Table of Contents

Cryptocurrencies are inherently volatile. But certain crypto assets retain their designated value over time – stable coins.

Stable coins are the ‘stable’ versions of their wild crypto counterparts. They are pegged to state-backed fiat currencies and sometimes to commodities like gold or oil.

Tether (USDT) is a fiat-collateralized stable coin. It is said to be 100 percent backed by the US Dollar in a 1:1 ratio. It is quite popular amongst bitcoin and cryptocurrency traders/investors.

But, USDT’s path to popularity has been quite an adventurous one. So, let’s dive in and try to understand it in detail.

History of Tether

In the beginning, there was no Tether, but Realcoin, the brainchild of Bitcoin Foundation boss Brock Pierce, entrepreneur Reeve Collins, and software developer Steve Collins. The company set up shop in Hong Kong and the Isle of Man.

Realcoin rebranded to Tether in the very same year and became associated with cryptocurrency exchange Bitfinex (also based in Hong Kong).

Bitfinex opened trading for USDT in January 2015 and since then the stablecoin has not looked back.

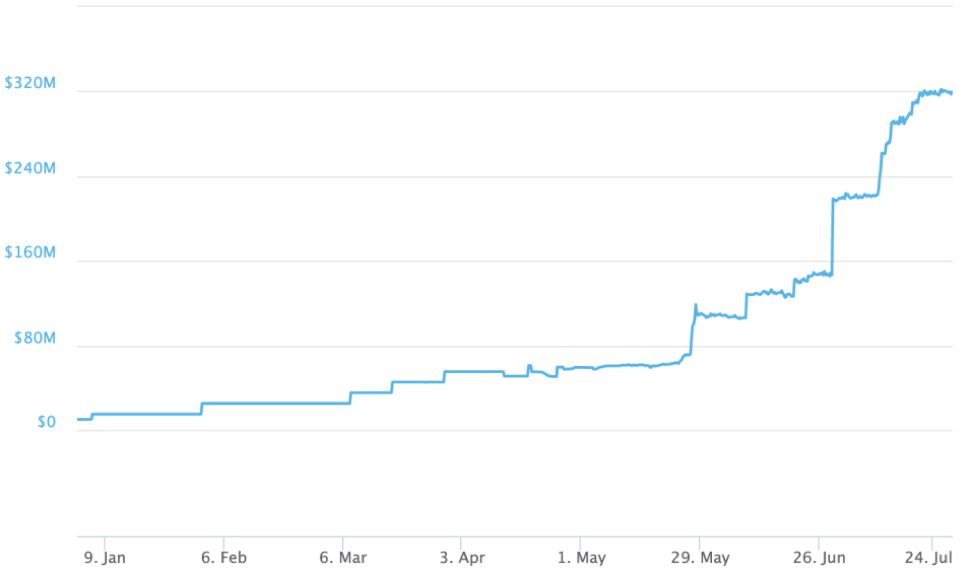

In 2017 Tether rose to prominence as the total USDT supply grew from $7 million to $320 million in just seven months.

The exponential growth in Tether’s supply continued throughout the 2017 bull market as bitcoin and cryptocurrency traders, leveraged USDT to enter crypto markets in large numbers.

USDT reported a 5X growth in circulation from $440 million to $2.3 billion in November 2017 to January 2018 window!

6 years after inception, Tether boasts of leading the cryptocurrency market wrt daily trading volumes. Also, the USDT supply figure has appreciated to the $10 billion mark.

How Does Tether Work?

Tether exists as a 1:1 currency peg for the US Dollar, Euro, and the Offshore Chinese Yuan . These fiat currency-backed stablecoins are essentially digital tokens that represent the value of their underlying assets.

They function just like their other cryptocurrency counterparts and move value on their respective blockchains.

Speaking of blockchains, Tether tokens operate on the Bitcoin (Omni and Liquid protocol), Ethereum, EOS, and Tron blockchains.

Tethers existing on these blockchains are like applications that leverage the open-source software of these decentralized networks for supply and issuance of tokenized real-world currencies.

All Tether stable coins are backed by reserves of the company. As per the official website:

The Tether Platform is fully reserved when the sum of all tethers in circulation is less than or equal to the value of our reserves.

Source: Tether FAQs, www.tether.to

Tether initially came up as a fiat-currency tokenization application idea on the Bitcoin network through the Omni protocol. But in recent times, Tether has found more success using Ethereum as it’s ‘transport protocol’.

One can now access smart contracts and decentralized applications on Ethereum using USDT.

Applications of Tether

Tether, most importantly USDT provides digital asset market participants with the best of both worlds – USD exposure and speed and security of cryptocurrencies.

