Table of Contents

It’s February 2021, and Bitcoin’s India rate is more than 38 lakhs. More people are turning to crypto assets as an investment than ever. In a matter as exciting and crowded as this, how can you optimize your gains?

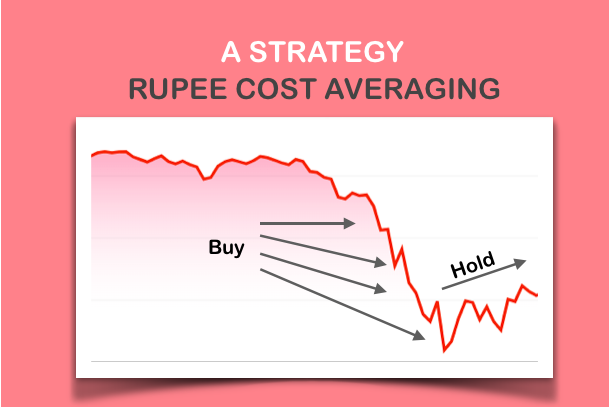

Whether it’s crypto assets or other markets, investors always want to buy low and sell high. To achieve this, they have to implement several trading strategies that maximize profits while minimizing the risk. Rupee Cost Averaging or RCA is one such investment strategy to optimize your restricting traders from buying equity at a high price and increasing their chances of lowering their net buying price.

Get WazirX News First

In Rupee Cost Averaging, traders invest a fixed amount of capital in an asset at regular intervals. This ensures that the trader buying a particular asset can enter at the best price they can simultaneously, not missing an entry in the asset.

What does Rupee Cost Averaging mean for BTC, ETH, and other crypto assets?

Rupee Cost Averaging is not just applicable to crypto assets; it is a relatively common practice in the crypto ecosystem. crypto assets tend to be volatile in nature. This means we see constant breakouts and fakeouts. Therefore it is preferable not to buy a particular crypto asset with all your capital all at once. Instead, accumulate them and buy them over extended periods, ideally during dips.

How to do Rupee Cost Averaging in crypto

- First, an investor needs to figure out the amount of capital they need to invest in a token.

- For example, the capital allocated to a coin (let’s say you’re buying ETH) is INR 12,000.

- Divide the amount into equal parts according to the number of supports above the lower trend line in the larger time frame. For example, if there are three supports (S1, S2, S3), you can divide your capital into INR 4000 each.

- You can also divide the allocated capital without the technical analyses just by dividing them into equal parts according to the number of times you want to invest over a fixed period of time.

- Buy on the first support or right away.

- Invest in a fixed period of time if the coin price is lesser than your previous entry point. If you figured out the support, invest in S2 and then S3.

How does Rupee Cost Averaging work in crypto?

As mentioned above, as of February 2021, Bitcoin’s India Rate is more than INR 38 lakhs investing it now requires Rupee Cost Averaging. The first support is near 36 lakhs; the second is near 34 lakhs. If you invest all your capital at once at the current price, your bitcoin buying price would be 38 lakhs.

If you apply Rupee Cost Averaging in this case and all the buying targets get hit, your net buying can decrease to around 36 lakhs. On the other hand, if you don’t use RCA and the price drops,, your net buying price is still 38 lakhs even though it will probably rebound. So if you apply RCA in this case, you can earn two lakhs more per Bitcoin compared to going all-in on the current price.

Advantages of Rupee Cost Averaging

- If a coin’s price is at its support, and there is a chance that the price action can go either way, RCA is the best way to enter since you can buy the dips while not missing an entry.

- By investing on a fixed schedule, traders can avoid the complex process of figuring out the best time to invest.

- Rupee Cost Averaging is a perfect tool to counter the crypto world’s volatility and provides you with an opportunity to decrease the net buying price.

- Investors can have the capital to buy the dips in terms of potential market crashes.

- Investors can stop investing in case of a critical bearish crossover; this way, they will only lose a chunk of the allocated capital.

- If you are an emotional investor, Rupee Cost Averaging can save you from selling your holdings; instead, you would be hoping for a dip so you can buy more.

Disadvantages of Rupee Cost Averaging

- Rupee Cost Averaging could be useful in maximizing profits, but it could be a double-edged sword. Imagine you split your capital, and only some of the initial targets got hit, and the coin price shot up, you won’t be able to use the allocated capital; hence this will affect your net profits.

- The task of allocating your assets and figuring out support could be complicated.

Rupee cost averaging is a powerful tool in a bearish market, and this method gave the phrase” buy the dips” meaning. So what are you thinking about? Head over to WazirX and buy crypto assets in INR with RCA.

