Table of Contents

Recently, former CEO of the insurance giant Prudential, George Ball in an interview with Reuters, said that bitcoin is an attractive long-term investment bet. He thinks that BTC is a safe haven for traders and investors.

It is important to know that Mr. Ball was previously a hater of bitcoin, cryptocurrencies and blockchain technology.

But then what made him change his heart? Why did a company like MicroStrategy buy $250 million worth of bitcoins last week?

Because these mainstream financial market bigwigs now believe that BTC has ‘concrete’ intrinsic value as opposed to traditional assets and markets.

And why’s that?

Because bitcoin is decentralized, durable, portable, fungible, scarce, divisible, and recognizable. And most importantly, the cryptocurrency’s design is based on the standard principles of mathematics.

Get WazirX News First

Decentralized

Probably the most unique trait that imparts bitcoin its value is decentralization. By the very design of its protocol, Bitcoin operates over a public network of computers – blockchain.

This network of participants keeps Bitcoin running by ensuring that every member has access to the latest version of the blockchain i.e the longest chain.

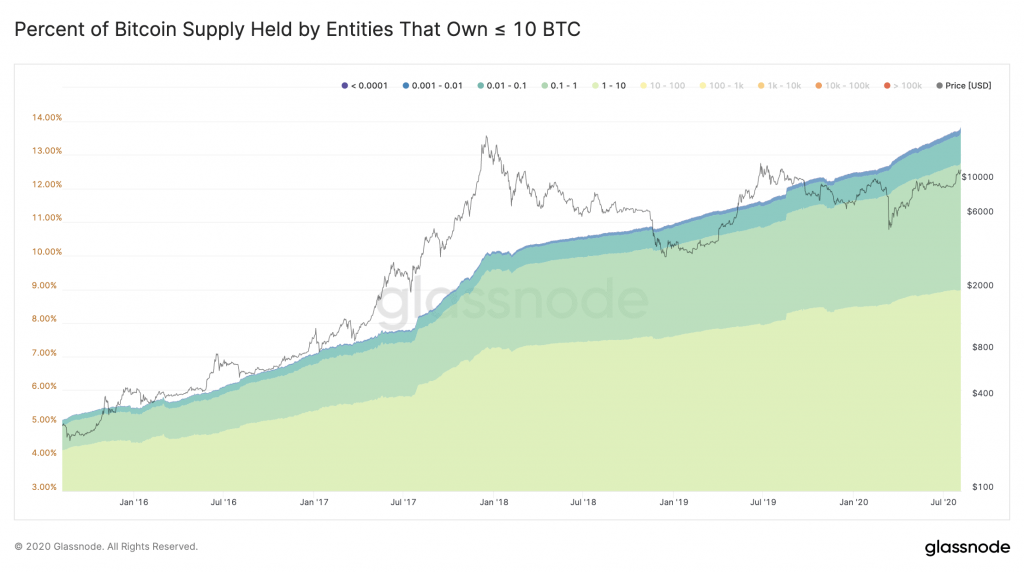

No central authority, or a third party organization controls Bitcoin. And recent data suggests that over the last 5 years, bitcoin’s ownership has become much more decentralized.

This means that the concentration of entities holding large number of BTC has reduced and those holding small quantities has significantly increased. One of the reason why bitcoin’s value is increasing.

Durability

Bitcoins are inherently lines of code that exist as ledger entries on a public and distributed network. For the last 11 years, this network has been running 24X7X365 with 99.98 percent uptime.

Cryptography secures BTC transactions. It also makes them remarkably efficient. Also, Bitcoin’s code is available in a public repository on GitHub, which in turn is stored in the Arctic Code Vault. From what it looks, bitcoin is a pretty durable asset and can stand the tests of time.

Portability

There are a number of wallet options available where you can transfer your BTC holdings and move around freely, travel anywhere you like.

You can access your bitcoins from anywhere across the world. Because the money that you spend on investing in BTC actually gets you ownership of a section on the Bitcoin blockchain.

This means that BTC is free from a physical form or a place of storage.

Bitcoin is so portable that now it is not necessary to connect to the internet for conducting a BTC transaction.

State-of-the-art advancements by Bitcoin development companies like Blockstream have made it possible to make BTC transfers without the web. So much so, that transactions can happen from outer space as well!

Scarcity

Scarcity is the most characteristic attribute of bitcoin that makes it a valuable asset. There will only ever be 21 million bitcoins.

This is a feature that pre-programmed in the Bitcoin right from the start when the first block was mined. Mining or the process of producing new BTC requires proof-of-work.

Miners have to prove that their hardware is capable of verifying transactions on the bitcoin protocol amid rising mining difficulty. This is how they win BTC rewards for successfully verifying transactions and circulating them in the market.

Also, a technical feature even known as halving which reduces the bitcoin block reward every four years, ensures that powerful miners don’t empty the entire remaining supply.

Divisibility

Divisibility is another aspect that makes bitcoin a valuable asset. 1 BTC is divisible into 10 million small entities. Each entity is a satoshi.

This means that bitcoin’s limited supply cannot hinder its adoption. The world’s topmost cryptocurrency can find usage even in fractional quantities, up to the eighth decimal place!

With regards to investment too, it is not necessary to buy 1 whole BTC. You can buy a few satoshis or just a small portion of the entire bitcoin.

Fungibility

Similar to all other legitimate assets like gold, and state-backed currencies like the INR, every bitcoin can be exchanged for another.

