Table of Contents

There are physical wallets that store physical, tangible currencies like the INR, USD, Euro, etc. Then there are other wallets that store digital information necessary for conducting monetary transactions. Bitcoin wallets belong in the second category.

Nowadays, even fiat currency transfers happen from mobile-based wallet apps like PhonePe, Google Pay, Paytm, etc.

But these wallets function by accessing your primary bank account or the money stored in the wallet. On the contrary, a BTC wallet is like your bank account.

Bitcoin wallets store digital information. Information regarding all BTC transactions and balances. Bitcoin wallets also contain the private and public keys necessary for conducting a BTC transaction. The other term for public keys is ‘wallet address’.

Wallet addresses are similar to your bank account details like account number, IFSC code, etc, that you share publicly for receiving payments.

Private keys are akin to your internet banking password or debit card pin.

Get WazirX News First

This was an overview. Let’s look at them in detail.

How do Bitcoin Wallets Work?

Bitcoin wallets are applications that facilitate BTC transactions by interacting with the Bitcoin blockchain.

Due to the underlying decentralized architecture, all bitcoins exist on the blockchain. No one owns any BTC in their bitcoin wallets. As mentioned earlier, BTC wallets only store public and private keys/wallet address.

A wallet’s combination of public and private keys helps access bitcoins from the blockchain for financial settlements.

When you buy bitcoin, you pay for a section of ownership on the Bitcoin blockchain. The private key in bitcoin wallets keeps that ownership safe.

Multi-Sig Wallets

Sending bitcoin from a wallet results in the creation of a transaction that has to be signed.

Transactions from single key wallets need only one signature. However, this exposes the wallet to risks of hacking and theft. Apart from this, the loss of the private key could make the available funds in the wallet unusable forever.

Multi-sig wallets need ‘multiple signatures’ to sign off transactions, and hence, reduce phishing risks considerably.

Generally, multi-sig wallets have two or more users. Therefore, the number of signatures required to authenticate transactions is less than or equal to the number of users. To know more about multi-sig wallets check out the video below:

Types of Bitcoin Wallets

Bitcoin wallets can be divided into three basic categories – software, hardware, paper.

Software Wallets

- Desktop Wallets – Desktop bitcoin wallets are PC and laptop-based wallets. They are free to download and install and are one of the safest wallet options out there. But a desktop wallet generally stores private keys in the computer’s hard drive. If the hard drive gets damaged or lost, the stored bitcoin funds could be lost forever. Some of the popular desktop wallets are Bitcoin Core, Electrum, Exodus, etc.

- Mobile Wallets – Mobile or smartphone wallets are a bit more convenient to use than desktop bitcoin wallets. They store private keys in the phone’s hard drive and make it easier to conduct BTC transactions. It is also super simple to track your bitcoin investment portfolio on a mobile wallet. It is advisable to active 2-Factor Authentication (2FA) on mobile bitcoin wallets for additional security. Some of the well-known smartphone wallets are Trust Wallet, WazirX, Atomic Wallet, Edge, Freewallet, etc.

- Web Wallets – Website based BTC wallets exist on the internet and can be accessed anywhere, anytime, and on any device – laptops or smartphones. However, there are physical/cloud online servers that store private keys of web wallets. You should exercise care and caution in choosing and handling a web wallet for your bitcoin transactions. Nonetheless, some options have a comparatively low chance of failure – Xapo, Strongcoin, etc.

Hardware Wallets

To date hardware bitcoin wallets or cold storage wallets are trustworthy options for storing BTC private keys. There have been no verifiable incidents on funds being stolen from hardware wallets.

They look like USB sticks/pen drives and are immune to computer viruses (as claimed by few hard wallet manufacturers). These wallets provide recovery options to retrieve private keys in case they get lost.

Although they are not free unlike the web, desktop, or mobile wallets but an investment in hardware bitcoin wallets guarantees the safety of your BTC holdings. But for that, you need to buy a hardware wallet from only the most trusted manufacturers in the industry. Some of them are Trezor, Ledger, KeepKey.

Paper Wallets

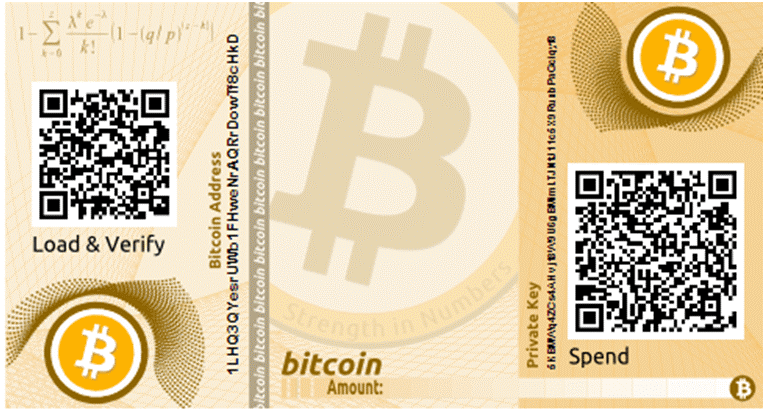

Paper BTC wallets are QR codes of public and private keys printed on paper. They just provide offline storage support.

