Table of Contents

There are physical wallets that store physical, tangible currencies like the INR, USD, Euro, etc. Then there are other wallets that store digital information necessary for conducting monetary transactions. Bitcoin wallets belong in the second category.

Nowadays, even fiat currency transfers happen from mobile-based wallet apps like PhonePe, Google Pay, Paytm, etc.

But these wallets function by accessing your primary bank account or the money stored in the wallet. On the contrary, a BTC wallet is like your bank account.

Bitcoin wallets store digital information. Information regarding all BTC transactions and balances. Bitcoin wallets also contain the private and public keys necessary for conducting a BTC transaction. The other term for public keys is ‘wallet address’.

Wallet addresses are similar to your bank account details like account number, IFSC code, etc, that you share publicly for receiving payments.

Private keys are akin to your internet banking password or debit card pin.

Get WazirX News First

This was an overview. Let’s look at them in detail.

How do Bitcoin Wallets Work?

Bitcoin wallets are applications that facilitate BTC transactions by interacting with the Bitcoin blockchain.

Due to the underlying decentralized architecture, all bitcoins exist on the blockchain. No one owns any BTC in their bitcoin wallets. As mentioned earlier, BTC wallets only store public and private keys/wallet address.

A wallet’s combination of public and private keys helps access bitcoins from the blockchain for financial settlements.

When you buy bitcoin, you pay for a section of ownership on the Bitcoin blockchain. The private key in bitcoin wallets keeps that ownership safe.

Multi-Sig Wallets

Sending bitcoin from a wallet results in the creation of a transaction that has to be signed.

Transactions from single key wallets need only one signature. However, this exposes the wallet to risks of hacking and theft. Apart from this, the loss of the private key could make the available funds in the wallet unusable forever.

Multi-sig wallets need ‘multiple signatures’ to sign off transactions, and hence, reduce phishing risks considerably.

Generally, multi-sig wallets have two or more users. Therefore, the number of signatures required to authenticate transactions is less than or equal to the number of users. To know more about multi-sig wallets check out the video below:

Types of Bitcoin Wallets

Bitcoin wallets can be divided into three basic categories – software, hardware, paper.

Software Wallets

- Desktop Wallets – Desktop bitcoin wallets are PC and laptop-based wallets. They are free to download and install and are one of the safest wallet options out there. But a desktop wallet generally stores private keys in the computer’s hard drive. If the hard drive gets damaged or lost, the stored bitcoin funds could be lost forever. Some of the popular desktop wallets are Bitcoin Core, Electrum, Exodus, etc.

- Mobile Wallets – Mobile or smartphone wallets are a bit more convenient to use than desktop bitcoin wallets. They store private keys in the phone’s hard drive and make it easier to conduct BTC transactions. It is also super simple to track your bitcoin investment portfolio on a mobile wallet. It is advisable to active 2-Factor Authentication (2FA) on mobile bitcoin wallets for additional security. Some of the well-known smartphone wallets are Trust Wallet, WazirX, Atomic Wallet, Edge, Freewallet, etc.

- Web Wallets – Website based BTC wallets exist on the internet and can be accessed anywhere, anytime, and on any device – laptops or smartphones. However, there are physical/cloud online servers that store private keys of web wallets. You should exercise care and caution in choosing and handling a web wallet for your bitcoin transactions. Nonetheless, some options have a comparatively low chance of failure – Xapo, Strongcoin, etc.

Hardware Wallets

To date hardware bitcoin wallets or cold storage wallets are trustworthy options for storing BTC private keys. There have been no verifiable incidents on funds being stolen from hardware wallets.

They look like USB sticks/pen drives and are immune to computer viruses (as claimed by few hard wallet manufacturers). These wallets provide recovery options to retrieve private keys in case they get lost.

Although they are not free unlike the web, desktop, or mobile wallets but an investment in hardware bitcoin wallets guarantees the safety of your BTC holdings. But for that, you need to buy a hardware wallet from only the most trusted manufacturers in the industry. Some of them are Trezor, Ledger, KeepKey.

Paper Wallets

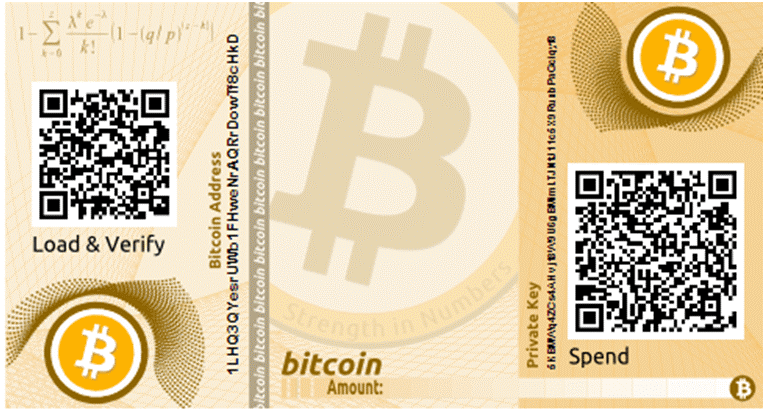

Paper BTC wallets are QR codes of public and private keys printed on paper. They just provide offline storage support.

