Table of Contents

MakerDAO is currently one of the most popular platforms in the DeFi world, so if you are familiar with the decentralized finance universe, there’s a good chance that you have heard of it. In 2020, even as the Covid-19 pandemic toppled fiat monetary systems across the globe, the DeFi space saw a significant rise in the number of daily active unique wallets, so much so that 2020 got dubbed the year of DeFi. This success of decentralized finance primarily got assigned to the MakerDAO platform, so big a part of the DeFi ecosystem it has come to be.

In this post, we talk about the MakerDAO platform, the DAI stablecoin, how it all works, and of course – MakerDAO price predictions for 2021.

What is MakerDAO?

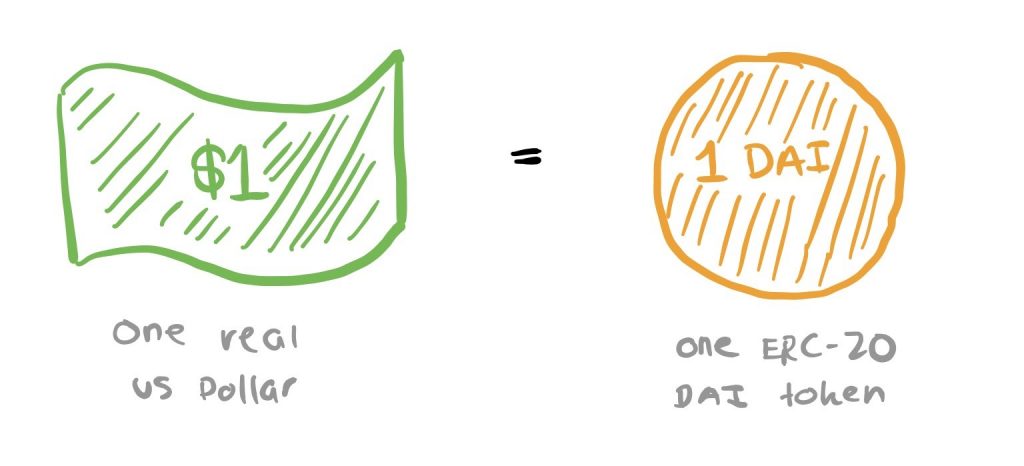

MakerDAO is best known as the platform to develop the stablecoin DAI . DAI is tethered to the value of the US dollar at a ratio of 1:1. Therefore 1 DAI = $1.

Created back in 2014, MakerDAO is an open-source project based upon the Ethereum ecosystem and a DAO or a Decentralized Autonomous Organization. However, the protocol launched the DAI stablecoins at the beginning of 2018. According to the market cap, the coin has grown significantly since then; as of the end of April 2021, DAI is ranked among the top 50 cryptocurrencies worldwide.

DAI has been designed to lower the impact of the price volatility most cryptocurrencies experience. It’s safe to say that at this point, DAI and MakerDAO together form the backbone of the still-developing DeFi universe.

How is DAI Different from Other Stablecoins?

DAI is definitely not the first stablecoin to exist upon a blockchain. It has its predecessors in USDT (Tether), TrueUSD, and more. Most stablecoins are usually backed by fiat currencies. Now, the threat associated with these stablecoins is that the custodial party that holds the actual fiat currencies can deny the redemption of any of these stablecoins on the ground of regulatory requirements.

Get WazirX News First

This is also the biggest difference between cryptocurrencies and stablecoins: while regular cryptocurrencies are permissionless, stablecoins are controlled by an authority figure.

Moreover, there’s also the fact that the custodial party might not have the right amount of fiat currency needed to power the stablecoins since there’s no way to verify whether they are telling the truth.

The Tether controversy has essentially made the traders and the crypto universe as a whole realize the issues associated with fiat-backed stablecoins. However, with DAI, traders can mostly forego the aforementioned risks. MakerDAO’s model vastly varies from other stablecoins primarily because it is decentralized – no central authority controls the issuance of DAI tokens. DAI is structured to use collateral in the form of Ethereum-based assets to preserve its peg to the US dollar.

The decentralized nature of MakerDAO is made possible by the holders of MakerDAO’s governance token MKR, who govern the platform through a decentralized autonomous organization.

How Does the MakerDAO Platform Function?

Maker warrants the stability of its DAO by making use of CDPs or Collateralized Debt Positions. These are smart contracts that keep the collateral users deposited on the platform and allow the generation of DAI tokens for borrowers. The presence of the debt locks up the collateral deposited within the smart contract until the users pay back the amount they had borrowed in DAI.

Naturally, once the debt is paid, a user can withdraw the collateral they had deposited. To preserve the system’s stability, an active CDP on Maker has a relatively higher collateral value than the debt.

This is how Maker works: first of all, a user has to send Maker their transaction to create a CDP. The user now funds the transaction, and once the collateralization is complete, the user can receive their DAI from the smart contract. The smart contract now accrues the debt and locks in the collateral deposited by the user until they pay back the debt and some additional fees like the Stability Fees payable in MKR.

