Table of Contents

You may have heard of something called a Bitcoin ‘halving’ occurring this year. In May 2020, Bitcoin went through its third halving, and its reward value dropped from 12.5 to 6.25 BTC per block mined. This essentially means that the reward for mining a block was cut in half yet again.

But how does this work?

In a centralized economy, the central bank is responsible for controlling the supply of money. However, in the case of cryptocurrencies like Bitcoin, there is no such centralized authority to control its monetary base. This necessitates that Bitcoin as a cryptocurrency must have its own mechanism to ensure a controlled supply.

This is where the concept of Bitcoin halving (or ‘halvening’) comes in. After every 210,000 blocks that are mined, the reward awarded to miners for every block gets halved. As a result, new bitcoins are released into circulation at only half the rate as compared to before that. (This is distinct from a coin burn – a mechanism that other cryptocurrencies apply to manage inflation)

Therefore, this controlled release of bitcoins helps maintain a synthetic form of Bitcoin inflation. This halving would continue till all the bitcoins have entered circulation, and after that, miners would be rewarded with the fee that network users will pay for processing transactions.

Get WazirX News First

Why is Bitcoin Halving Important for Cryptocurrency Investors?

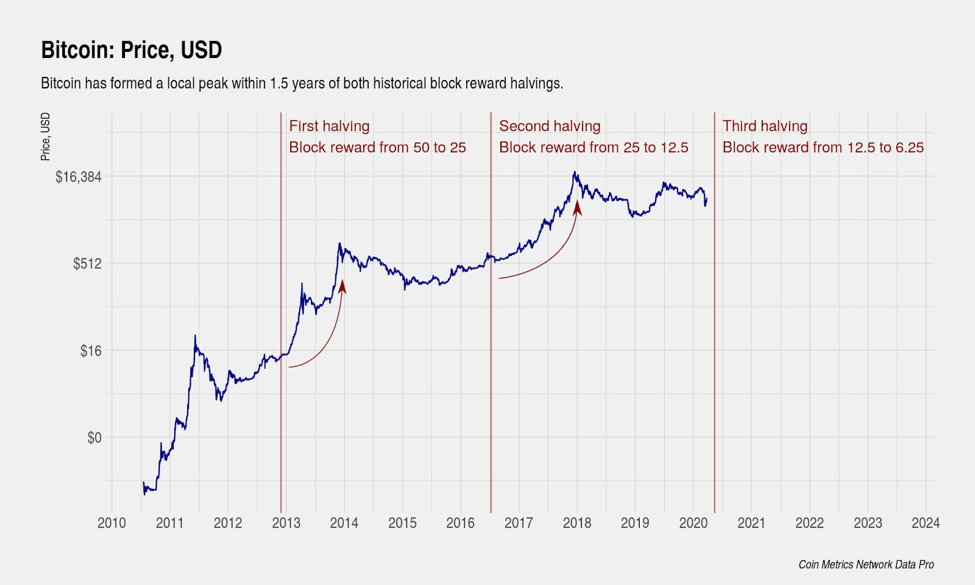

Is there any significance of this phenomenon for cryptocurrency investors? This is easier to understand when we notice the patterns that are set off by a halving event. When a halving occurs, bitcoins’ supply decreases, and the consequent higher demand leads to a rise in Bitcoin prices. And quite clearly, Bitcoin halvings in the past have resulted in a dramatic rise in Bitcoin prices, only to drop later. Let’s have a look.

- The First Halving

In November 2012, the first Bitcoin halving took place, halving the reward for mining from 50 to 25 BTC. The consequent effect on the prices saw a surge of about 8000% in the year that followed.

- The Second Halving

The second such event occurred in July 2016 when the reward was halved from 25 to 12.5 BTC, and as a result, Bitcoin prices surged by nearly 1000%.

- The Third Halving

The events of May 2020 have again led to an all-time high in Bitcoin prices, nearly reaching $20,000 in November 2020.

Therefore, crypto investors can make use of this knowledge in various ways. Understanding the market fluctuations – price rise followed by a drop – is important for anyone who intends to make gains from these market movements. At the same time, it is also important to understand the effects of other global situations, such as the ongoing pandemic, to figure out whether all halvings will necessarily result in similar price movements.

