The taxation of cryptocurrencies varies by country. Some countries, such as the United States, have a clear set of guidelines for taxing cryptocurrency transactions, while others have yet to establish clear regulations.

Overall, the global regulatory landscape for cryptocurrencies is constantly evolving, with many governments and financial institutions still trying to figure out the best way to handle this new technology.

Here are a few examples of how some countries approach crypto taxes:

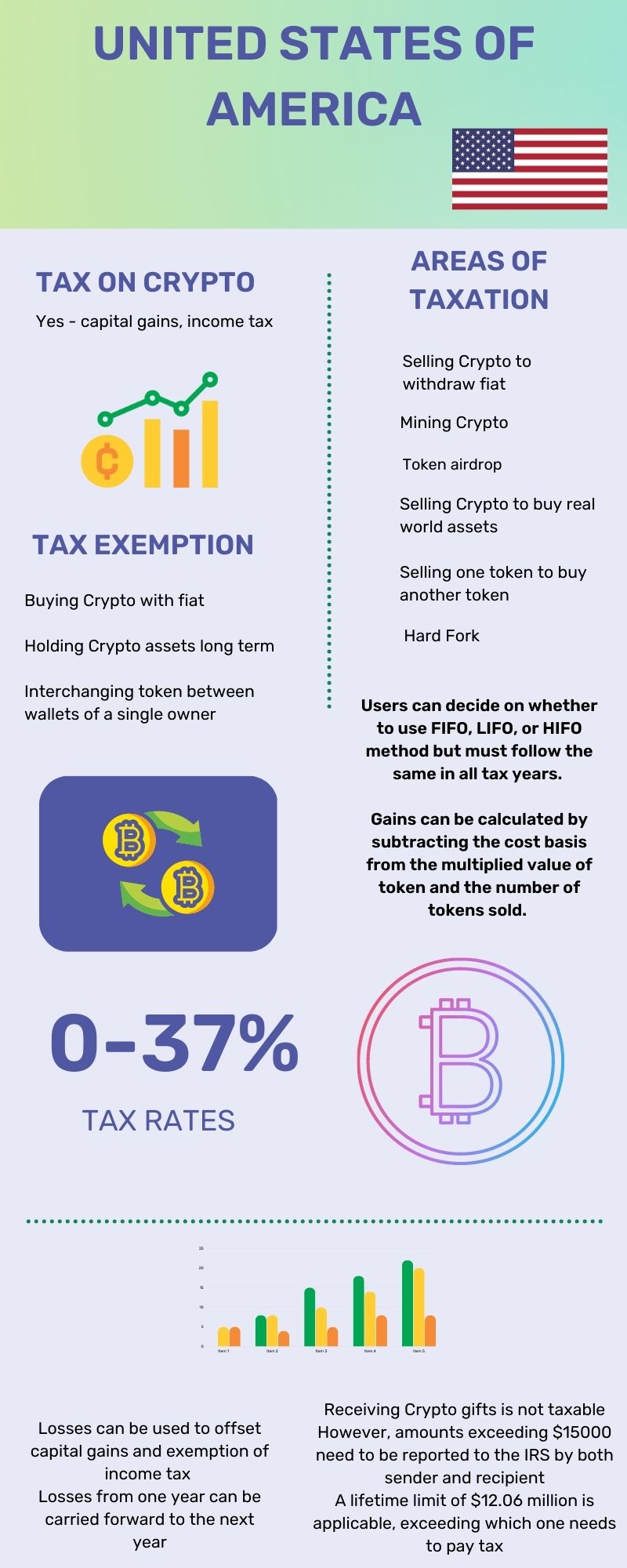

United States of America

In the United States, cryptocurrencies are considered property for tax purposes. This means that any transactions involving cryptocurrencies must be reported on your tax return.

Selling Crypto for fiat, token airdrops, mining or staking Crypto, buying one token with another are all taxable in the USA. The rates vary between 0-37% for capital gains and income tax. However, holding Crypto for long term or buying Crypto with fiat are not taxable.

Calculating Crypto tax is up to users who can choose to calculate Crypto by either FIFO or LIFO tax. FIFO(first in, first out) method means the total profits are calculated based on tokens which are bought first. LIFO(last in, first out) method means the total profits are determined based on the last tokens bought at the time of selling.

