Table of Contents

The Indian crypto community has grown exponentially ever since the Supreme Court lifted the banking ban on digital currencies and the ongoing Bitcoin bull run. The gap between 1 BTC to INR continues to increase in value.

In the process of educating ourselves about Bitcoin and other cryptocurrencies, we have all asked how the Indian rupee (a fiat currency) is different from Bitcoins. To understand this, one needs to understand what Bitcoin is and what it brings to the table.

What is Bitcoin?

A Bitcoin is a digital currency that is not issued by any government organization or a private institution. It is backed by powerful technology known as the “blockchain,” which makes the process trustless and prevents a single party from taking control over the process. Relative to fiat, Bitcoins provide a more secure, privacy-oriented, and cheaper way of transaction.

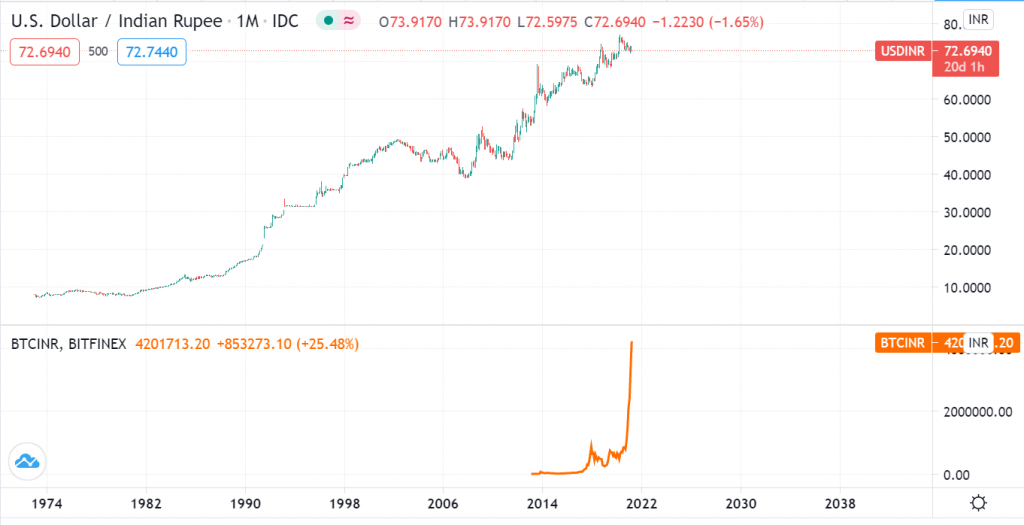

The markets decide the value of the Indian rupee, Bitcoin, or any other asset. The constant rise of Bitcoin price in India over the years shows strong adoption trends of Bitcoins and other cryptocurrencies.

INR vs. BTC – a comparison

INR vs. BTC: Governance

The biggest difference between the Indian rupee and Bitcoin is their governance. INR is issued by the Reserved Bank of India (RBI), India’s central bank and regulatory body. Like other fiat currencies, INR is centralized, and the supply could be changed according to the market demands.

On the other hand, Bitcoin is governed by the community, i.e., every decision regarding the blockchain and network will be taken by the miners. The voting process in the community follows the rule of 1 GPU: 1 vote. The supply of Bitcoin is predetermined by the algorithm, and so is the number of coins.

INR vs. BTC: usability

Billions of Indians use the Indian rupee for multiple decades; like other fiat currencies, INR is mostly used in cash for day-to-day monetary needs. People can also transfer money from bank account to bank account via IMPS, NEFT, UPI, or by debit or credit cards. The cross-border transaction, where INR is converted to any other fiat, can be proved to be very costly and hence not a good option.

Bitcoin, on the other hand, is a cheaper and dependable alternative for cross-border transactions. But the algorithm of Bitcoins restricts it for commercial purposes only; the transaction speed of Bitcoins is way lower than fiat. For instance, a MasterCard can carry out thousands of transactions per second, but Bitcoin can only carry out seven transactions per second, and if the network is busy, the price could shoot up. This leaves Bitcoin room to improve usability in day-to-day life.

INR vs. BTC: How are new currencies made?

In the case of INR, as mentioned above, RBI mints new currencies. The supply is variable according to the economic conditions of India.

Bitcoin’s transactions are supported by the community, the validators of Bitcoin transactions are known as miners, and they have to solve complex mathematical problems with the help of the computation power of their hardware. In return for their computation efforts, the algorithm rewards the miners with new Bitcoins, thus adding new Bitcoins to the supply. To further increase the demand, the supply of Bitcoin is fixed to 21 million. This process determines the Bitcoin price in INR, or any other currency for that matter.

INR vs. BTC: volatility

Since the whole country uses INR, it is important that it not be volatile. Due to this stable nature, you will find pairs like BTC to INR on Indian crypto exchanges. Traders can still trade INR on forex markets but less profitable than Bitcoin and other cryptocurrencies.

Bitcoin is volatile in nature, so volatile that it sometimes makes moves worth lakhs of rupees in a matter of hours. But this volatile nature of Bitcoin helped it increase its value from less than INR 50 to more than INR 40 Lakhs.