Bitcoins irrespective of their history of ownership and usage still continue to hold value up until the individual satoshi.

Bitcoins/Satoshis emerging from one source are completely interchangeable with an equivalent number of bitcoins/satoshis emerging from some other source.

Recognizable

As of date bitcoin has garnered a lot of respect and credibility as an investable asset. Despite being criticized as a scam, and a Ponzi scheme, BTC has made a lot of money for investors especially the early entrants.

Also, it has accrued quite some support from conventional financial market and technology influencers like Federal Reserve chairman Jerome Powell, billionaire macro investor Paul Tudor Jones, Twitter founder, and CEO Jack Dorsey, etc.

These are some of the attributes that explain why bitcoins have value. Know any other feature, that imparts value to BTC? Share them with us in the comments below!

Frequently Asked Questions

Who Created Bitcoin?

Bitcoin is the first application of the concept of "cryptocurrency," first articulated in 1998 on the cypherpunks mailing list by Wei Dai, who proposed a new form of money that relies on cryptography rather than a central authority to manage its creation and transactions. Satoshi Nakamoto published the initial Bitcoin specification and proof of concept on the cryptography mailing list in 2009. Satoshi exited the project in late 2010, with little information about himself available. Since then, the community has evolved, with numerous people working on Bitcoin. Satoshi's anonymity has sparked unfounded fears, many of which may be traced back to a misunderstanding of Bitcoin's open-source nature.

How To Convert Bitcoin To Cash?

There are many ways of converting Bitcoin to cash, such as crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, Peer to Peer Transactions. You can use cryptocurrency exchanges such as WazirX for this. Unlike typical ATMs, which allow you to withdraw money from your bank account, a Bitcoin ATM is a physical location where you may buy and sell Bitcoins using fiat currency. Several websites provide the option of selling Bitcoin in return for a prepaid debit card that may be used just like a standard debit card. You can sell Bitcoin for cash through a peer-to-peer platform in a faster and more anonymous manner.

How Much Is 1 Bitcoin Worth Today?

Check out the current price of Bitcoin on the WazirX exchange. Bitcoin's value is primarily determined by its supply and demand in the market. Other elements have an impact on its worth. Its intrinsic value can also be calculated by calculating the average marginal cost of producing a Bitcoin at any given time, based on the block reward, electricity price, mining hardware energy efficiency, and mining difficulty.

Is Bitcoin Mining Free?

Bitcoin mining isn't free, but it can be tried on a budget. Bitcoin mining is an essential part of the blockchain ledger's upkeep and development and the act of issuing new Bitcoins. It is accomplished by the use of cutting-edge computers that tackle complicated computational arithmetic problems. The effort of auditor miners is rewarded. They're in charge of ensuring that Bitcoin transactions go off without a fuss and that they're legal.

How To Invest In Bitcoin?

Bitcoin may be invested in two ways: through mining or exchanges. Bitcoin mining is carried out by high-powered computers that solve challenging computational arithmetic problems that are too difficult to complete by hand and complex enough to tax even the most powerful computers. WazirX, a Bitcoin exchange, is another alternative.

What Are The Chances Of Bitcoin Crashing?

Two Yale University economists (Yukun Liu and Aleh Tsyvinski) produced research titled "Risks and Returns of Cryptocurrency" in 2018. They looked at the possibility of Bitcoin crashing to zero in a single day. The authors discovered that the chances of an undefined tragedy crashing Bitcoin to zero ranged from 0 percent to 1.3 percent and was around 0.4 percent at the time of publishing, using Bitcoin's history returns to determine its risk-neutral disaster probability. Others claim that because Bitcoin has no intrinsic value, it will inevitably crash to zero. On the other hand, Bitcoin advocates argue that the currency is backed by customer confidence and mathematics.

What Is The Meaning Of Bitcoin?

Bitcoin is a type of cryptocurrency that was first introduced in January 2009. It is invented based on the key concepts and notions presented in a whitepaper by Satoshi Nakamoto, a mysterious and pseudonymous figure. The name of the individual or people who invented technology is yet unknown. Bitcoin promises reduced transaction fees than existing online payment methods, and a decentralized authority controls it, unlike government-issued currencies.

How Many Bitcoins Are There?

There are 18,730,931.25 Bitcoins in circulation as of June 2021. The total number of Bitcoins that would ever be there is just 21 million. On average, 144 blocks are mined every day, with 6.25 Bitcoins per block. The average number of new Bitcoins mined every day is 900, calculated by multiplying 144 by 6.25.

How To Make Bitcoin?

Bitcoin mining is not just the process of putting new Bitcoins into circulation, but it is also an essential part of the blockchain ledger's upkeep and development. It is carried out with the assistance of highly advanced computers that answer challenging computational math problems. Miners are rewarded for their efforts as auditors. They are in charge of ensuring that Bitcoin transactions are legitimate. Satoshi Nakamoto, who is the founder of Bitcoin, innovated this standard for keeping Bitcoin users ethical. Miners help to prevent the "double-spending problem" by confirming transactions.

How Can I Convert Bitcoins To Cash?

Bitcoin may be converted to cash in various ways, including crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, and Peer to Peer Transactions. You may do this by using Bitcoin exchanges like WazirX. You may also sell Bitcoin for cash faster and more anonymously through a peer-to-peer marketplace.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.