitment to innovation and constant improvement. With platforms like Sushiswap, the future of DeFi looks quite bright indeed.

Frequently Asked Questions

What Is The Safest Cryptocurrency To Invest In?

Bitcoin has had the highest market capitalization, has been around the longest, has the most experienced development team, and has enormous network impact and brand recognition. As a result, while trading cryptocurrencies, the rate of return on Bitcoin is commonly used as a benchmark. However, the risks associated with cryptocurrencies remain, and the safest cryptocurrency for you depends on your analysis.

Is Cryptocurrency Legal In India?

In India, cryptocurrencies are legal; anyone can purchase, sell, and trade cryptocurrencies. They are currently unregulated; India does not have a regulatory framework in place to regulate its functioning. According to the Ministry of Corporate Affairs (MCA), companies must now declare their crypto trading/investments during the financial year, according to the Ministry of Corporate Affairs (MCA). Cryptocurrency transactions have been taxable in India when people receiving such gains are Indian tax residents or where the crypto is considered to be domiciled in India

Is Ethereum Safe To Invest?

The Bitcoin market is unquestionably more volatile than the stock market. This may not be the market for you if you are incredibly risk-averse. Ethereum, on the other hand, may be a terrific investment for you if you're a diamond-handed investor who won't lose sight of short-term losses. Ethereum is a relatively safe investment as it is also based on blockchain.

What Is Crypto?

Crypto or a cryptocurrency is a digital currency protected by cryptography, making counterfeiting and double-spending nearly impossible. Blockchain technology is used to produce cryptocurrencies (a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a government does not issue them. The word "cryptocurrency" refers to the encryption methods employed to keep digital currencies and the network secure.

Who Invented Cryptocurrency?

Satoshi Nakamoto invented cryptocurrencies and the technology that makes them function in 2009. The presumed pseudonymous individual or persons who invented Bitcoin used this identity. In addition, Nakamoto created the first blockchain database. Even though many people have claimed to be Satoshi Nakamoto, the person's identity remains unknown.

Is Cryptocurrency Safe To Invest In?

Cryptocurrency investments are subject to market risks, but if sufficient security measures are not taken, trading accounts can be maliciously accessed. Investments come with risks and uncertainties, and we cannot claim that any digital currency investment is risk-free. Buying and selling cryptocurrencies can be risky even if the trader is knowledgeable about the market and treats their coins carefully.

How To Invest In Cryptocurrency?

There are two ways of investing in cryptocurrency, mining and via exchanges. Cryptocurrency mining is considered the procedure of verifying and adding transactions to the blockchain public ledger. Another option is via cryptocurrency exchanges. Exchanges generate money by collecting transaction fees, but there are alternative websites where you can interact directly with other users who want to trade cryptocurrencies.

How Cryptocurrency Works?

Cryptocurrencies use cryptography technology to keep transactions and their units (tokens) secure. Cryptocurrency works via a technology called the blockchain. A blockchain is a decentralized technology that handles and records transactions across numerous computers. The security of this technology is part of its value.

What Are The Best Cryptocurrencies To Invest In?

The best cryptocurrencies to invest in would be the ones you study and analyze in detail. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and many altcoins such as Tron, Ripple, Litecoin, etc.

Is Crypto Legal In India?

Cryptocurrencies are legal in India, and anyone can purchase, sell, and exchange them. It is currently uncontrolled, as India lacks a regulatory structure to oversee its operations. Per the Ministry of Corporate Affairs, companies must now record their crypto trading/investments within the financial year. In cases where a person receiving the gains is an Indian tax resident, or the cryptocurrency is regarded as domiciled in India, cryptocurrency transactions have been taxable in India

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.