Table of Contents

The cryptocurrency industry started with Bitcoin. Ripple came later but both are equally popular amongst cryptocurrency investors and enthusiasts.

Bitcoin, the cryptocurrency, by numbers has the largest market share. XRP (Ripple’s very own digital currency token) is not far behind and ranks on number 4, as per data from CoinMarketCap and CoinGecko.

Both cryptocurrency systems employ blockchain in their operation yet there are a few differences on some fundamental levels. To talk about those differences, we have to take into consideration their primary aspects – the protocols and the cryptocurrencies.

First, let’s discuss the protocol differences.

Bitcoin vs Ripple: Protocol Differences

The Bitcoin Protocol

Satoshi Nakamoto founded the Bitcoin protocol as a “Peer-to-Peer Electronic Cash System” in 2009.

Basically, it is a decentralized public ledger that records all bitcoin (BTC) transactions. All ledger entries are made only after the transactions are verified sufficiently, which is done by bitcoin miners. Miners solve complex mathematical algorithms to process different BTC transfers. They then add the transaction data to the blockchain.

Get WazirX News First

Solving these math puzzles, verifying transactions, and consequently adding blocks to the blockchain requires considerable computing power and time. The quickest miners are rewarded for their efforts with an appropriate number of bitcoins. This is the ‘proof-of-work’ protocol that makes new BTC become a part of the Bitcoin economy.

After the latest halving event, the Bitcoin blockchain has been churning out nearly 900 bitcoins every day. For more information on bitcoin mining, check out the video below:

The Ripple protocols: RippleNet and XRPL

While the Bitcoin blockchain is an open platform for people to join, and contribute in it’s growth by transacting and mining, Ripple is a fintech company based in San Francisco, California with RippleNet being it’s unique fintech offering.

With RippleNet, the company intends to form a holistic ecosystem of banks, payment processors, and other financial institutions, enabling them to conduct super fast and efficient international payments. The primary idea is to enable real-time settlement of monetary transactions with adequate transparency and security.

Take a look at the video below to understand RippleNet’s design and it’s working:

RippleNet is Ripple’s financial technology facet, but there’s a decentralized aspect too. It’s the XRP Ledger or XRPL.

The XRP Ledger is a decentralized ledger secured by cryptography and powered by a network of peer-to-peer computers. XRPL’s native cryptocurrency XRP fuels all transactions on the network and together they are the primary operating force behind Ripple’s real-time financial transaction system.

It does not employ proof of work to verify transfers. Contrary to Bitcoin’s mining process, XRPL participants function as independent validating nodes and compare transaction records to ascertain the authenticity of transactions.

XRPL’s network of active validators are 153 in number and include universities, exchanges, and financial institutions.

Time and again, the company has constantly maintained that XRPL is an independent open-source platform and free from any kind of commercial association. This means that even if Ripple shuts down, the XRP Ledger will continue to operate normally.

Other Differences

Transaction Metrics

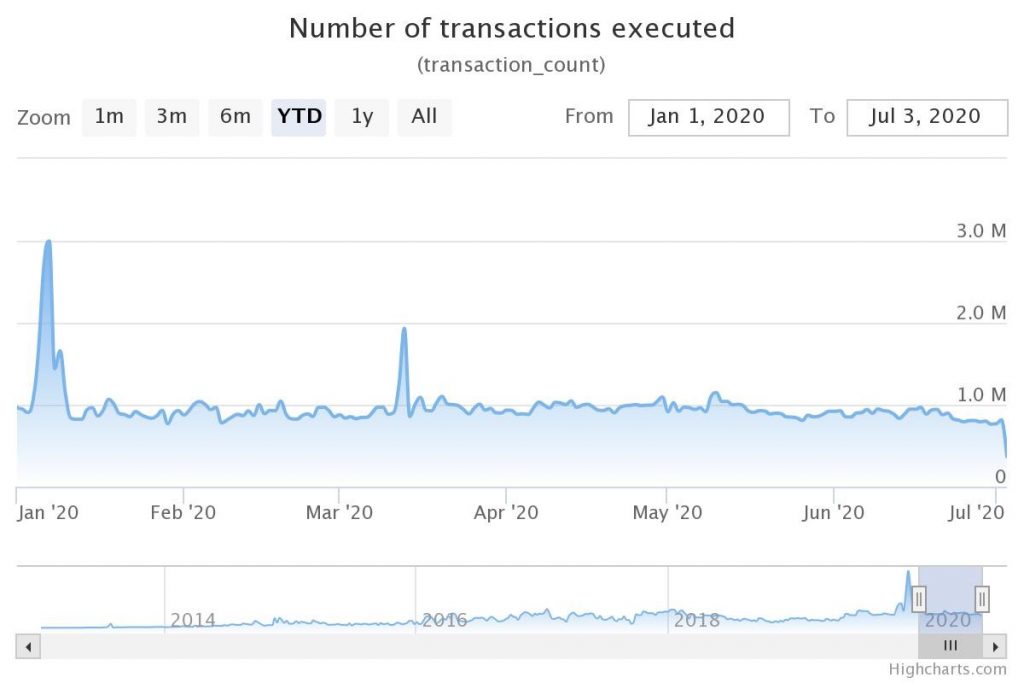

Bitcoin handles about 300,000 to 400,000 transactions per day with 7 – 15 transfers happening in a second. Confirmation times for transactions may range from several minutes to a few hours.

