Table of Contents

You may have heard of something called a Bitcoin ‘halving’ occurring this year. In May 2020, Bitcoin went through its third halving, and its reward value dropped from 12.5 to 6.25 BTC per block mined. This essentially means that the reward for mining a block was cut in half yet again.

But how does this work?

In a centralized economy, the central bank is responsible for controlling the supply of money. However, in the case of cryptocurrencies like Bitcoin, there is no such centralized authority to control its monetary base. This necessitates that Bitcoin as a cryptocurrency must have its own mechanism to ensure a controlled supply.

This is where the concept of Bitcoin halving (or ‘halvening’) comes in. After every 210,000 blocks that are mined, the reward awarded to miners for every block gets halved. As a result, new bitcoins are released into circulation at only half the rate as compared to before that. (This is distinct from a coin burn – a mechanism that other cryptocurrencies apply to manage inflation)

Therefore, this controlled release of bitcoins helps maintain a synthetic form of Bitcoin inflation. This halving would continue till all the bitcoins have entered circulation, and after that, miners would be rewarded with the fee that network users will pay for processing transactions.

Get WazirX News First

Why is Bitcoin Halving Important for Cryptocurrency Investors?

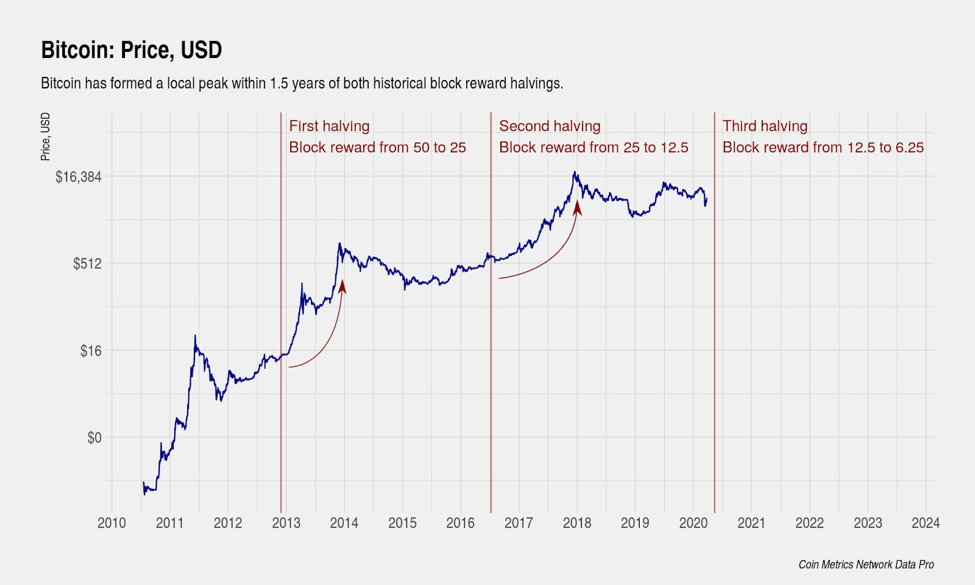

Is there any significance of this phenomenon for cryptocurrency investors? This is easier to understand when we notice the patterns that are set off by a halving event. When a halving occurs, bitcoins’ supply decreases, and the consequent higher demand leads to a rise in Bitcoin prices. And quite clearly, Bitcoin halvings in the past have resulted in a dramatic rise in Bitcoin prices, only to drop later. Let’s have a look.

- The First Halving

In November 2012, the first Bitcoin halving took place, halving the reward for mining from 50 to 25 BTC. The consequent effect on the prices saw a surge of about 8000% in the year that followed.

- The Second Halving

The second such event occurred in July 2016 when the reward was halved from 25 to 12.5 BTC, and as a result, Bitcoin prices surged by nearly 1000%.

- The Third Halving

The events of May 2020 have again led to an all-time high in Bitcoin prices, nearly reaching $20,000 in November 2020.

Therefore, crypto investors can make use of this knowledge in various ways. Understanding the market fluctuations – price rise followed by a drop – is important for anyone who intends to make gains from these market movements. At the same time, it is also important to understand the effects of other global situations, such as the ongoing pandemic, to figure out whether all halvings will necessarily result in similar price movements.

For bitcoin miners, understanding the halving of the mining reward with respect to increasing value is essential. For example, if the third halving was expected to reduce the Bitcoin inflation rate from 3.6% to 1.8%, then these changes are relevant to how the gains would be calculated. The operational costs of mining, such as hardware, electricity, etc., are estimated at $6,851 by Bitcoin.com. This corresponds to a 30% margin because 70% of the block rewards would have to be sold to cover the operational costs. So if the halvings push up the Bitcoin price but not by much, then it is not a great investment for miners (while being great for investors).