Both QR codes need to be scanned onto a software wallet to make a transfer. Paper wallets are difficult to be hacked but precautions need to be taken before creating one.

No one should be around when you are printing paper wallets. Use only offline printers for printing the wallets. It is advisable to use an operating system like Ubuntu, running from a flash drive or DVD.

The website generating the public and private BTC keys should run offline (before the keys are generated). Lastly, paper bitcoin wallets are susceptible to damage through spillage or wear and tear. You should protect the printed information with a good quality lamination or plastic coating.

Choosing the right wallet can go a long way in protecting your bitcoin holdings from bad actors and malicious players. After you buy bitcoin, make sure to walk that extra mile and secure your investment.

Also you can download the wallet and Start Trading Now!

Android – WazirX – Bitcoin Wallet

iOS – WazirX – Bitcoin Wallet

Frequently Asked Questions

How Many Bitcoins Are There?

There are 18,730,931.25 Bitcoins in circulation as of June 2021. The total number of Bitcoins that would ever be there is just 21 million. On average, 144 blocks are mined every day, with 6.25 Bitcoins per block. The average number of new Bitcoins mined every day is 900, calculated by multiplying 144 by 6.25.

What Is The Meaning Of Bitcoin?

Bitcoin is a type of cryptocurrency that was first introduced in January 2009. It is invented based on the key concepts and notions presented in a whitepaper by Satoshi Nakamoto, a mysterious and pseudonymous figure. The name of the individual or people who invented technology is yet unknown. Bitcoin promises reduced transaction fees than existing online payment methods, and a decentralized authority controls it, unlike government-issued currencies.

Is Bitcoin Legal In India?

In India, Bitcoin is not illegal. Because of cryptocurrency's rapid evolution, policymakers and regulators seemed to have recognized the chance to accept the new technology early. From the infamous 'RBI ban' in 2018 to reports of an impending bill banning cryptos in 2021 that has yet to develop, India has seen its fair share of ups and downs when it comes to Bitcoin regulation. Last year, the Supreme Court Of India approved the use of Bitcoin throughout the country. According to the Supreme Court, the existence of Bitcoin or any other cryptocurrency is unregulated but not unlawful.

What Is Bitcoin?

Bitcoin is a decentralized digital currency that may be purchased, traded, and traded without intermediary like a bank. Bitcoin is built on the blockchain, which is a distributed digital ledger. Wei Dai suggested a new kind of money that relies on cryptography rather than a central authority to oversee its production and transactions on the cypherpunks mailing list in 1998. Bitcoin was the first application of that notion. In 2009, Satoshi Nakamoto sent out the first Bitcoin specification and proof of concept to a cryptography mailing group.

How Bitcoin Works?

Bitcoin is based on the blockchain, a distributed digital ledger. As the name implies, blockchain is a connected database made up of blocks that hold information about each transaction, such as the date and time, total value, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological sequence, forming a digital chain of blocks. Blockchain is decentralized, meaning a centralized institution does not own it

How Does Bitcoin Work?

The blockchain, a distributed digital ledger, is what Bitcoin is based on. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain. Entries are linked in chronological order to form a digital blockchain. Blockchain is decentralized, which means any central authority does not control it.

Is Bitcoin Cash A Good Investment?

Bitcoin Cash is a hard fork of Bitcoin formed in 2017 to address Bitcoin's scalability and challenges. Bitcoin Cash seeks to make global transactions faster, cheaper, and more secure. Bitcoin Cash is now accepted by thousands of online and offline businesses all over the world. Studied correctly, Bitcoin Cash may be an investment worthy of consideration.

What Is Bitcoin And How Does It Work?

Bitcoin is decentralized digital money that may be bought, sold, and exchanged without an intermediary such as a bank. Bitcoin is based on a blockchain that is considered to be a distributed digital ledger. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain

How Can I Convert Bitcoins To Cash?

Bitcoin may be converted to cash in various ways, including crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, and Peer to Peer Transactions. You may do this by using Bitcoin exchanges like WazirX. You may also sell Bitcoin for cash faster and more anonymously through a peer-to-peer marketplace.

Is Bitcoin And Cryptocurrency The Same Thing?

Bitcoin is a cryptocurrency that was designed to facilitate cross-border transactions, eliminate government control over transactions, and streamline the entire process without third-party intermediaries. The absence of intermediaries has resulted in a significant reduction in transaction costs. Satoshi Nakamoto, the creator of Bitcoin, created the first cryptocurrency in 2008. It began as open-source software for money transfers. Since then, plenty of cryptocurrencies have emerged, with some focusing on specific fields.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.