Table of Contents

Bitcoin and Ethereum are the top two projects that are extremely important and valuable in the cryptocurrency space. Both serve unique purposes and have a significant fan following amongst investors, traders, hobbyists, and blockchain developers.

Apart from the aforementioned folks, both digital currency systems boast of increasingly high corporate and institutional demand. Financial and technology organizations and firms from miscellaneous other verticals have shown interest in adopting Bitcoin and Ethereum.

But despite their surging popularity, there are notable differences. Discussing these differences can help us appreciate the two blockchain-based protocols. Speaking of protocols, let’s start by differentiating them, and then we can move on to the individual cryptocurrency differences.

Bitcoin vs Ethereum: Protocol Differences

Bitcoin emerged as a by-product of the 2008 Great Recession. Anonymous creator Satoshi Nakamoto presented the white paper in 2009, in which he introduced Bitcoin as a ‘Peer-to-Peer Electronic Cash System’. This system consists of the Bitcoin blockchain and the cryptocurrency bitcoin (BTC).

Vitalik Buterin presented the Ethereum white paper in 2013. With the launch in 2015, the project was introduced as the world’s first programmable blockchain with ether (ETH) as the currency of exchange.

Both blockchains have a distributed public ledger design and employ proof of work (PoW) mining to verify and process cryptocurrency transactions. Miners solve complex mathematical algorithms with industry-grade computing hardware to validate settlements and add them to the respective blockchains post-confirmation. To know more about PoW check out the video below:

Ethereum: The Smart Contract and dApp Building Platform

But Ethereum has a leg up on Bitcoin when it comes to usability. That advantage comes from its ability to support the development of smart contracts and decentralized applications (Apps).

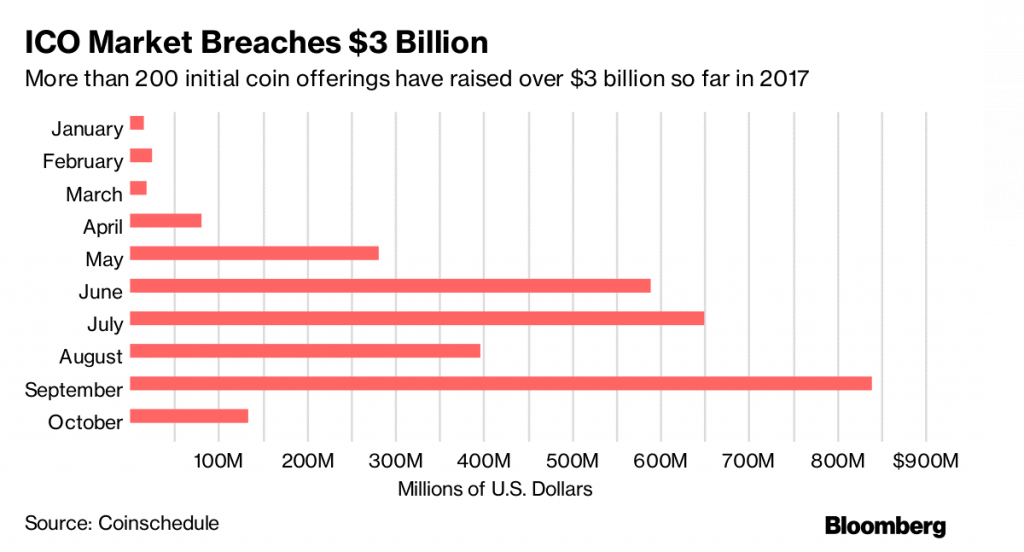

This actually catalyzed the ICO boom of 2017 where numerous blockchain-based applications sprung up showcasing the immense technological prowess of Ethereum as a dApp building platform, with Solidity its smart contract programming language becoming the industry standard.

Did you lose yourself at smart contracts? A detailed article from our end on the same is in works. Until then see the video below to understand them visually:

Anyone can code applications involving some digital value, that executes as programmed and can be accessed from anywhere in the world. That’s Ethereum’s USP for users.

Apart from financial transactions, the network’s native cryptocurrency token ETH monetizes the operation of these applications. Ethereum developers intend the platform to become the decentralized version of the internet.

Bitcoin is primarily functioning as a peer-to-peer financial settlement system with bitcoin largely gaining prominence as a value preserving investment asset, similar to gold. Media portals and financial commentators haven’t shied away from calling BTC as ‘Gold 2.0’ or ‘digital gold’.

Bitcoin vs Ethereum: Other Differences

Cryptocurrency Supply and Circulation

Bitcoin’s code by default has a production cap on the number of bitcoins that will be ever produced and that’s 21 million. Currently, there are 18.4 million BTC in circulation which means that these many coins have already been mined.

Contrary to BTC there doesn’t seem to be a limit in ETH supply, and the total number of ethers in circulation crossed the 100 million mark two years back. Now that figure stands at 111 million.

Block Size and Transaction Stats

Over the years, the average Bitcoin block size has considerably increased and is now trending at 1.2 MB/block. Bitcoin’s block size has been in discussion quite a lot. This has resulted in the formation of different cryptocurrency systems altogether.

These systems split from the main Bitcoin blockchain through a process called forking, and are called ‘hard forks’. Some of the well-known forks of Bitcoin are Bitcoin Cash, Bitcoin SV, Bitcoin Gold, Bitcoin Diamond, etc. Get more clarity about Bitcoin hard forks from the video below:

The average size for Ethereum blocks has also been variable since its inception, mostly trending in the 20 KB to 30 KB range. Ethereum also had its share of forks. Contrary to Bitcoin’s forks, almost all forking events were upgrades. Ethereum forking events are calculated steps taken for the blockchain to transition from the PoW mining system to PoS (proof-of-stake). More on proof-of-stake below:

Gas and Transaction Fees

Successful completion of financial transactions or transactions involving smart contracts on Ethereum has to be paid for with ‘gas’. Measured in Gwei, a subunit of ether, the value of gas to be charged to process a transaction is determined by Ethereum miners. They can choose to forego a transaction if the gas prices are not satisfactory.