The XRP Ledger confirms transactions in 3-5 seconds. Data from the XRP metrics website, XRPSCAN reveals that XRPL has processed 800,000 – 1 million transactions per day in 2020.

BTC vs XRP: Cryptocurrency Differences

Cryptocurrency Supply and Circulation

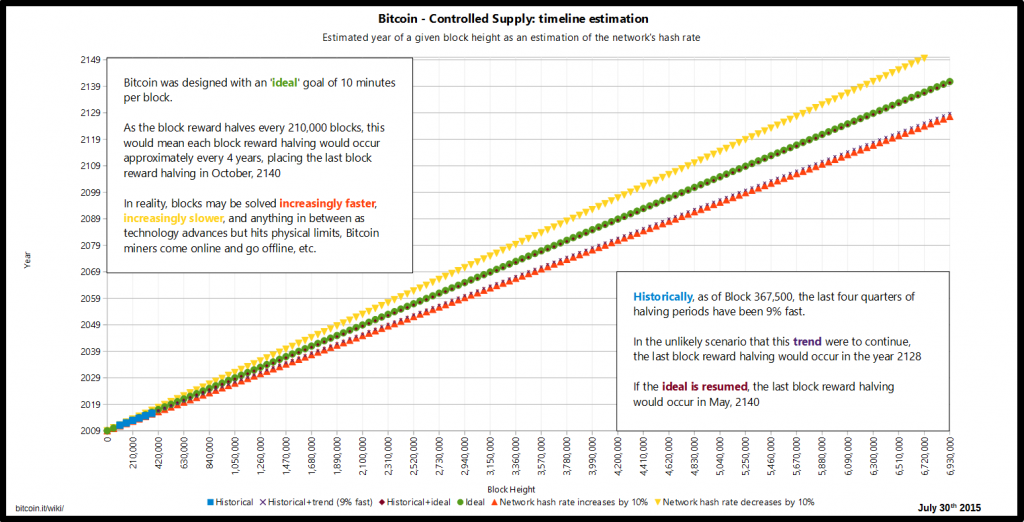

Bitcoins have a maximum supply of 21 million tokens. No individual or centralized authority controls BTC’s circulation. One of the most distinctive features of bitcoin is that it is divisible. One BTC consists of 100 million smaller units known as satoshis.

XRP has a total supply of 100 billion coins. These are indivisible. Out of these 100 billion units, millions were distributed in various stages of airdrops, preliminary sales, or private placements. Banks too received XRP for their international payment trials.

Ripple ensured that token distributions didn’t affect the XRP supply. The current circulation is a little above 44 billion. There is a smart contract operated escrow system in place, that releases 1 billion coins every month in the market. It is programmed to take back all unused XRPs after the month to avoid oversupply or misuse.

Application

Since the last 11 years, bitcoin has become widely popular for being an extremely profitable investment asset, similar to gold. Most folks just buy and hold BTC for extended periods to reap exponential profits. Apart from this, bitcoin has recently seen a significant influx of institutional investors, who trade in bitcoin derivative offerings, like futures and options.

Ripple is in the business of adding an increasing number of banking and financial partners to its growing payments ecosystem. As per the website, more than 300 financial institutions in 40+ countries are already using RippleNet. XRP is at the heart of these partnerships as the digital asset makes inter financial interactions possible.

Ripple also has an additional service called On-Demand Liquidity, for its partners to conduct smooth monetary transfers using XRP. Some of Ripple’s Indian partners include IndusInd Bank, Kotak Mahindra Bank, YES Bank.

Even with their dissimilarities, Bitcoin and Ripple are interesting and promising cryptocurrency platforms and can make a world of difference to global financial systems.

In order to truly gauge the potential of these cryptocurrencies, you will have to own and use them yourself. WazirX offers seamless options for you to buy bitcoin or Ripple’s token XRP or both comfortably. For more details visit: https://wazirx.com

Further Reading:

What is Litecoin (LTC), Hows is it Different from Bitcoin

What are the Differences Between Ripple (XRP) and Ethereum (ETH)

What is the difference between Bitcoin, Ethereum, and Ripple?

