Table of Contents

You may have heard of something called a Bitcoin ‘halving’ occurring this year. In May 2020, Bitcoin went through its third halving, and its reward value dropped from 12.5 to 6.25 BTC per block mined. This essentially means that the reward for mining a block was cut in half yet again.

But how does this work?

In a centralized economy, the central bank is responsible for controlling the supply of money. However, in the case of cryptocurrencies like Bitcoin, there is no such centralized authority to control its monetary base. This necessitates that Bitcoin as a cryptocurrency must have its own mechanism to ensure a controlled supply.

This is where the concept of Bitcoin halving (or ‘halvening’) comes in. After every 210,000 blocks that are mined, the reward awarded to miners for every block gets halved. As a result, new bitcoins are released into circulation at only half the rate as compared to before that. (This is distinct from a coin burn – a mechanism that other cryptocurrencies apply to manage inflation)

Therefore, this controlled release of bitcoins helps maintain a synthetic form of Bitcoin inflation. This halving would continue till all the bitcoins have entered circulation, and after that, miners would be rewarded with the fee that network users will pay for processing transactions.

Get WazirX News First

Why is Bitcoin Halving Important for Cryptocurrency Investors?

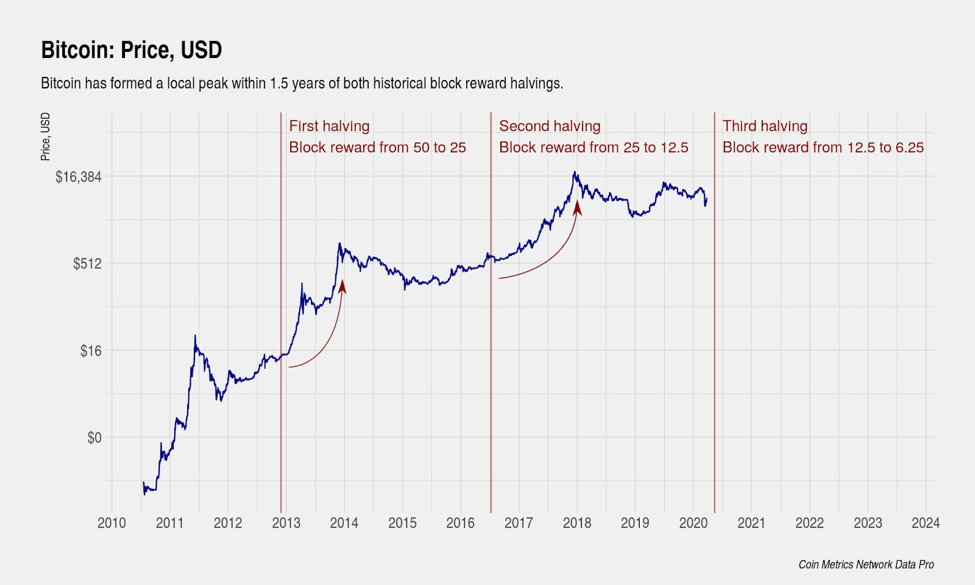

Is there any significance of this phenomenon for cryptocurrency investors? This is easier to understand when we notice the patterns that are set off by a halving event. When a halving occurs, bitcoins’ supply decreases, and the consequent higher demand leads to a rise in Bitcoin prices. And quite clearly, Bitcoin halvings in the past have resulted in a dramatic rise in Bitcoin prices, only to drop later. Let’s have a look.

- The First Halving

In November 2012, the first Bitcoin halving took place, halving the reward for mining from 50 to 25 BTC. The consequent effect on the prices saw a surge of about 8000% in the year that followed.

- The Second Halving

The second such event occurred in July 2016 when the reward was halved from 25 to 12.5 BTC, and as a result, Bitcoin prices surged by nearly 1000%.

- The Third Halving

The events of May 2020 have again led to an all-time high in Bitcoin prices, nearly reaching $20,000 in November 2020.

Therefore, crypto investors can make use of this knowledge in various ways. Understanding the market fluctuations – price rise followed by a drop – is important for anyone who intends to make gains from these market movements. At the same time, it is also important to understand the effects of other global situations, such as the ongoing pandemic, to figure out whether all halvings will necessarily result in similar price movements.

For bitcoin miners, understanding the halving of the mining reward with respect to increasing value is essential. For example, if the third halving was expected to reduce the Bitcoin inflation rate from 3.6% to 1.8%, then these changes are relevant to how the gains would be calculated. The operational costs of mining, such as hardware, electricity, etc., are estimated at $6,851 by Bitcoin.com. This corresponds to a 30% margin because 70% of the block rewards would have to be sold to cover the operational costs. So if the halvings push up the Bitcoin price but not by much, then it is not a great investment for miners (while being great for investors).