Here are some key points to keep in mind when reporting cryptocurrency taxes in the USA:

- Capital gains and losses: Any time you sell, trade, or exchange your cryptocurrency, you will have a capital gain or loss. These gains or losses must be reported on your tax return.

- Cost basis: Your cost basis is the original value of the cryptocurrency when you acquired it. This is used to calculate your capital gains or losses.

- Tax forms: Cryptocurrency transactions must be reported on Form 8949, Sales and Other Dispositions of Capital Assets. If you have a net gain from cryptocurrency transactions, you will also need to report it on Schedule D, Capital Gains and Losses.

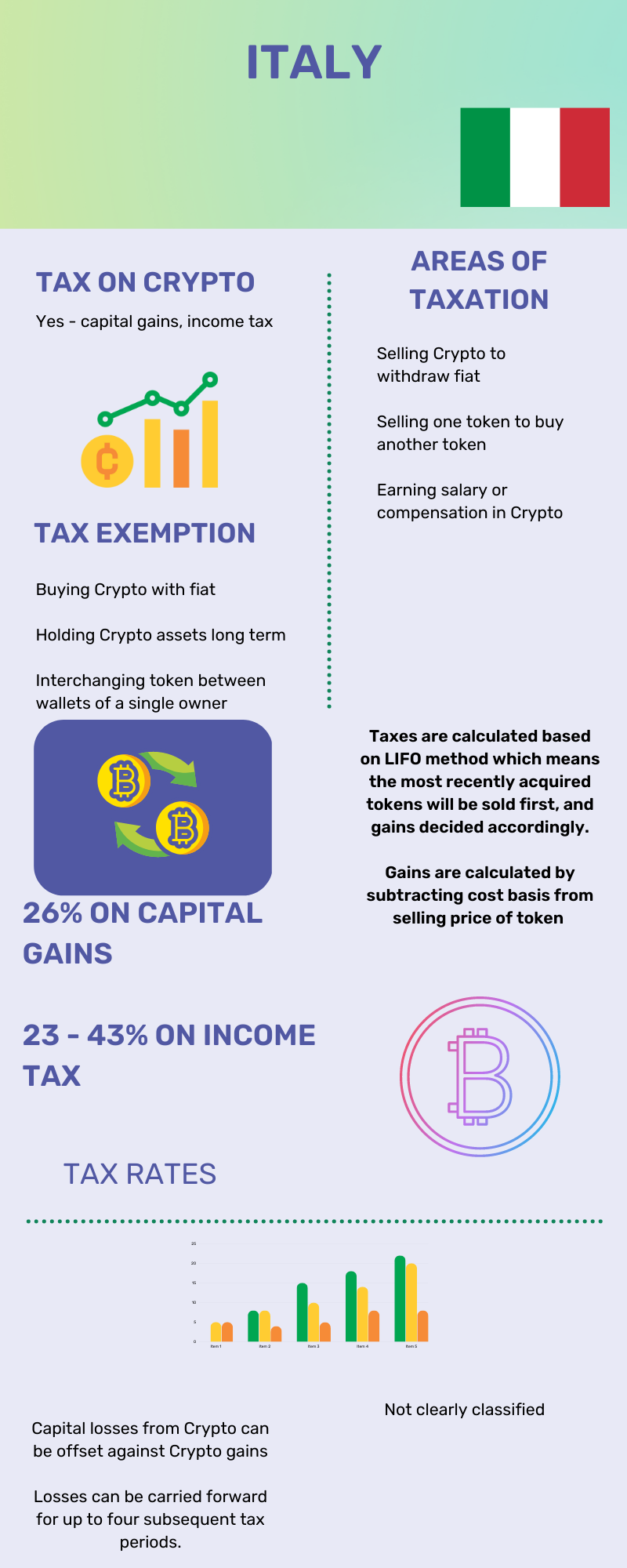

Italy

In Italy, cryptocurrency is considered a financial instrument and is subject to capital gains tax. If the value of the portfolio exceeds 2000 Euros, 26% capital gains tax is applicable as per the 2023 laws.

Buying Crypto with fiat, holding Crypto for long term will not accrue taxes. Selling Crypto to withdraw fiat, trading one token for another, etc, using Crypto to pay for real world assets, earning compensation in Crypto are all taxable.

