Disclaimer: Originally Published in the Economic Times.

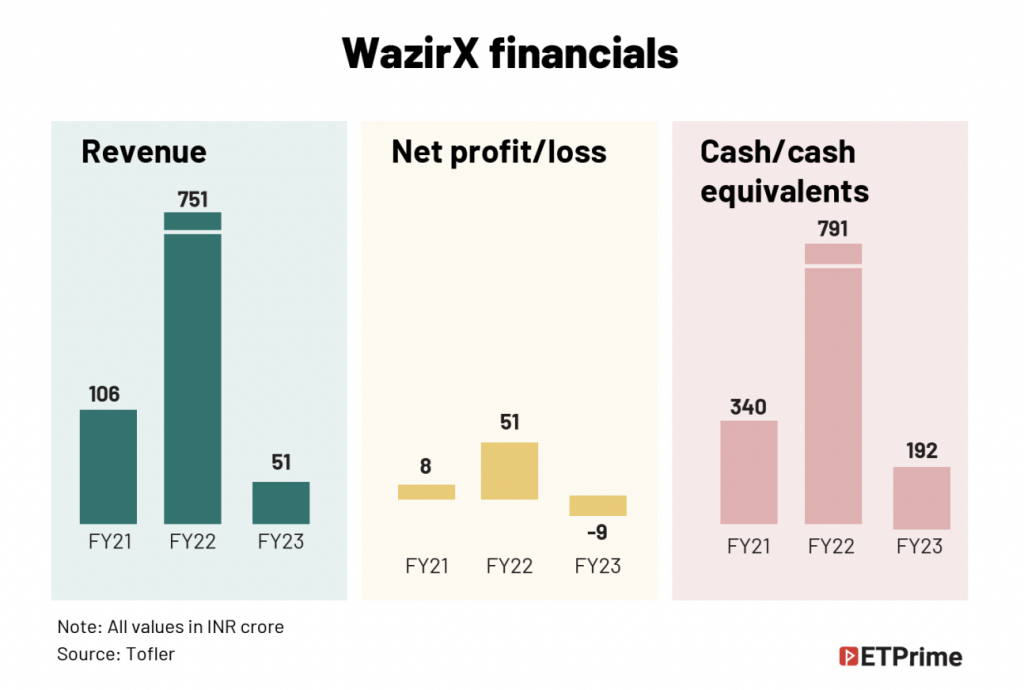

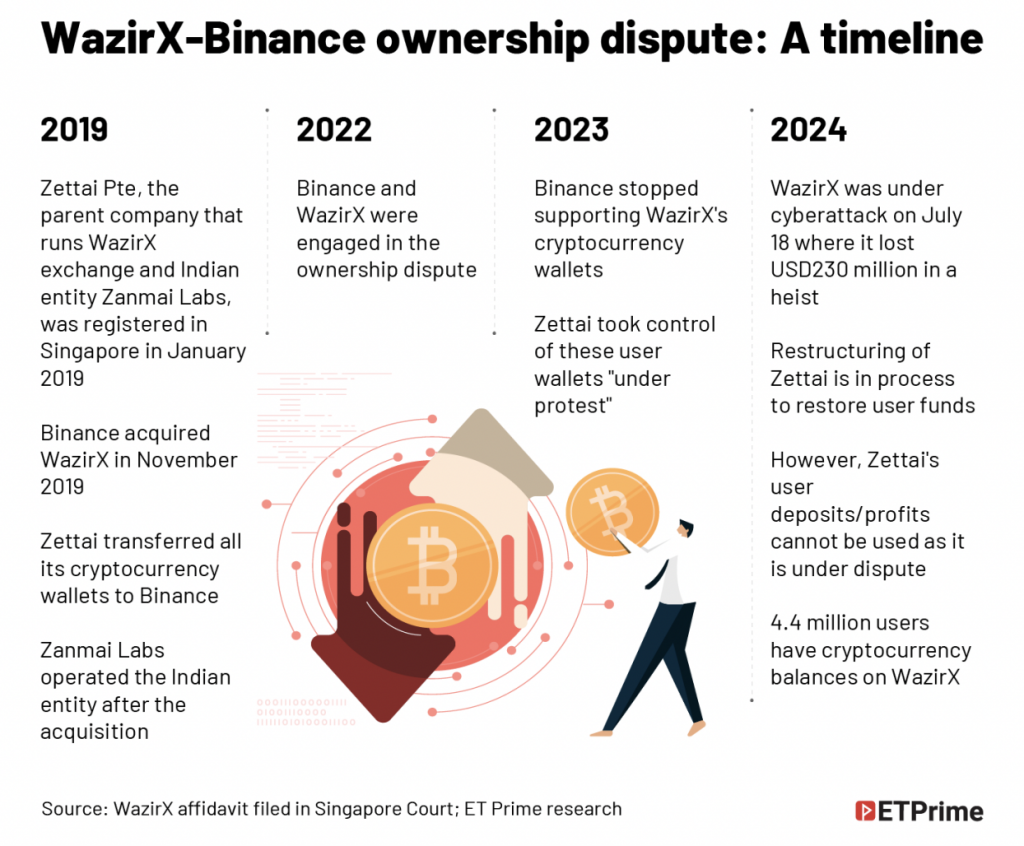

Cryptocurrency exchange WazirX has been in the eye of storm since the July 18 cyberattack that shaved USD230 million off its customers’ assets. And one question that has been plaguing its 16 million users since the heist is: Why can’t WazirX use its profits to pay them? Only, WazirX cannot use it, going by what the company shared in a recent media townhall. Not the least of all is dwindling revenues at WazirX, after stringent taxation that came into the picture in 2022.

At the crux of it is the company’s ownership battle with the world’s largest cryptocurrency firm, Binance. According to George Gwee, director – global restructuring advisory, Kroll Singapore, which is overseeing WazirX restructuring in a bid to distribute existing assets to users, due to the nature of acquisition with Binance, WazirX’s Singapore-based parent entity Zettai Pte does not capture the revenue or profits generated on the platform and will not be able to contribute to the process. While Gwee and WazirX did not share the financial details of Zettai due to dispute, according to Tracxn, the entity had registered revenue of USD108 million as of March 2022 and profits at USD7.06 million.

This is important. The Indian exchange, in its affidavit, had insisted that Binance is the owner and had taken over operations “under protest”. It is undergoing a restructuring process to distribute its existing assets to its users and is in talks with international exchanges to get potential ‘white knights’ onboard or through partnerships to expedite recovery.

The ownership dispute, according to sources ET Prime spoke to, has made the process complex. ET Prime in this story decodes the tangled web of relationships between WazirX and Binance, and why is the Singapore entity Zettai at the center of the dispute.

WazirX’s complex relationship

There are two key entities that are tied up with WazirX – Zettai Pte Ltd registered in Singapore in January 2019 and its subsidiary Zanmai Labs Pvt Ltd.

Zanmai was incorporated in 2017 in India. But after the Reserve Bank of India (RBI) banned cryptocurrency transactions, Zettai Pte was incorporated in Singapore, as the parent entity, to handle the crypto trading operations, as INR was banned in the country.

WazirX has 16 million registered users, of which 4.4 million have cryptocurrency balances on the platform.