What is the difference between Litecoin and Ethereum?

Difference between Litecoin (LTC) and Ripple (XRP)

What is the difference between a token and a Bitcoin?

India Rupee vs Bitcoin: 6 things you should compare

What are the Differences Between Peer-to-Peer and Regular Bitcoin Exchanges?

What are the Differences Between Bitcoin and Ethereum?

Frequently Asked Questions

Is Bitcoin Mining Free?

Bitcoin mining isn't free, but it can be tried on a budget. Bitcoin mining is an essential part of the blockchain ledger's upkeep and development and the act of issuing new Bitcoins. It is accomplished by the use of cutting-edge computers that tackle complicated computational arithmetic problems. The effort of auditor miners is rewarded. They're in charge of ensuring that Bitcoin transactions go off without a fuss and that they're legal.

What Are The Chances Of Bitcoin Crashing?

Two Yale University economists (Yukun Liu and Aleh Tsyvinski) produced research titled "Risks and Returns of Cryptocurrency" in 2018. They looked at the possibility of Bitcoin crashing to zero in a single day. The authors discovered that the chances of an undefined tragedy crashing Bitcoin to zero ranged from 0 percent to 1.3 percent and was around 0.4 percent at the time of publishing, using Bitcoin's history returns to determine its risk-neutral disaster probability. Others claim that because Bitcoin has no intrinsic value, it will inevitably crash to zero. On the other hand, Bitcoin advocates argue that the currency is backed by customer confidence and mathematics.

How Bitcoin Mining Works?

Bitcoin mining is a crucial element of the blockchain ledger's upkeep and development and the act of bringing new Bitcoins into circulation. It's done with the help of cutting-edge computers that solve exceedingly challenging computational arithmetic problems. Auditor miners are rewarded for their work. They're in charge of ensuring that Bitcoin transactions go through smoothly and legitimately. This standard was established by Satoshi Nakamoto, the founder of Bitcoin, to keep Bitcoin users ethical. By confirming transactions, miners assist in avoiding the "double-spending issue."

How To Invest In Bitcoin?

Bitcoin may be invested in two ways: through mining or exchanges. Bitcoin mining is carried out by high-powered computers that solve challenging computational arithmetic problems that are too difficult to complete by hand and complex enough to tax even the most powerful computers. WazirX, a Bitcoin exchange, is another alternative.

How To Buy Ripple Coin In India?

Here are the common steps by which you can buy Ripple (XRP) tokens in India at your trusted Crypto exchange, like WazirX.

- Select a trusted Crypto exchange, like WazirX, that supports the Ripple token.

- Create an account: You can create your account by providing personal information and complying with the KYC verification.

- Add funds to your account: Exchanges support various ways by which you can add funds to your account. You can do a bank transfer or a debit/ credit card.

- Buy Ripple (XRP): You can now easily trade Ripple (XRP).

How To Convert Bitcoin To Cash?

There are many ways of converting Bitcoin to cash, such as crypto exchanges, Bitcoin ATMs, Bitcoin Debit Cards, Peer to Peer Transactions. You can use cryptocurrency exchanges such as WazirX for this. Unlike typical ATMs, which allow you to withdraw money from your bank account, a Bitcoin ATM is a physical location where you may buy and sell Bitcoins using fiat currency. Several websites provide the option of selling Bitcoin in return for a prepaid debit card that may be used just like a standard debit card. You can sell Bitcoin for cash through a peer-to-peer platform in a faster and more anonymous manner.

What Is Bitcoin And How Does It Work?

Bitcoin is decentralized digital money that may be bought, sold, and exchanged without an intermediary such as a bank. Bitcoin is based on a blockchain that is considered to be a distributed digital ledger. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain

How Many Bitcoins Will Ever Be Created?

The source code of Bitcoin stipulates that it must have a restricted and finite quantity. As a result, only 21 million Bitcoins will ever be generated. These Bitcoins are added to the Bitcoin supply at a predetermined rate of one block every ten minutes on average. The supply of Bitcoins will be depleted once miners have unlocked this number of Bitcoins. It's possible, however, that the protocol for Bitcoin will be altered to allow for a higher supply.

What Type Of Currency Is Bitcoin?

Bitcoin is a type of digital currency or cryptocurrency. In January 2009, Bitcoin was established. It's based on Satoshi Nakamoto's ideas, which he laid out in a whitepaper. The name of the individual or people who invented the technology remains unknown.

Should I Invest In XRP 2023?

XRP is a virtual currency that was created by Ripple Labs. It is used to facilitate cross-border payments and is often referred to as a "bridge currency." XRP is one of the top Cryptos by market capitalization and is traded on many Crypto exchanges. You can consider investing in XRP in 2023, but it is also advisable to conduct your own research before making any investment decision.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.