The scenario is a bit different in Bitcoin. Miners charge transaction fees to process transfers but there’s a preference-based model involved. A higher fee needs paying for transactions that are urgent and require faster processing. Depending on the fees, transactions get cleared in either a single block or multiple blocks.

Bitcoin can process around 5-7 transactions per second whereas Ethereum can deal with 12-15 transactions per second.

The Ethereum blockchain has gone from processing around 500,000 to 1 million transactions per day this year. Normally, Bitcoin manages between 300,000 to 700,000 transactions per day though mostly it stays at around 300,000. Average Ethereum block confirmation time is around 15 seconds whereas for Bitcoin it can range from several minutes to a few hours.

Even with all their differences Bitcoin and Ethereum will remain attractive cryptocurrency projects in both financial as well as development terms. If you are looking to buy bitcoin, Ethereum, or both, you can do so through WazirX. Visit this link to know more: https://wazirx.com/

Also you can download the app and Start Trading Now!

Android App – WazirX – Buy Sell Bitcoin & Cryptocurrency Exchange

iOS App – WazirX

Frequently Asked Questions

How To Make Bitcoin?

Bitcoin mining is not just the process of putting new Bitcoins into circulation, but it is also an essential part of the blockchain ledger's upkeep and development. It is carried out with the assistance of highly advanced computers that answer challenging computational math problems. Miners are rewarded for their efforts as auditors. They are in charge of ensuring that Bitcoin transactions are legitimate. Satoshi Nakamoto, who is the founder of Bitcoin, innovated this standard for keeping Bitcoin users ethical. Miners help to prevent the "double-spending problem" by confirming transactions.

How Does Bitcoin Work?

The blockchain, a distributed digital ledger, is what Bitcoin is based on. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain. Entries are linked in chronological order to form a digital blockchain. Blockchain is decentralized, which means any central authority does not control it.

How Much Is 1 Bitcoin Worth Today?

Check out the current price of Bitcoin on the WazirX exchange. Bitcoin's value is primarily determined by its supply and demand in the market. Other elements have an impact on its worth. Its intrinsic value can also be calculated by calculating the average marginal cost of producing a Bitcoin at any given time, based on the block reward, electricity price, mining hardware energy efficiency, and mining difficulty.

Is Bitcoin Mining Free?

Bitcoin mining isn't free, but it can be tried on a budget. Bitcoin mining is an essential part of the blockchain ledger's upkeep and development and the act of issuing new Bitcoins. It is accomplished by the use of cutting-edge computers that tackle complicated computational arithmetic problems. The effort of auditor miners is rewarded. They're in charge of ensuring that Bitcoin transactions go off without a fuss and that they're legal.

How Bitcoin Works?

Bitcoin is based on the blockchain, a distributed digital ledger. As the name implies, blockchain is a connected database made up of blocks that hold information about each transaction, such as the date and time, total value, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological sequence, forming a digital chain of blocks. Blockchain is decentralized, meaning a centralized institution does not own it

Who Created Bitcoin?

Bitcoin is the first application of the concept of "cryptocurrency," first articulated in 1998 on the cypherpunks mailing list by Wei Dai, who proposed a new form of money that relies on cryptography rather than a central authority to manage its creation and transactions. Satoshi Nakamoto published the initial Bitcoin specification and proof of concept on the cryptography mailing list in 2009. Satoshi exited the project in late 2010, with little information about himself available. Since then, the community has evolved, with numerous people working on Bitcoin. Satoshi's anonymity has sparked unfounded fears, many of which may be traced back to a misunderstanding of Bitcoin's open-source nature.

Is Bitcoin Trading Is Legal In India?

In 2020, the Supreme Court of India lifted the RBI’s restrictions on cryptocurrencies. According to the Supreme Court, the existence of Bitcoin or another cryptocurrency is unregulated but not unlawful. The verdict has greatly aided the world of digital money in the country. To put it another way, investing in Bitcoin is perfectly legal, and you may do so through various apps and traders.

How Many Bitcoins Are There?

There are 18,730,931.25 Bitcoins in circulation as of June 2021. The total number of Bitcoins that would ever be there is just 21 million. On average, 144 blocks are mined every day, with 6.25 Bitcoins per block. The average number of new Bitcoins mined every day is 900, calculated by multiplying 144 by 6.25.

What Are The Chances Of Bitcoin Crashing?

Two Yale University economists (Yukun Liu and Aleh Tsyvinski) produced research titled "Risks and Returns of Cryptocurrency" in 2018. They looked at the possibility of Bitcoin crashing to zero in a single day. The authors discovered that the chances of an undefined tragedy crashing Bitcoin to zero ranged from 0 percent to 1.3 percent and was around 0.4 percent at the time of publishing, using Bitcoin's history returns to determine its risk-neutral disaster probability. Others claim that because Bitcoin has no intrinsic value, it will inevitably crash to zero. On the other hand, Bitcoin advocates argue that the currency is backed by customer confidence and mathematics.

What Is Meant By Bitcoin?

Bitcoin is a digital currency that was initially released in January 2009. It is based on ideas offered by Satoshi Nakamoto, a mysterious and pseudonymous figure, in a whitepaper. The name of the person or individuals who invented technology has not been revealed. Bitcoin promises lower transaction fees than other online payment systems, and unlike government-issued currencies, it is decentralized.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.