In order to calculate capital gains, the cost basis of the token is subtracted from the selling price to get gains or loss value. It is usually done by LIFO(last in, first out) method where the total profits are determined based on the last tokens bought at the time of selling.

The Italian tax agency, Agenzia delle Entrate, considers cryptocurrency to be a financial asset and therefore subject to capital gains tax.

To report crypto taxes in Italy, individuals must include their cryptocurrency transactions and holdings in their Unico PF (Modello Unico Persone Fisiche) tax return. This includes any purchases, sales, exchanges, or transfers of cryptocurrency, as well as any income generated from mining or staking.

Individuals are also required to report the value of their cryptocurrency holdings at the end of the tax year, including any gains or losses from the previous year. It is important to note that the value of the cryptocurrency must be reported in euros, based on the exchange rate at the time of the transaction.

In case users don’t want to calculate the capital gains or fail to do so, they can pay a flat tax of 14% on their portfolio value.

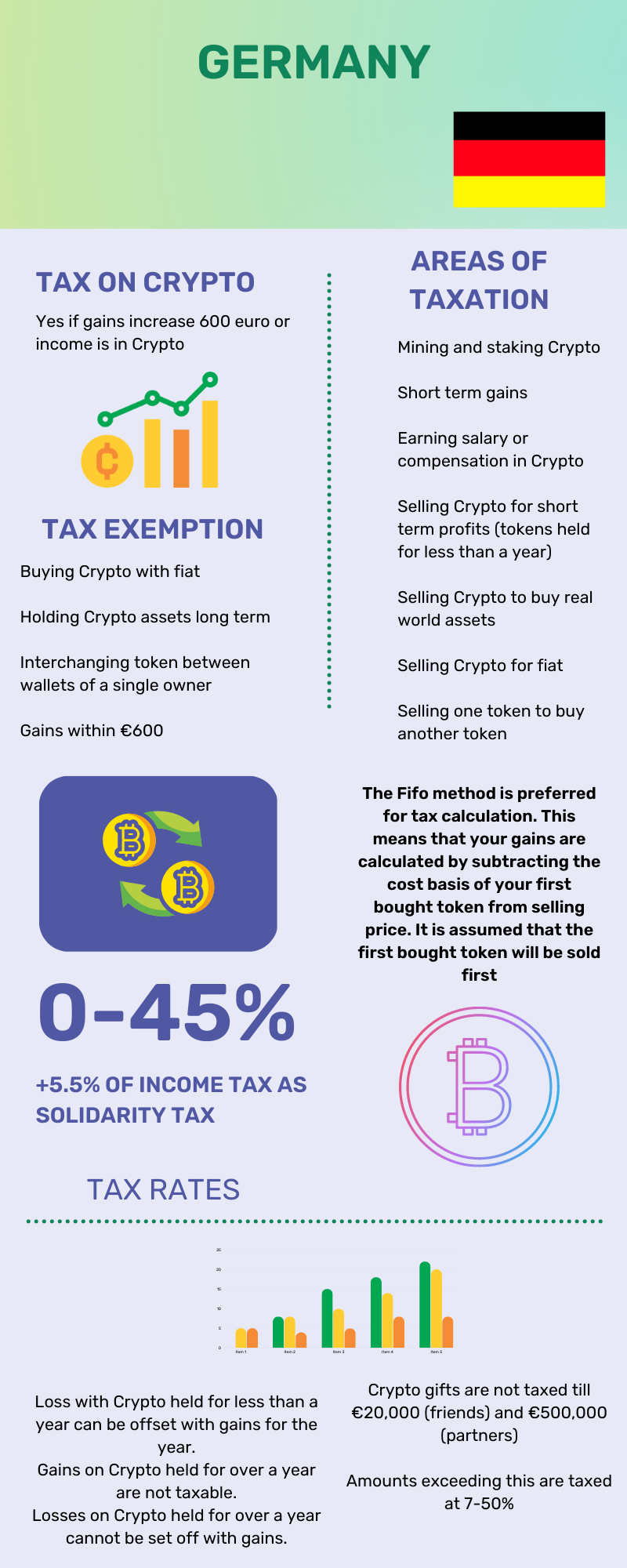

Germany

In Germany, cryptocurrency are private assets and are subject to Income Tax. Capital gains tax do not usually apply on individuals but on businesses. An individual’s profits are tax-free as long as they are under 600€.