For bitcoin miners, understanding the halving of the mining reward with respect to increasing value is essential. For example, if the third halving was expected to reduce the Bitcoin inflation rate from 3.6% to 1.8%, then these changes are relevant to how the gains would be calculated. The operational costs of mining, such as hardware, electricity, etc., are estimated at $6,851 by Bitcoin.com. This corresponds to a 30% margin because 70% of the block rewards would have to be sold to cover the operational costs. So if the halvings push up the Bitcoin price but not by much, then it is not a great investment for miners (while being great for investors).

For new investors, Bitcoin halving presents a great opportunity to understand the cryptocurrency domain and begin making investments.

Conclusion

Crypto investors, particularly those holding Bitcoins for sufficient duration to make gains, can benefit greatly from such halvings. For a volatile asset, such a pattern that has occurred thrice so far seems fairly consistent.

With the next halving expected in another 4 years, it remains to be seen whether the price-boost pattern is set in stone or simply happens to coincide with other market forces.

Also you can download the app and Start Trading Now!

Android App – Bitcoin Exchange

iOS App – Cryptocurrency Exchange

Frequently Asked Questions

What Is The Meaning Of Crypto?

A cryptocurrency is a digital currency that is secured by the process of cryptography, making counterfeiting and double-spending almost impossible to happen. Blockchain technology is used to produce cryptocurrencies ( a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a centralized authority does not issue them.

Is Bitcoin A Good Investment For The Future?

Some investors are afraid of the risks or devastation, but others are very eager to pursue the possibility of profit from a Bitcoin investment. A Bitcoin investment is similar to stock investing, except it can be more volatile.

How Bitcoin Mining Works?

Bitcoin mining is a crucial element of the blockchain ledger's upkeep and development and the act of bringing new Bitcoins into circulation. It's done with the help of cutting-edge computers that solve exceedingly challenging computational arithmetic problems. Auditor miners are rewarded for their work. They're in charge of ensuring that Bitcoin transactions go through smoothly and legitimately. This standard was established by Satoshi Nakamoto, the founder of Bitcoin, to keep Bitcoin users ethical. By confirming transactions, miners assist in avoiding the "double-spending issue."

Who Invented Cryptocurrency?

Satoshi Nakamoto invented cryptocurrencies and the technology that makes them function in 2009. The presumed pseudonymous individual or persons who invented Bitcoin used this identity. In addition, Nakamoto created the first blockchain database. Even though many people have claimed to be Satoshi Nakamoto, the person's identity remains unknown.

What Type Of Currency Is Bitcoin?

Bitcoin is a type of digital currency or cryptocurrency. In January 2009, Bitcoin was established. It's based on Satoshi Nakamoto's ideas, which he laid out in a whitepaper. The name of the individual or people who invented the technology remains unknown.

What Is The Meaning Of Bitcoin?

Bitcoin is a type of cryptocurrency that was first introduced in January 2009. It is invented based on the key concepts and notions presented in a whitepaper by Satoshi Nakamoto, a mysterious and pseudonymous figure. The name of the individual or people who invented technology is yet unknown. Bitcoin promises reduced transaction fees than existing online payment methods, and a decentralized authority controls it, unlike government-issued currencies.

How Bitcoin Works?

Bitcoin is based on the blockchain, a distributed digital ledger. As the name implies, blockchain is a connected database made up of blocks that hold information about each transaction, such as the date and time, total value, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological sequence, forming a digital chain of blocks. Blockchain is decentralized, meaning a centralized institution does not own it

How Cryptocurrency Works?

Cryptocurrencies use cryptography technology to keep transactions and their units (tokens) secure. Cryptocurrency works via a technology called the blockchain. A blockchain is a decentralized technology that handles and records transactions across numerous computers. The security of this technology is part of its value.

Is Bitcoin Safe And Legal In India?

In 2020, the Supreme Court of India lifted the RBI’s restrictions on cryptocurrencies. According to the Supreme Court, the existence of Bitcoin or another cryptocurrency is unregulated but not unlawful. The verdict has greatly aided the world of digital money in the country. To put it another way, investing in Bitcoin is perfectly legal, and you may do so through various apps and traders.

How Safe Are Cryptocurrencies?

Cryptocurrencies can be safe, but your crypto wallets can be hacked if proper security steps are not performed.There are also dangers and uncertainties associated with investments, and we cannot declare any virtual currency investment risk-free. Buying and selling cryptocurrencies does not have to be dangerous if the trader is well-versed in the market and treats his coins with care.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.