For new investors, Bitcoin halving presents a great opportunity to understand the cryptocurrency domain and begin making investments.

Conclusion

Crypto investors, particularly those holding Bitcoins for sufficient duration to make gains, can benefit greatly from such halvings. For a volatile asset, such a pattern that has occurred thrice so far seems fairly consistent.

With the next halving expected in another 4 years, it remains to be seen whether the price-boost pattern is set in stone or simply happens to coincide with other market forces.

Also you can download the app and Start Trading Now!

Android App – Bitcoin Exchange

iOS App – Cryptocurrency Exchange

Frequently Asked Questions

How To Make Bitcoin?

Bitcoin mining is not just the process of putting new Bitcoins into circulation, but it is also an essential part of the blockchain ledger's upkeep and development. It is carried out with the assistance of highly advanced computers that answer challenging computational math problems. Miners are rewarded for their efforts as auditors. They are in charge of ensuring that Bitcoin transactions are legitimate. Satoshi Nakamoto, who is the founder of Bitcoin, innovated this standard for keeping Bitcoin users ethical. Miners help to prevent the "double-spending problem" by confirming transactions.

Who Invented Cryptocurrency?

Satoshi Nakamoto invented cryptocurrencies and the technology that makes them function in 2009. The presumed pseudonymous individual or persons who invented Bitcoin used this identity. In addition, Nakamoto created the first blockchain database. Even though many people have claimed to be Satoshi Nakamoto, the person's identity remains unknown.

What Is The Rate Of Bitcoin?

The price of Bitcoin in INR at WazirX is ₹26.8 lakhs as of June 2021. Head over to the BTC-INR exchange page on WazirX to get real-time prices.

How Many Cryptocurrencies Are There?

There are over 5000 other digital currencies available on the internet in addition to Bitcoins. The only problem is that they haven't gotten the users' attention. Besides Bitcoins, a few other digital currencies have gained popularity among users. It's been more than ten years since Bitcoins were first released, and now they've achieved new heights thanks to their phenomenal success.

How To Invest In Cryptocurrency?

There are two ways of investing in cryptocurrency, mining and via exchanges. Cryptocurrency mining is considered the procedure of verifying and adding transactions to the blockchain public ledger. Another option is via cryptocurrency exchanges. Exchanges generate money by collecting transaction fees, but there are alternative websites where you can interact directly with other users who want to trade cryptocurrencies.

How To Create Bitcoin Account?

Firstly, Go to the WazirX website and sign up. Then, a verification mail will be sent to you. The link sent via verification mail would be available only for a few seconds so make sure you click on the link sent to you as soon as possible, and it will verify your email address successfully. The next step is to set up security, so select the most suitable option for you. After you have set up the security, you will get a choice to either proceed further with or without completing the KYC procedure. After that, you will be directed to the Funds and Transfer page, where you could start depositing Bitcoins to your wallet. You can also deposit INR and then use it to buy Bitcoin for your WazirX Bitcoin wallet.

Is Bitcoin And Cryptocurrency The Same Thing?

Bitcoin is a cryptocurrency that was designed to facilitate cross-border transactions, eliminate government control over transactions, and streamline the entire process without third-party intermediaries. The absence of intermediaries has resulted in a significant reduction in transaction costs. Satoshi Nakamoto, the creator of Bitcoin, created the first cryptocurrency in 2008. It began as open-source software for money transfers. Since then, plenty of cryptocurrencies have emerged, with some focusing on specific fields.

Which Cryptocurrency Is Best To Invest Now?

Litecoin has an 84 million coin limit and a 12.5 LTC block reward, which is more than other cryptos. Miners will find that mining Litecoin is faster than mining any other cryptocurrency because the average time to mine a Litecoin is under two minutes. Because of its increasing popularity, Litecoin is the best of all the altcoins. At WazirX, the current price of Litecoin is ₹12,410.22.

How Safe Are Cryptocurrencies?

Cryptocurrencies can be safe, but your crypto wallets can be hacked if proper security steps are not performed.There are also dangers and uncertainties associated with investments, and we cannot declare any virtual currency investment risk-free. Buying and selling cryptocurrencies does not have to be dangerous if the trader is well-versed in the market and treats his coins with care.

How Many Bitcoins Are There?

There are 18,730,931.25 Bitcoins in circulation as of June 2021. The total number of Bitcoins that would ever be there is just 21 million. On average, 144 blocks are mined every day, with 6.25 Bitcoins per block. The average number of new Bitcoins mined every day is 900, calculated by multiplying 144 by 6.25.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.