Till the time of Binance’s now disputed acquisition in November 2019, Zettai operated the Indian entity Zanmai Labs. Later, the cryptocurrency wallets and assets were transferred to Binance under Transfer Transaction Agreement, terms of which are confidential.

Post this, the affidavit said, while Binance looked at crypto-to-crypto business, Zanmai was licensed by the exchange to operate INR services for the Indian market.

After a public dispute in August 2022 over ownership, Binance terminated its crypto wallet services in February 2023. Since then, Nischal Shetty, co-founder, WazirX, in his affidavit said the company was compelled to accept “under protest” the transfer of cryptocurrency tokens held by Binance to Zettai in the interest of users.

This raises three key questions about the role the Indian and Singapore entities are playing in the restructuring process.

#1 Who is funding the recovery process?

Zanmai India has kept aside USD12 million of crypto to fund the investigation, restructuring, and legal cost for the dispute. Kroll’s Gwee said that Zettai is not able to contribute to the process due to the transaction structure it entered with Binance in 2019 at the time of acquisition. This is despite the profits the entity had made in the last few years.

#2 Who is booking Zettai’s profits?

During the media townhall on September 2 over Zettai’s restructuring, Gwee explained that the crypto-to-crypto business is in an ongoing dispute, and revenues associated with that flow to Binance and not to Zettai. He added that as a result, Zettai does not capture any of those revenues, cash flows, or profits in its books. Shetty pointed out that, as per its terms and conditions, Binance is the one booking those profits. Email sent to Binance seeking clarity on the issue did not elicit any response.

#3 Where will users get the money from?

If the restructuring process goes through, the existing assets in WazirX’s balance sheet will be distributed to users. The company currently has USD284 million in liquid assets on a range of wallets and on third- party exchange platforms. According to Gwee, only 57% of the users’ assets could be recovered as per the current estimates.

According to the affidavit, Zettai owes USD546 million to 4.3 million users in unsecured liabilities. If users want to withdraw funds, Zettai will be liable to pay, only if it owns the platforms with the funds. This means users will not be able to make a full claim on this since there is no clarity on who owns the platform.

Original Source: ETPrime