Table of Contents

Note: This post has been written by a WazirX Warrior as a part of the “WazirX Warrior program“.

There have been multiple methods used to predict the price of Bitcoin in the coming future. Few popular methods are Non-linear deep learning methods (LSTM and RNN), ARIMA model, Time-series forecasting of Bitcoin prices using high-dimensional features, and so on. But the most famous method is the Stock-to-flow (SF or STF or S2F) model.

The STF method gained its popularity because it can be used on all commodities where we have current stock data and the expected flow in the future. The popular use cases are gold, silver, and now Bitcoin. Bitcoin fits in well to be considered for STF because we have the data of current and total Bitcoin supply and expected new Bitcoin being created every year.

Therefore, Stock-to-flow is generally applied to natural resources, and Bitcoin is the first manmade asset to have the same characteristics.

What is the Stock-to-flow ratio?

STF ratio can be calculated using two metrics: Stock and Flow. It essentially shows how much supply enters the market each year for a given resource relative to the total supply. The higher the Stock to Flow ratio, the less new supply enters the market relative to the total supply. As such, an asset with a higher Stock to Flow ratio should, in theory, retain its value well over the long-term.

What is the current Stock-to-flow ratio of Gold and Bitcoin?

Gold Current Stock : 190,000 tons

Gold expected to flow in future (In one year): 3400 tons

STF Ratio : Current stock/Expected Flow = 190000/3400 = ~56

Bitcoin Current Stock: 18.5 Million

Bitcoin expected flow in future (In one year): 0.35 Million

STF Ratio : Current stock/Expected Flow = 18.5/0.35 = ~52

By this and at the time of writing, Gold is more scarce than Bitcoin as Gold’s SFT ratio is higher than Bitcoin.

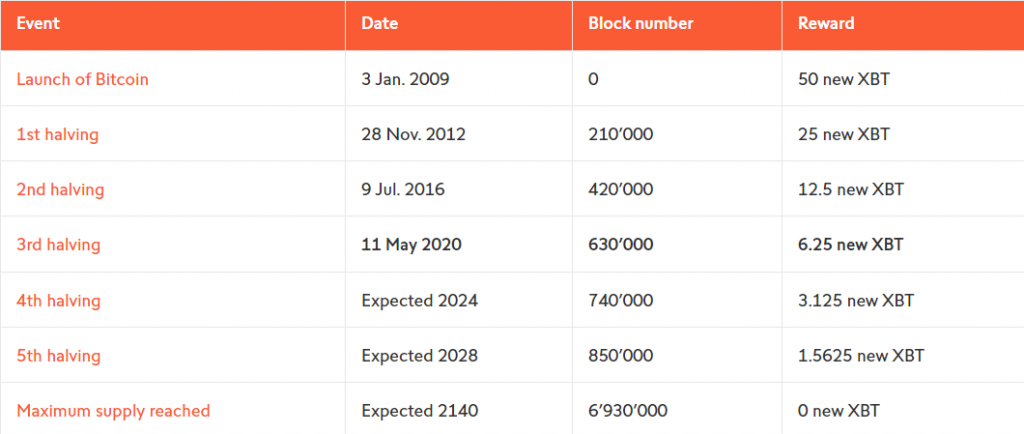

We also need to consider Bitcoin halving, where the amount of new supply entering the system is halved every 210,000 blocks. With each halving, the time required to reach the next 210,000 increase.

Note: The abbreviation “XBT” comes from the International Standards Organization (ISO) that maintains a list of internationally recognized currencies. The standard dictates that if a currency is not associated with a particular country, it should begin with an “X”, hence “XBT”. Another example of this is the abbreviation for gold, “XAU”.

What will be the Stock-to-Flow ratio of Gold and Bitcoin after 4 years ?

As per data available, Gold will continue to mine with a flow of 3400 tons a year, which means we will have 13,600 tons added to current stock after 4 years.

The STF ratio of gold after 4 years will be:

Gold Stock after 4 years : 203600 (190,000 +13,600) tons

Gold expected to flow in future (In one year): 3400 tons

STF Ratio : Current stock/Expected Flow = 203600/3400 = ~60

The STF ratio of Bitcoin after 4 years will be:

Bitcoin Current Stock after 4 years : 19.9 (18.5+1.4) Millions

Bitcoin expected to flow in future (In one year): 0.175 Million (Post next halving)

STF Ratio : Current stock/Expected Flow = 19.9/0.175 = ~113

These are some astonishing numbers that show that in 4 years, Bitcoin will be way more scarce than the age-old trusted asset Gold. This will be a great event in the history of mankind.

What does the ratio tell us?

The current ratio of Gold, 56, will take us 56 years to mine the gold we currently have in stock.

In the same way, after 4 years and with the ratio of 113 for Bitcoin, it will take 113 years for us to mine the Bitcoin we will have in stock in 2024.

This is why the higher the ratio, the higher the scarcity, the higher the price.

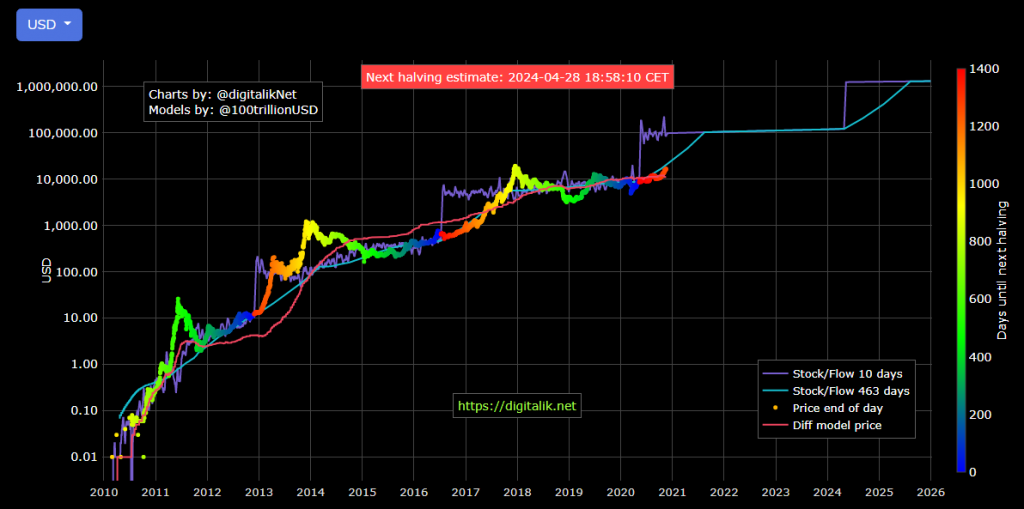

Stock-to-flow Chart

The above chart is up to date as of 17 Nov 2020 and below are the latest ratio:

- Current STF Ratio – 50.5

- Next halving expected – 28 April 2024

Conclusion

The Stock to Flow model measures the relationship between the currently available stock of a resource and its production rate. It’s typically applied to precious metals and other commodities, but some argue it may apply to Bitcoin as well.

In this sense, Bitcoin may be viewed as a scarce digital resource. According to this analysis method, the unique propositions of Bitcoin should make it an asset that retains its value over the long-term.

However, every model is as strong as its assumptions, and it may not be able to account for all aspects of Bitcoin valuation.

Any information found on this page is not to be considered as financial advice. You should do your own research before making any decisions.

WazirX Warrior Author: Jay Tanwar

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.