Table of Contents

Right now, Celsius is trending on crypto Twitter. There is a lot of speculation going around. Investors and depositors have concerns. A lot is going on. Was a CeFi lender created on top of quicksand, ostensibly on a robust and US-regulated foundation?

In this article, let’s find out what’s going on with Celsius.

A quick introduction to Celsius Network

The Celsius Network is a blockchain-based financial technology (fintech) network that provides interest-bearing savings accounts, borrowing, and payments using digital and fiat currencies. It runs on an economic basis that defies traditional banking paradigms while putting the Celsius community first.

Celsius distributes 80% of its earnings to network members as prizes, while the remaining 20% goes toward project expansion. The Celsius community is prioritized in this value offer, disrupting traditional banking methods. The Celsius Network creates an integrated ecosystem by combining its portfolio of goods with its native CEL token alongside significant digital assets and fiat currencies.

How does Celsius work?

The Celsius Network comprises Celsius-hosted accounts and several crypto exchanges to limit crypto-asset transfers outside of the system.

In the end, the Celsius system is made up of four crucial players:

- Lenders: Depositors who receive interest on their account’s assets.

- Borrowers: Margin traders that want to take short or long leveraged positions.

- Celsius Platform: Facilitates transactions, monitors risk, and calculates trading fees.

- External exchange markets: Executes deals and borrows/provides liquidity in the external exchange markets.

Earning

Participants deposit crypto assets on the Celsius network to make extra money and receive incentives in various cryptocurrencies, including Bitcoin, Ethereum, and USDC.

Celsius controls assets put in a ‘Lending Stake Pool,’ which are then loaned to other exchanges, and the interest earned is shared among users.

Celsius utilizes a modified Proof-of-Stake (PoS) formula to calculate the distribution given to lenders. The interest paid to lenders is a function of the cash placed and the number of days participating in Celsius’ consensus method.

Borrowing

Several users would want to use the Celsius platform to borrow money.

- General Users – Users that deposit crypto on the Celsius Network and utilize the funds as collateral to acquire a loan.

- Traders – The accredited investors (or SEC-registered funds) who borrow capital from Celsius lending pools to trade. These accounts require a minimum balance of $10k to cover potential losses and fees in certain trading activities.

- Exchanges – Institutions borrowing from Celsius loan pools will require additional liquidity to settle transactions.

So, that was a detailed explanation of what the Celsius network is and how it works. Next, let’s look at what’s happening in the aftermath of the Celsius network’s demise.

What’s happening with the Celcius network?