Both QR codes need to be scanned onto a software wallet to make a transfer. Paper wallets are difficult to be hacked but precautions need to be taken before creating one.

No one should be around when you are printing paper wallets. Use only offline printers for printing the wallets. It is advisable to use an operating system like Ubuntu, running from a flash drive or DVD.

The website generating the public and private BTC keys should run offline (before the keys are generated). Lastly, paper bitcoin wallets are susceptible to damage through spillage or wear and tear. You should protect the printed information with a good quality lamination or plastic coating.

Choosing the right wallet can go a long way in protecting your bitcoin holdings from bad actors and malicious players. After you buy bitcoin, make sure to walk that extra mile and secure your investment.

Also you can download the wallet and Start Trading Now!

Android – WazirX – Bitcoin Wallet

iOS – WazirX – Bitcoin Wallet

Frequently Asked Questions

Is Bitcoin Safe And Legal In India?

In 2020, the Supreme Court of India lifted the RBI’s restrictions on cryptocurrencies. According to the Supreme Court, the existence of Bitcoin or another cryptocurrency is unregulated but not unlawful. The verdict has greatly aided the world of digital money in the country. To put it another way, investing in Bitcoin is perfectly legal, and you may do so through various apps and traders.

What Is Bitcoin Used For?

Bitcoin was created as a means of sending money over the internet. The digital currency was designed to be a non-centralized alternative payment system that could be used in the same way as traditional currencies. Bitcoin is being used by an increasing number of businesses and individuals. This includes establishments such as restaurants, apartments, and law firms.

How To Create Bitcoin Account?

Firstly, Go to the WazirX website and sign up. Then, a verification mail will be sent to you. The link sent via verification mail would be available only for a few seconds so make sure you click on the link sent to you as soon as possible, and it will verify your email address successfully. The next step is to set up security, so select the most suitable option for you. After you have set up the security, you will get a choice to either proceed further with or without completing the KYC procedure. After that, you will be directed to the Funds and Transfer page, where you could start depositing Bitcoins to your wallet. You can also deposit INR and then use it to buy Bitcoin for your WazirX Bitcoin wallet.

How To Invest In Bitcoin?

Bitcoin may be invested in two ways: through mining or exchanges. Bitcoin mining is carried out by high-powered computers that solve challenging computational arithmetic problems that are too difficult to complete by hand and complex enough to tax even the most powerful computers. WazirX, a Bitcoin exchange, is another alternative.

Is Bitcoin Trading Is Legal In India?

In 2020, the Supreme Court of India lifted the RBI’s restrictions on cryptocurrencies. According to the Supreme Court, the existence of Bitcoin or another cryptocurrency is unregulated but not unlawful. The verdict has greatly aided the world of digital money in the country. To put it another way, investing in Bitcoin is perfectly legal, and you may do so through various apps and traders.

Is Bitcoin A Good Investment For The Future?

Some investors are afraid of the risks or devastation, but others are very eager to pursue the possibility of profit from a Bitcoin investment. A Bitcoin investment is similar to stock investing, except it can be more volatile.

What Type Of Currency Is Bitcoin?

Bitcoin is a type of digital currency or cryptocurrency. In January 2009, Bitcoin was established. It's based on Satoshi Nakamoto's ideas, which he laid out in a whitepaper. The name of the individual or people who invented the technology remains unknown.

How Can I Convert Bitcoins To Cash?

Bitcoin may be converted to cash in various ways, including crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, and Peer to Peer Transactions. You may do this by using Bitcoin exchanges like WazirX. You may also sell Bitcoin for cash faster and more anonymously through a peer-to-peer marketplace.

What Are The Chances Of Bitcoin Crashing?

Two Yale University economists (Yukun Liu and Aleh Tsyvinski) produced research titled "Risks and Returns of Cryptocurrency" in 2018. They looked at the possibility of Bitcoin crashing to zero in a single day. The authors discovered that the chances of an undefined tragedy crashing Bitcoin to zero ranged from 0 percent to 1.3 percent and was around 0.4 percent at the time of publishing, using Bitcoin's history returns to determine its risk-neutral disaster probability. Others claim that because Bitcoin has no intrinsic value, it will inevitably crash to zero. On the other hand, Bitcoin advocates argue that the currency is backed by customer confidence and mathematics.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.