Table of Contents

The world of cryptocurrency is continually evolving, and as investors and traders, it is crucial to be well-versed with tax regulations, especially Tax Deducted at Source (TDS) on crypto transactions, which has gained significant importance in recent times. This comprehensive guide will break down the intricacies of Crypto TDS, enabling you to remain compliant and track your crypto tax obligations effectively.

What is Crypto TDS?

Tax Deducted at Source (TDS) is a system where taxes are deducted at the source of income, acting as an advance tax payment. In the crypto context, TDS is applicable when specific transactions meet criteria defined by tax authorities. The Income-Tax Act, of 1961, introduced a new section, 194S, via the Finance Bill of 2022, levying a 1% TDS on the consideration paid for the transfer of Virtual Digital Assets (VDA). As cryptocurrencies fall under the definition of VDA, TDS is applicable to certain crypto transactions.

TDS Deduction and Rates

The following rates are applicable for TDS on various crypto transactions:

It’s important to note that if a user hasn’t filed their Income Tax Return in the last two years, and the total TDS amount for each of those years is ₹50,000 or more, the TDS rate for crypto-related transactions will be increased to 5%.

TDS Tracking

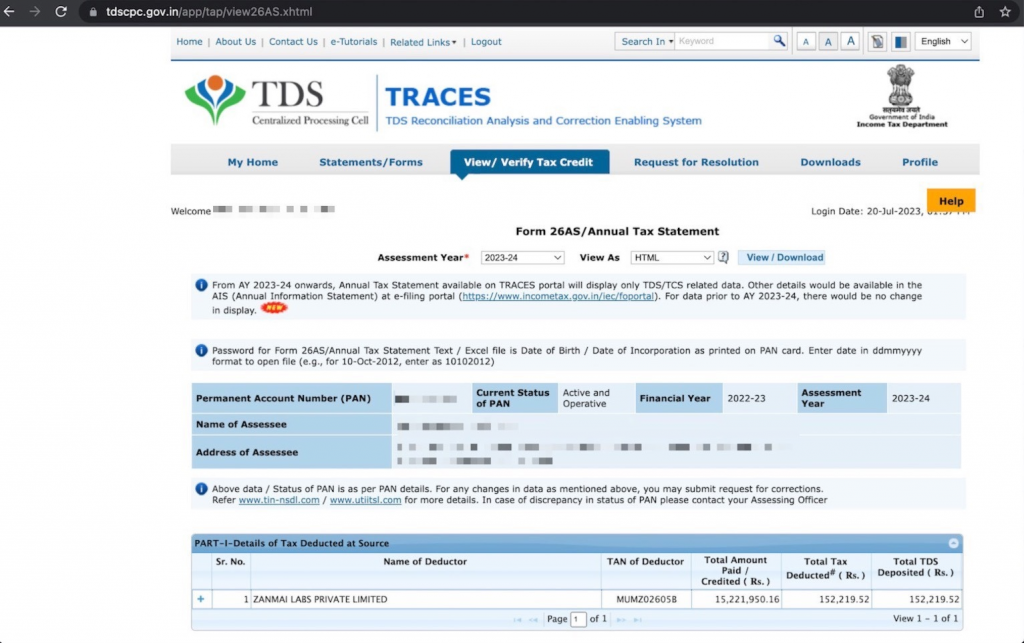

To check TDS details on the Income Tax platform, users can visit https://www.tdscpc.gov.in/app/login.xhtml and log in using their PAN details. New users can select “Register as a new user.” To view all TDS details, go to View/Verify Tax Credit > Select View Form 26AS > Select Assessment Year > Select View/Download. For transactions done on WazirX, the TDS details will be displayed under the Name of Deductor as “Zanmai Labs Private Limited”. (Check FAQ 1)

Additionally, users can check the deducted TDS on crypto for a specific trade on WazirX by visiting their completed order history and selecting the trade. The deducted TDS amount will be displayed. For a comprehensive history of TDS deductions, users can download their trading report by going to Account Settings > Download Reports > Trading Report > Enter the timeline > Request Trading Report.

Crypto/INR:

Crypto/Crypto:

In the above example, TDS is deducted in USDT. Later on, WazirX converts this USDT into INR and transfers it to the Income Tax Department.

As cryptocurrency gains mainstream acceptance in India, the government is taking steps to ensure proper taxation and compliance. Implementing TDS on cryptocurrency transactions is one such measure. By deducting tax at the source, the government aims to plug tax evasion loopholes and enhance revenue collection. To ensure compliance, authorities are leveraging KYC, transaction reporting, data sharing, and blockchain analysis. As a responsible citizen, it is crucial for every taxpayer involved in cryptocurrency transactions to be aware of these regulations and fulfill their tax obligations transparently.

TDS deduction is an essential aspect of crypto trading, ensuring compliance with tax regulations and contributing to the country’s revenue. WazirX takes care of TDS deductions on behalf of its users, making the process smooth and hassle-free. By understanding the rates, provisions, and tracking methods, crypto traders can stay informed about their Crypto tax liabilities and efficiently manage their crypto investments.

Frequently Asked Questions

What is the Total Amount Paid/Credited section under Zanmai Labs Private Limited in my Form 26AS mean?

The Total Amount Paid/Credited represents the total volume of trades done on WazirX where TDS was deducted.

PS: This is not your income!

Why is the TDS deducted on WazirX not shown in my Form 26AS?

For the trades done on WazirX, it can take up to 45-60 days after the financial quarter has ended for the details to reflect in your Form 26 AS.

Would my Form 26AS show my profit/loss received while trading?

No, Form 26AS would only display the volume of trades done on WazirX where TDS was deducted.

For a detailed overview of Crypto TDS, check out the following insightful video: