Table of Contents

Ethereum, despite being the alma mater of a majority of dApps and Defi platforms, hasn’t been able to scale efficiently to make the dApps eligible for mainstream adoption. The transaction throughput and gas fees are other trailing issues that often leave the developers frustrated. Ranked #173 in the cryptocurrency charts (as of 01 June 2022), Chromia seeks to tackle these issues by facilitating the development of secure dApps using familiar paradigms.

Chromia can help dApps scale to millions of users without compromising the user experience by rethinking blockchain architecture and making it more intuitive via relational databases.

Curious to know more about Chromia? We’ve got you sorted.

The article will discuss how Chromia works, Tokenomics of the CHR token, Chromia price in INR, Chromia’s price prediction for the future, and much more.

Get WazirX News First

What is Chromia?

Chromia is a Layer-1 blockchain that acts as a Layer-2 EVM-compatible enhancement for Ethereum and BSC (Binance Smart Chain). It is a relational blockchain platform that allows developers to build dApps suited for mass-scale real-world use cases.

Blockchain is, at times, criticized as a dumb database technology that needs data that gets stored on the blockchain and is processed for the blockchain to interact with the users. In a modern world where day-to-day operations are powered by relational databases such as the web, banks, social networks, etc., blockchain as a digital ledger isn’t always the best bet.

Chromia combines blockchain tech and relational databases to make dApps more user-friendly and powerful. Many enterprises have used and optimized these relational databases for decades. Chromia can be used as a public, private or hybrid blockchain.

CHR is the native token of the platform. Chromia (CoinMarketCap data) has a market capitalization of $142.89 million as of 01 June 2022. It is designed to bring developers, investors, and users together in a mutually beneficial relationship.

Chromia’s USPs

- Rell is the custom programming language of the Chromia blockchain. It is very similar to SQL in terms of functionality. It has been specially designed for coding purposes. Developers can enhance the existing dApps and create new ones with greater scalability, improved data handling, and customizable fees. Rell is easier to use than other blockchain languages, and with just a few lines of code, developers can code 7-10x faster.

- The Chromia Vault, a wallet software, helps users with a secure address to manage their tokens and dApps on the Chromia blockchain. The Vault also has ‘Single Sign On’ – a unique feature that eliminates the need for entering passwords each time a user logs in to their accounts without any compromise on the security.

Founders: The Chromia blockchain was founded by Henrik Hjelte, CEO of Chromia; Or Perelman, COO; and Alex Mizrahi, CTO of Chromia, in 2018. The founding team was earlier credited with developing the protocol Colored Coins and Bitcoin Wallet Safebit. The Chromia project is backed by 21M Capital, Neo Global Capital, and Arrington XRP Capital.

How Does Chromia Work?

Any dApp that operates on the Chromia blockchain has its own sidechain that is rooted in and runs parallel to the main blockchain. Chromia places a blockchain inside a database, and for handling voting and consensus, it adds a light software layer. This leads to the creation of nodes that are distributed among various participants. Any request to write data first goes to any of the nodes which share it with the other nodes. A consensus is reached post the inspection of the nodes. In this way, the data is finally logged into the blockchain.

Chromia can be used both as an enterprise and an independent public blockchain. The relational databases provide versatility, flexibility, and consistency to the data and application, making Chromia blockchain a perfect fit for the publicly hosted application infrastructure for the reformed internet, granting sovereignty to the users. Chromia is also an ideal layer-2 to Ethereum as it helps to make transactions cheaper and faster.

Platforms Hosted on the Chromia Blockchain

The Chromia blockchain hosts several popular applications across a wide and diverse range:

- Metaverse-themed P2E games like My Neighbor Alice, Chain Alliance, Mines of Dalarnia, Krstopia, etc.

- Enterprise-level applications like LAC Property Chain – a land administration initiative in Latin America and the Caribbean, Lingon, CapChap, etc.

- Defi-based options trading platform like Hedget.

- Applications like Green Asset Wallets, Chromunity, etc.

CHR Token

The CHR token is the native token of the Chromia platform and derives its value within the Chromia ecosystem via various utilities.

- CHR can be used to pay hosting fees by dApps and developers of other platforms hosted on the Chromia blockchain

- The token can also be used as a reserve by dApps to peg their own native tokens

- It can also be used to pay fees on the dApps hosted on the CHR network

- The token holders can stake their CHR tokens and earn passive rewards

Chromia Price Prediction

The token CHR or Chromia’s price in INR is 20.50 as of 01 June 2022. With a slew of use cases and utilities deriving utility for the CHR token, demand for CHR token from the dApps and users of CHR blockchain will increase, subsequently increasing the price of the CHR token in the long run. The Chromia price prediction is optimistic and bullish as Defi gathers enough steam to go mainstream. Buy Chromia in INR here.

Key Metrics of CHR Token

The CHR token is an ERC-20 token with a circulating supply of 567.37 million tokens. The circulating supply was reduced post the burning of 22 million CHR tokens. The maximum supply of the CHR token is 1 billion. The tokens are released on a monthly basis, and the distribution schedule will be extended to 2025 and beyond.