INR vs. BTC: currency model

The value of INR depends on inflation, forex demand, economic conditions, and many other factors. Even though the RBI can’t directly influence INR’s forex value, it can alter the supply by minting more or less amount, potentially influencing the buying and selling power.

Bitcoin comes into the category of the deflationary model of cryptocurrencies; this is because the mining reward is halved after every 210,000 blocks are mining. Also, the supply of Bitcoins has an upper market cap of 21 million. Due to these demand and supply rules, the price of BTC to INR is always on the rise.

INR vs. BTC: investment

INR and other fiats are generally safer than cryptocurrencies and require skills for good returns. Forex markets are generally not volatile and are made for scalping. They are certainly not profitable as the BTC markets.

Even though cryptocurrencies are volatile, they can bring you significant returns if you play your cards right. The above chart shows the exponential growth of BTC over the years in the monthly time frame.

Want to invest in Bitcoins from India? WazirX has got you covered with hundreds of cryptocurrencies from BTC to INR pairs. Sign up on WazirX right now.

Further Reading:

How to trade in cryptocurrency in INR?

6 Things to Consider Before Investing in Bitcoin

4 Things to Consider Before Investing in Cryptocurrencies

Frequently Asked Questions

Is Bitcoin Trading Is Legal In India?

In 2020, the Supreme Court of India lifted the RBI’s restrictions on cryptocurrencies. According to the Supreme Court, the existence of Bitcoin or another cryptocurrency is unregulated but not unlawful. The verdict has greatly aided the world of digital money in the country. To put it another way, investing in Bitcoin is perfectly legal, and you may do so through various apps and traders.

How Bitcoin Mining Works?

Bitcoin mining is a crucial element of the blockchain ledger's upkeep and development and the act of bringing new Bitcoins into circulation. It's done with the help of cutting-edge computers that solve exceedingly challenging computational arithmetic problems. Auditor miners are rewarded for their work. They're in charge of ensuring that Bitcoin transactions go through smoothly and legitimately. This standard was established by Satoshi Nakamoto, the founder of Bitcoin, to keep Bitcoin users ethical. By confirming transactions, miners assist in avoiding the "double-spending issue."

How To Create Bitcoin Account?

Firstly, Go to the WazirX website and sign up. Then, a verification mail will be sent to you. The link sent via verification mail would be available only for a few seconds so make sure you click on the link sent to you as soon as possible, and it will verify your email address successfully. The next step is to set up security, so select the most suitable option for you. After you have set up the security, you will get a choice to either proceed further with or without completing the KYC procedure. After that, you will be directed to the Funds and Transfer page, where you could start depositing Bitcoins to your wallet. You can also deposit INR and then use it to buy Bitcoin for your WazirX Bitcoin wallet.

Is Bitcoin Mining Free?

Bitcoin mining isn't free, but it can be tried on a budget. Bitcoin mining is an essential part of the blockchain ledger's upkeep and development and the act of issuing new Bitcoins. It is accomplished by the use of cutting-edge computers that tackle complicated computational arithmetic problems. The effort of auditor miners is rewarded. They're in charge of ensuring that Bitcoin transactions go off without a fuss and that they're legal.

How To Invest In Bitcoin?

Bitcoin may be invested in two ways: through mining or exchanges. Bitcoin mining is carried out by high-powered computers that solve challenging computational arithmetic problems that are too difficult to complete by hand and complex enough to tax even the most powerful computers. WazirX, a Bitcoin exchange, is another alternative.

How Does Bitcoin Work?

The blockchain, a distributed digital ledger, is what Bitcoin is based on. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain. Entries are linked in chronological order to form a digital blockchain. Blockchain is decentralized, which means any central authority does not control it.

Is Bitcoin And Cryptocurrency The Same Thing?

Bitcoin is a cryptocurrency that was designed to facilitate cross-border transactions, eliminate government control over transactions, and streamline the entire process without third-party intermediaries. The absence of intermediaries has resulted in a significant reduction in transaction costs. Satoshi Nakamoto, the creator of Bitcoin, created the first cryptocurrency in 2008. It began as open-source software for money transfers. Since then, plenty of cryptocurrencies have emerged, with some focusing on specific fields.

What Is Bitcoin And How Does It Work?

Bitcoin is decentralized digital money that may be bought, sold, and exchanged without an intermediary such as a bank. Bitcoin is based on a blockchain that is considered to be a distributed digital ledger. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain

Is Bitcoin Safe And Legal In India?

In 2020, the Supreme Court of India lifted the RBI’s restrictions on cryptocurrencies. According to the Supreme Court, the existence of Bitcoin or another cryptocurrency is unregulated but not unlawful. The verdict has greatly aided the world of digital money in the country. To put it another way, investing in Bitcoin is perfectly legal, and you may do so through various apps and traders.

What Is Bitcoin Used For?

Bitcoin was created as a means of sending money over the internet. The digital currency was designed to be a non-centralized alternative payment system that could be used in the same way as traditional currencies. Bitcoin is being used by an increasing number of businesses and individuals. This includes establishments such as restaurants, apartments, and law firms.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.