This process allows MakerDAO to provide users with loans without requiring a trusted party to vouch for the borrowers or a KYC protocol. Instead, with Maker, the repayment terms are at the user’s preference, and the smart contract guarantees the collateral’s security.

Governance on MakerDAO

As mentioned before, governance on the MakerDAO protocol is supervised by the community of MKR token holders. Indeed, MKR holders can propose any changes in the way Maker is run or vote on the governance changes suggested by other users. MKR holders can vote on the many issues, including introducing new assets as types of collateral, changing the risk parameters of the existing collateral loans, picking price oracles and emergency oracles, and more. Further, MKR holders can also initiate an emergency shutdown of the Maker platform should they notice any threats or irregularities.

MakerDAO Price Prediction: Is It Worth Investing in 2021?

The MakerDAO price was around $582.22 on January 1 of 2021, and by the end of the month, it had already gone up to about $1,480.81. As of April 2021, Maker has been on a positive run so far, with MakerDAO price being near $4000 at the end of the same month. As per MakerDAO price predictions for 2021, the MakerDAO price will certainly go up despite market fluctuations.

Furthermore, according to MakerDAO price predictions and crypto experts the token could be trading at almost double its current value by the end of the year, with a MakerDAO price of over $7000. Going by these forecasts, it’s safe to call MakerDAO a safe investment as of right now.

And that was everything you need to know about the MakerDAO platform, all in one place, along with the MakerDAO price predictions. To trade DAI, and over a hundred other cryptocurrencies in India, do give MakerDAO on WazirX a visit!

Frequently Asked Questions

What Is Virtual Currency?

Virtual currency is a type of uncontrolled digital currency that can only be used online. It is exclusively stored and transacted using designated software, mobile or computer applications, or unique digital wallets, and all transactions are conducted through secure, dedicated networks. Because digital currency is just currency issued by a bank in digital form, virtual currency is not the same as a digital currency. Virtual currency, unlike ordinary money, is based on a trust structure and cannot be issued by a central bank or other banking regulatory organization.

Is Cryptocurrency Safe To Invest In?

Cryptocurrency investments are subject to market risks, but if sufficient security measures are not taken, trading accounts can be maliciously accessed. Investments come with risks and uncertainties, and we cannot claim that any digital currency investment is risk-free. Buying and selling cryptocurrencies can be risky even if the trader is knowledgeable about the market and treats their coins carefully.

How To Invest In Cryptocurrency Stocks?

Cryptocurrency can be purchased in two ways: through mining or exchanges. The process of confirming and adding transactions to the blockchain public ledger is known as cryptocurrency mining. Cryptocurrency exchanges are another option. Exchanges make money by charging transaction fees, but there are alternative platforms where you may communicate directly with other cryptocurrency traders.

Can I Invest In Cryptocurrency?

Yes, with exchanges like WazirX, you may invest in cryptocurrency in India. To begin, go to the WazirX website and register. After that, you will receive a verification email. The link received by verification mail will only be available for a few seconds, so make sure you click it as quickly as possible. This will successfully verify your email address. The following step is to set up security, so choose the best solution for you. After you've set up the security, you'll be given the option of continuing with or without completing the KYC process.

How Safe Are Cryptocurrencies?

Cryptocurrencies can be safe, but your crypto wallets can be hacked if proper security steps are not performed.There are also dangers and uncertainties associated with investments, and we cannot declare any virtual currency investment risk-free. Buying and selling cryptocurrencies does not have to be dangerous if the trader is well-versed in the market and treats his coins with care.

What Is Cryptocurrency?

A cryptocurrency is a digital currency secured by encryption, due to which chances of activities such as counterfeiting and double-spending taking place get close to impossible. Cryptocurrencies get created on blockchain technology ( a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are unique in that they do not get issued by any central authority. The term "cryptocurrency" comes from the encryption techniques used to keep digital currencies and the network safe.

What Is The Meaning Of Crypto?

A cryptocurrency is a digital currency that is secured by the process of cryptography, making counterfeiting and double-spending almost impossible to happen. Blockchain technology is used to produce cryptocurrencies ( a distributed ledger enforced by a distributed network of computers). Cryptocurrencies are distinct in that a centralized authority does not issue them.

Is Mining Cryptocurrency Legal?

Cryptocurrency mining can be time-consuming, expensive, and sporadically profitable. Mining has an appeal for many cryptocurrency enthusiasts as miners are paid directly with crypto tokens for their efforts. The legality of cryptocurrency mining is dependent on where you live. In India, there is no restriction on crypto mining.

Is crypto legal?

Crypto is legal in most countries, including India. While nations like the U.S. and many in Europe have regulatory frameworks, others like China have strict bans.

How Cryptocurrency Works?

Cryptocurrencies use cryptography technology to keep transactions and their units (tokens) secure. Cryptocurrency works via a technology called the blockchain. A blockchain is a decentralized technology that handles and records transactions across numerous computers. The security of this technology is part of its value.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.