Frequently Asked Questions

Who Created Bitcoin?

Bitcoin is the first application of the concept of "cryptocurrency," first articulated in 1998 on the cypherpunks mailing list by Wei Dai, who proposed a new form of money that relies on cryptography rather than a central authority to manage its creation and transactions. Satoshi Nakamoto published the initial Bitcoin specification and proof of concept on the cryptography mailing list in 2009. Satoshi exited the project in late 2010, with little information about himself available. Since then, the community has evolved, with numerous people working on Bitcoin. Satoshi's anonymity has sparked unfounded fears, many of which may be traced back to a misunderstanding of Bitcoin's open-source nature.

How To Convert Bitcoin To Cash?

There are many ways of converting Bitcoin to cash, such as crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, Peer to Peer Transactions. You can use cryptocurrency exchanges such as WazirX for this. Unlike typical ATMs, which allow you to withdraw money from your bank account, a Bitcoin ATM is a physical location where you may buy and sell Bitcoins using fiat currency. Several websites provide the option of selling Bitcoin in return for a prepaid debit card that may be used just like a standard debit card. You can sell Bitcoin for cash through a peer-to-peer platform in a faster and more anonymous manner.

How Much Is 1 Bitcoin Worth Today?

Check out the current price of Bitcoin on the WazirX exchange. Bitcoin's value is primarily determined by its supply and demand in the market. Other elements have an impact on its worth. Its intrinsic value can also be calculated by calculating the average marginal cost of producing a Bitcoin at any given time, based on the block reward, electricity price, mining hardware energy efficiency, and mining difficulty.

Is Bitcoin Mining Free?

Bitcoin mining isn't free, but it can be tried on a budget. Bitcoin mining is an essential part of the blockchain ledger's upkeep and development and the act of issuing new Bitcoins. It is accomplished by the use of cutting-edge computers that tackle complicated computational arithmetic problems. The effort of auditor miners is rewarded. They're in charge of ensuring that Bitcoin transactions go off without a fuss and that they're legal.

How To Invest In Bitcoin?

Bitcoin may be invested in two ways: through mining or exchanges. Bitcoin mining is carried out by high-powered computers that solve challenging computational arithmetic problems that are too difficult to complete by hand and complex enough to tax even the most powerful computers. WazirX, a Bitcoin exchange, is another alternative.

What Are The Chances Of Bitcoin Crashing?

Two Yale University economists (Yukun Liu and Aleh Tsyvinski) produced research titled "Risks and Returns of Cryptocurrency" in 2018. They looked at the possibility of Bitcoin crashing to zero in a single day. The authors discovered that the chances of an undefined tragedy crashing Bitcoin to zero ranged from 0 percent to 1.3 percent and was around 0.4 percent at the time of publishing, using Bitcoin's history returns to determine its risk-neutral disaster probability. Others claim that because Bitcoin has no intrinsic value, it will inevitably crash to zero. On the other hand, Bitcoin advocates argue that the currency is backed by customer confidence and mathematics.

What Is The Meaning Of Bitcoin?

Bitcoin is a type of cryptocurrency that was first introduced in January 2009. It is invented based on the key concepts and notions presented in a whitepaper by Satoshi Nakamoto, a mysterious and pseudonymous figure. The name of the individual or people who invented technology is yet unknown. Bitcoin promises reduced transaction fees than existing online payment methods, and a decentralized authority controls it, unlike government-issued currencies.

How Many Bitcoins Are There?

There are 18,730,931.25 Bitcoins in circulation as of June 2021. The total number of Bitcoins that would ever be there is just 21 million. On average, 144 blocks are mined every day, with 6.25 Bitcoins per block. The average number of new Bitcoins mined every day is 900, calculated by multiplying 144 by 6.25.

How To Make Bitcoin?

Bitcoin mining is not just the process of putting new Bitcoins into circulation, but it is also an essential part of the blockchain ledger's upkeep and development. It is carried out with the assistance of highly advanced computers that answer challenging computational math problems. Miners are rewarded for their efforts as auditors. They are in charge of ensuring that Bitcoin transactions are legitimate. Satoshi Nakamoto, who is the founder of Bitcoin, innovated this standard for keeping Bitcoin users ethical. Miners help to prevent the "double-spending problem" by confirming transactions.

How Can I Convert Bitcoins To Cash?

Bitcoin may be converted to cash in various ways, including crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, and Peer to Peer Transactions. You may do this by using Bitcoin exchanges like WazirX. You may also sell Bitcoin for cash faster and more anonymously through a peer-to-peer marketplace.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.