For new investors, Bitcoin halving presents a great opportunity to understand the cryptocurrency domain and begin making investments.

Conclusion

Crypto investors, particularly those holding Bitcoins for sufficient duration to make gains, can benefit greatly from such halvings. For a volatile asset, such a pattern that has occurred thrice so far seems fairly consistent.

With the next halving expected in another 4 years, it remains to be seen whether the price-boost pattern is set in stone or simply happens to coincide with other market forces.

Also you can download the app and Start Trading Now!

Android App – Bitcoin Exchange

iOS App – Cryptocurrency Exchange

Frequently Asked Questions

Is Bitcoin Legal In India?

In India, Bitcoin is not illegal. Because of cryptocurrency's rapid evolution, policymakers and regulators seemed to have recognized the chance to accept the new technology early. From the infamous 'RBI ban' in 2018 to reports of an impending bill banning cryptos in 2021 that has yet to develop, India has seen its fair share of ups and downs when it comes to Bitcoin regulation. Last year, the Supreme Court Of India approved the use of Bitcoin throughout the country. According to the Supreme Court, the existence of Bitcoin or any other cryptocurrency is unregulated but not unlawful.

How Can I Get Bitcoin?

To begin, go to the WazirX website and register. After that, you will receive a verification email. The link received by verification mail will only be available for a few seconds, so make sure you click it as quickly as possible. This will successfully verify your email address. The following step is to set up security, so choose the best solution for you. After you've set up the security, you'll be given the option of continuing with or without completing the KYC process. Following that, you'll be sent to the Funds & Transfers section, where you can begin depositing Bitcoins into your wallet. You may also use INR to fund your WazirX Bitcoin wallet and then use it to purchase Bitcoin.

How Many Bitcoins Are There?

There are 18,730,931.25 Bitcoins in circulation as of June 2021. The total number of Bitcoins that would ever be there is just 21 million. On average, 144 blocks are mined every day, with 6.25 Bitcoins per block. The average number of new Bitcoins mined every day is 900, calculated by multiplying 144 by 6.25.

How Bitcoin Mining Works?

Bitcoin mining is a crucial element of the blockchain ledger's upkeep and development and the act of bringing new Bitcoins into circulation. It's done with the help of cutting-edge computers that solve exceedingly challenging computational arithmetic problems. Auditor miners are rewarded for their work. They're in charge of ensuring that Bitcoin transactions go through smoothly and legitimately. This standard was established by Satoshi Nakamoto, the founder of Bitcoin, to keep Bitcoin users ethical. By confirming transactions, miners assist in avoiding the "double-spending issue."

Is Cryptocurrency Legal In India?

In India, cryptocurrencies are legal; anyone can purchase, sell, and trade cryptocurrencies. They are currently unregulated; India does not have a regulatory framework in place to regulate its functioning. According to the Ministry of Corporate Affairs (MCA), companies must now declare their crypto trading/investments during the financial year, according to the Ministry of Corporate Affairs (MCA). Cryptocurrency transactions have been taxable in India when people receiving such gains are Indian tax residents or where the crypto is considered to be domiciled in India

What Are The Best Cryptocurrencies To Invest In?

The best cryptocurrencies to invest in would be the ones you study and analyze in detail. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and many altcoins such as Tron, Ripple, Litecoin, etc.

Is crypto legal?

Crypto is legal in most countries, including India. While nations like the U.S. and many in Europe have regulatory frameworks, others like China have strict bans.

Can I Invest In Cryptocurrency?

Yes, with exchanges like WazirX, you may invest in cryptocurrency in India. To begin, go to the WazirX website and register. After that, you will receive a verification email. The link received by verification mail will only be available for a few seconds, so make sure you click it as quickly as possible. This will successfully verify your email address. The following step is to set up security, so choose the best solution for you. After you've set up the security, you'll be given the option of continuing with or without completing the KYC process.

How Safe Are Cryptocurrencies?

Cryptocurrencies can be safe, but your crypto wallets can be hacked if proper security steps are not performed.There are also dangers and uncertainties associated with investments, and we cannot declare any virtual currency investment risk-free. Buying and selling cryptocurrencies does not have to be dangerous if the trader is well-versed in the market and treats his coins with care.

Which Cryptocurrency Is Best To Invest In 2021?

Many altcoins are flourishing to invest in. Some cryptocurrencies with great potential are Ether, Ripple, Tron, and more. Investors are trying to diversify their portfolios and are flocking to the leading cryptocurrencies. Many growing businesses are already accepting cryptocurrency as acceptable payment methods.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.