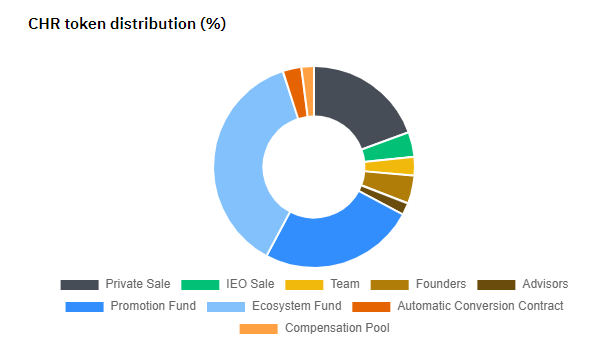

Token Supply Distribution

The breakdown of the token supply distribution is as follows:

- Private Sale: 19.40% of the total supply.

- IEO Sale: 4.00% of the total supply.

- Team: 2.98% of the total supply.

- Founders: 4.50% of the total supply.

- Advisors: 1.92% of the total supply.

- Promotion Fund: 25.00% of the total supply.

- Ecosystem Fund: 37.20% of the total supply.

- Automatic Conversion Contract: 3.00% of the total supply.

- Compensation Pool: 2.00% of the total supply.

Chromia, as a relational database-powered blockchain protocol, holds immense potential and possibilities in the web3 internet space. If reading about Chromia’s ever-evolving and multi-dimensional personality makes you feel you should invest in the cryptocurrency, head over to WazirX to know Chromia’s price in INR and buy Chromia in India at the best price at WazirX. Happy trading!

Frequently Asked Questions

What Is The Meaning Of Crypto?

A cryptocurrency is a digital currency that is secured by the process of cryptography, making counterfeiting and double-spending almost impossible to happen. Blockchain technology is used to produce cryptocurrencies ( a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a centralized authority does not issue them.

Which Cryptocurrency Is Best To Invest In 2021?

Many altcoins are flourishing to invest in. Some cryptocurrencies with great potential are Ether, Ripple, Tron, and more. Investors are trying to diversify their portfolios and are flocking to the leading cryptocurrencies. Many growing businesses are already accepting cryptocurrency as acceptable payment methods.

How Cryptocurrency Works?

Cryptocurrencies use cryptography technology to keep transactions and their units (tokens) secure. Cryptocurrency works via a technology called the blockchain. A blockchain is a decentralized technology that handles and records transactions across numerous computers. The security of this technology is part of its value.

Is Cryptocurrency Banned In India?

No, cryptocurrency is not banned in India. India has seen its ups and downs in the crypto sector concerning its legal status. The Reserve Bank of India (RBI) issued a circular in April 2018 advising all organizations under its jurisdiction not to trade in virtual currencies or provide services to assist anyone in dealing with or settling them. A government committee proposed outlawing all private cryptocurrencies in mid-2019, with up to ten years in prison and severe penalties for anyone dealing in digital currency. The Supreme Court overruled the RBI's circular in March 2020, allowing banks to undertake cryptocurrency transactions from dealers and exchanges.

How Many Cryptocurrencies Are There?

There are over 5000 other digital currencies available on the internet in addition to Bitcoins. The only problem is that they haven't gotten the users' attention. Besides Bitcoins, a few other digital currencies have gained popularity among users. It's been more than ten years since Bitcoins were first released, and now they've achieved new heights thanks to their phenomenal success.

What Is Crypto?

Crypto or a cryptocurrency is a digital currency protected by cryptography, making counterfeiting and double-spending nearly impossible. Blockchain technology is used to produce cryptocurrencies (a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a government does not issue them. The word "cryptocurrency" refers to the encryption methods employed to keep digital currencies and the network secure.

Is Cryptocurrency Legal In India?

In India, cryptocurrencies are legal; anyone can purchase, sell, and trade cryptocurrencies. They are currently unregulated; India does not have a regulatory framework in place to regulate its functioning. According to the Ministry of Corporate Affairs (MCA), companies must now declare their crypto trading/investments during the financial year, according to the Ministry of Corporate Affairs (MCA). Cryptocurrency transactions have been taxable in India when people receiving such gains are Indian tax residents or where the crypto is considered to be domiciled in India

Who Invented Cryptocurrency?

Satoshi Nakamoto invented cryptocurrencies and the technology that makes them function in 2009. The presumed pseudonymous individual or persons who invented Bitcoin used this identity. In addition, Nakamoto created the first blockchain database. Even though many people have claimed to be Satoshi Nakamoto, the person's identity remains unknown.

Are Cryptocurrencies A Good Investment?

Cryptocurrency has the potential to make you extremely wealthy, and the potential to cause you to lose your money. Crypto assets, like any other investment, come with many risks and potential rewards. Fundamentally, cryptocurrency is an excellent investment, particularly if you want to gain direct exposure to the demand for digital currency.

Is Ethereum Safe To Invest?

The Bitcoin market is unquestionably more volatile than the stock market. This may not be the market for you if you are incredibly risk-averse. Ethereum, on the other hand, may be a terrific investment for you if you're a diamond-handed investor who won't lose sight of short-term losses. Ethereum is a relatively safe investment as it is also based on blockchain.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.