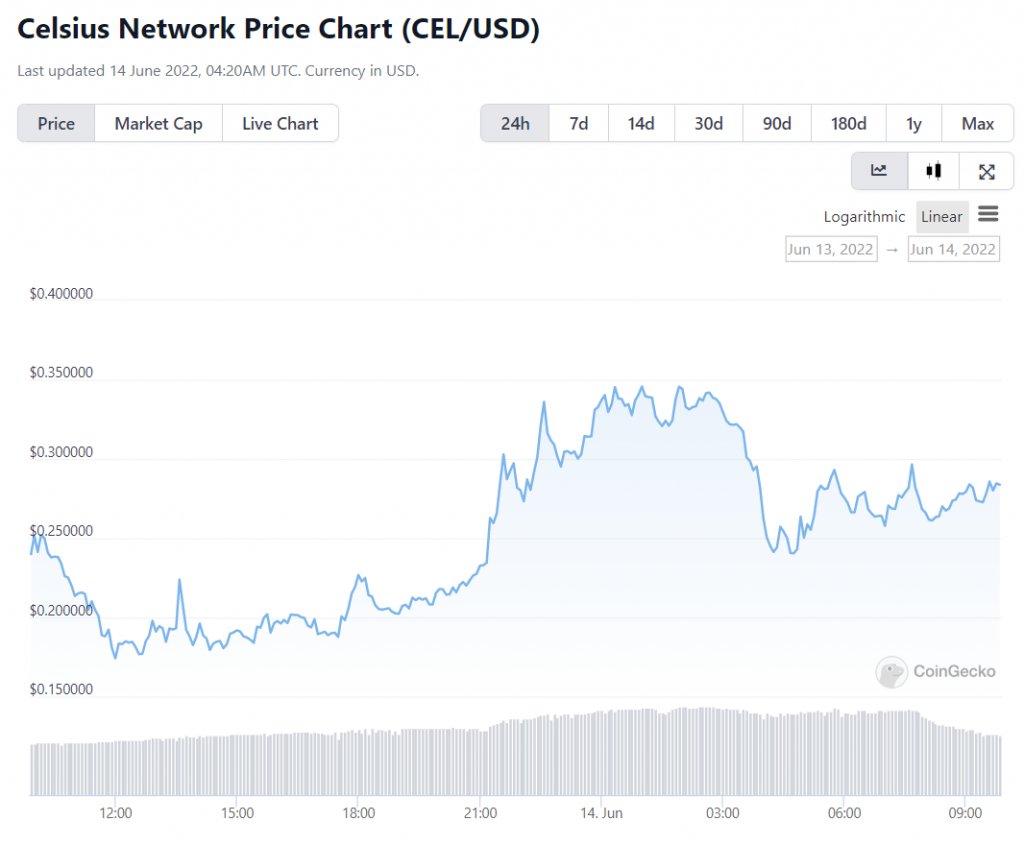

The digital token of Celsius Network Ltd. fell approximately 20% on Friday, June 10th, 2022, as concerns grow about the long-term viability of the high returns being provided by the lending platform and others in the crypto market in the aftermath of the Terra blockchain’s failure.

According to its website, Celsius’s CEL coin offers “real cash benefits,” including up to 30% more weekly returns. However, according to pricing statistics site CoinGecko, CEL sold at roughly 53 cents, down 21% in the last 24 hours.

Here’s a snapshot view of what the decline looked like:

While the cause of the current drop is unknown, demand for high-yielding lending methods has dropped since Terra’s failure in May. Depositors of TerraUSD (UST) stablecoins were promised payouts as high as 20% on the dead blockchain, which was the primary driver of Terra’s growth. Celsius has acknowledged its Terra exposure but has previously stated that it was able to avoid Terra’s issue early on.

In a public statement, Celsius recognized the drop but noted that the price is frequently influenced by market factors unrelated to the company’s performance.

“Looking across the entire crypto sector, we are undoubtedly in a crypto winter. The price of all cryptocurrencies has clearly been affected by a general market downturn. We are squarely focused on building for the long-term,” the statement stated.

Rehypothecation – One possible reason behind the fall

Rehypothecation is thought to be one of the causes of the Celsius network’s demise.

To figure out what’s going on with Celsius, we need to know what this phrase means. What do you suppose Celsius does with your ETH when you deposit it to earn 6% or USDC to earn 7.1 percent? Do they just sit on your money and keep it in your account?

To pay you interest, they need to make money on that money, like other investment organizations that operate with deposits, whether banks or otherwise. Net Interest Margin is the phrase used in banking to describe this. This is where they charge 5% for a loan and offer you 1% in interest. The Net Interest Margin is one of the banking business’s most significant ratios and KPIs, accounting for 4% of the difference. Celsius is doing the same thing.

Rehypothecation is when Celsius makes money by lending out your collateral. But, once again, that’s an oversimplification. What if a business borrowed money and then lent it out with your collateral?

We now have a corporation that functions as a fractional reserve bank, similar to a traditional bank. And that’s a bad thing. Since loan and investment losses might result in the loss of your collateral and the company’s losses, you assumed the collateral was safe.

Note: This helps keep the prices of Bitcoin, Ethereum, Litecoin, and other long-running blue-chip projects low.

Final thoughts

While short in liquidity, Celsius might be solvent and even profitable. But we don’t know, and considering some of the collateral mismanagement and ETH losses, we don’t believe this is the case. So if you believe the dangers at Celsius currently outweigh the profits, you should reduce your investment and sell the token if you have it.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.