Also, USDT makes BTC and crypto trading super convenient. And that’s why it is the most popular USD stable coin (yes, there are more) and the 4th most popular cryptocurrency in the world.

USDT can serve as the perfect medium of monetary exchange between individuals and institutions without the interference of banks and third-party financial organizations.

Recently, Tether announced the launch of Tether Gold (XAUT). Owning a XAUT stable coin translates to owning one ounce of physical gold, from the yellow metal stash located in a vault in Switzerland.

Currently, XAUT functions as a smart contract token on the Ethereum and Tron blockchains.

How to Buy Tether (USDT) Cryptocurrency Stablecoin in India?

WazirX has garnered the reputation of popularizing Tether usage in India with the best USDT to INR conversion rates.

As an alternative to the usual INR deposit and withdrawal mechanism, we launched the world’s first USDT based P2P transaction portal to let crypto traders and investors sort out transactions swiftly and with convenience and also check out the price of tether in india.

To buy USDT through WazirX, you need to register on the platform first, then finish a super quick KYC process and finally deposit funds for the purchase. Here’s how it goes:

Step 1: Account Creation

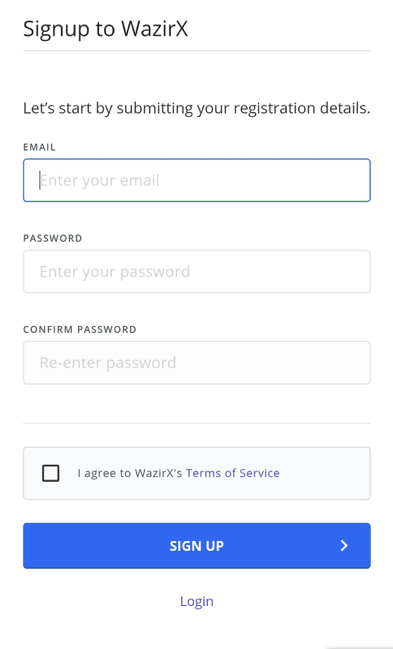

- Download the WazirX app or visit the website. Then hit the Sign-Up button

- Fill in your email address (one that you use frequently), and your desired password

- Click on the Terms of Service checkbox, but go through it once before checking

- Then press the Sign Up button

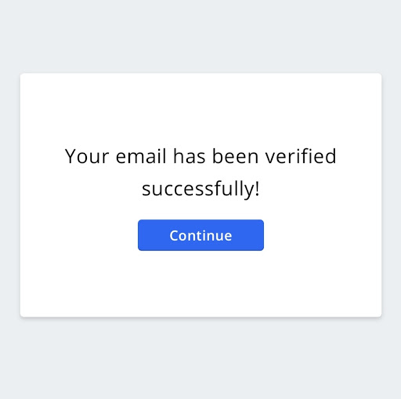

- You will be sent a verification email after hitting the sign-up button. If you have received it, click on Verify Email to complete the process. If you haven’t, check your spam folder. Or hit Resend Here. On successful verification, you should see this message:

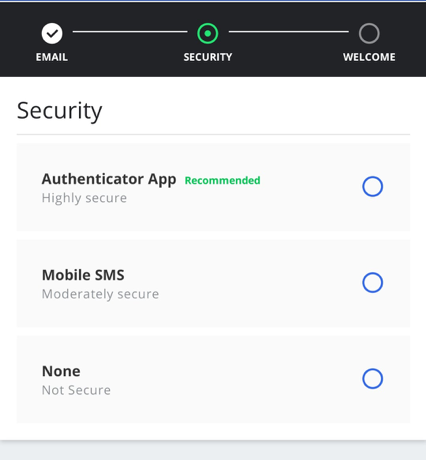

Securing Your Account

For security purposes, we highly recommend enabling 2-factor authentication (2FA). You can do so by downloading the Google Authenticator app and connecting it to your account.

KYC Verification

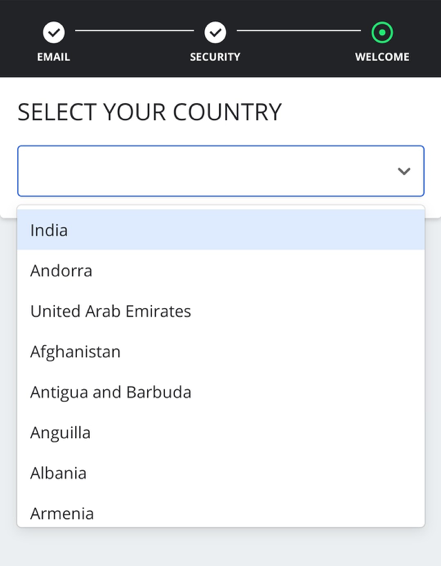

The last stage in the account set up process is KYC verification. Select your country from the list:

Then verify your KYC and finish the process. After that, you are all set to buy USDT from WazirX!

Step 2: Depositing Funds

Depositing INR

You can deposit INR funds from your bank account to your WazirX account via UPI/IMPS/NEFT/RTGS.

Just submit details like bank name, account number, IFSC code, etc of the bank account with which you wish to transact, and then you are good to go.

In case the INR deposit is rejected, check out the WazirX support page for such issues.

Depositing Cryptocurrency

Depositing cryptocurrencies into your WazirX account, either from your wallet or another exchange is an effortless process. It’s also free – with no fees charged on any deposit!

Start by obtaining your deposit address from your WazirX wallet. Then, share this address on the ‘Send Address’ section of your other wallet for transferring your cryptocurrencies.

For more details, check out the WazirX Support page on depositing cryptocurrencies.

Step 3: Buy USDT with INR

With all the necessary steps covered, you are now ready to buy USDT with your deposited funds. Here’s the process:

Log on to the WazirX app or website to view the latest USDT/INR prices.

On the app, press the USDT/INR price ticker. After that, scroll down a bit, and you will find the BUY/SELL button amongst the ‘Charts’, ‘Orders’, ‘Trades’, and ‘My Orders’ options at the bottom.

Enter the INR amount with which you want to buy USDT. Note that this amount should be less than or equal to the INR funds deposited in your WazirX account.

Hit BUY, and wait for the order to execute.

Once the transaction is executed, you should find the USDT bought added to your WazirX wallet.

Also you can download the app and Start Trading Now!

Android App – WazirX – Buy Sell Bitcoin & Other Cryptocurrencies

iOS App – WazirX

Frequently Asked Questions

How To Buy USTD In India?

To purchase Tether (USDT) in India, the best way is to register on a licensed and regulated Crypto exchange that lists and offers USDT trading. Any such exchange that has listed Tether on its platform will allow for the exchange of INR for the stablecoin or other digital assets. Deposits of INR can be made via various secure methods such as Bank Transfer, Debit/Credit Card, and UPI deposit for quick purchase of USDT. Here's a step by step guide on the same: https://wazirx.com/blog/how-to-buy-tether-usdt-coin-in-india/

What Is USDT P2P Wazirx?

P2P (peer-to-peer) on WazirX is a feature that enables users to buy or sell USDT directly from/to other users on the WazirX platform without the involvement of a third-party intermediary.

How To Withdraw USDT To Bank Account?

To withdraw USDT to a bank account, you can transfer your USDT to an exchange that supports the withdrawal of USDT to a bank account. Then, you can initiate a withdrawal request and provide the necessary information, such as the bank account number, name, etc. The withdrawal process may take a few days to complete.

How To Sell USDT In India?

The most popular ways of converting USDT to cash are through leading crypto exchanges or peer-to-peer platforms, which provide different payment options like bank account transfers, card payments, and UPI. USDT can be easily exchanged for other Crypto or fiat on licensed crypto exchanges such as WazirX. Many top exchanges support this digital asset because of its prominence and market share.

How To Convert USDT To BTC?

To convert USDT to BTC, you can use the WazirX web/mobile app. First, go to the "exchange" option and select BTC from the list of tokens available in the USDT market. Then, fill out the buy order form and click on "Buy BTC".

How To Create USDT Wallet?

To create a USDT wallet, you have two options. Either you can choose:

- a crypto exchange or

- a dedicated wallet provider.

Where To Buy USTD?

You can buy Tether (USDT) in India at a crypto exchange like WazirX. It is trusted by almost 1.3 Crores Indians and is considered one of the best exchanges in India that works continuously to improve its features and user experience.

How Does Tether USDT Work?

When a user puts fiat money into Tether's reserve, using that money to buy USDT instead of fiat, Tether then issues tokens representing that same digital amount. The USDT can then be shared, stored, or traded. According to a 1-to-1 dollar parity, if a customer deposits $100 in the Tether reserve, they will receive 100 Tether tokens. However, when users redeem Tether tokens for fiat money, the coins are destroyed and taken out of circulation.

What Is USDT?

USDT is a fiat-collateralized stablecoin which is pegged 1:1 to the U.S. Dollar. Each USDT is backed by one US dollar worth of assets and can be used like any other token on the chain it's issued on. Tether provides transparency, stability, and low fees for users, bridging the gap between fiat currencies and blockchain assets.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

One Comment