Mining and staking income may be taxed as business income. In addition to that token airdrops, NFTs, using Crypto to buy fiat, other tokens or real world assets, earning compensation in Crypto, DeFi lending are all taxable.

It is important to note that the reporting and declaration of cryptocurrency transactions is the responsibility of the individual. The German Federal Tax Office has issued guidance on the proper reporting of cryptocurrency transactions, including the requirement to report all transactions regardless of their value.

In Germany, cryptocurrencies are private assets. Germany’s tax law states that private assets incur Income Tax. The tax rates are 0-45%.

German tax authorities recommend calculating Crypto taxes with the FIFO(first in, first out) method which means the total profits are calculated based on tokens which are bought first.

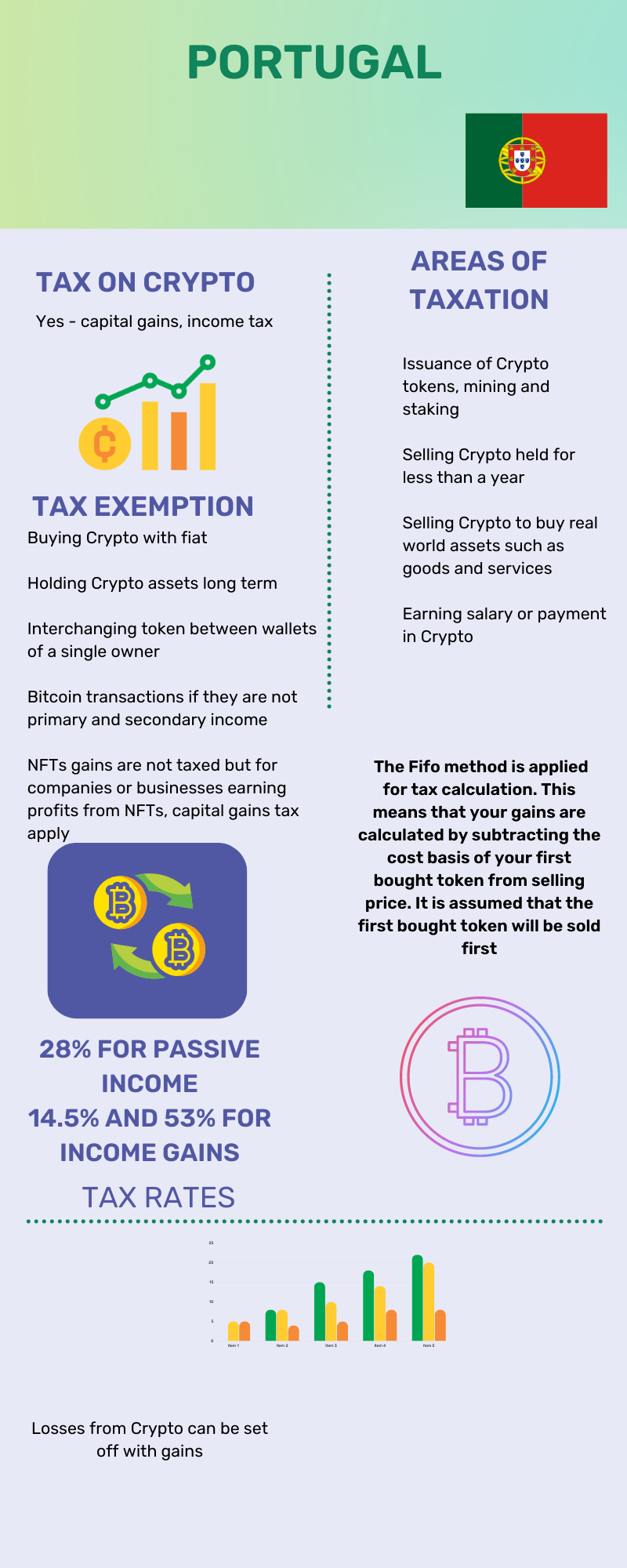

Portugal

In Portugal, cryptocurrency qualifies as capital income or self employment income.

Passive income from Crypto will be taxes at 28%. Crypto mining, validation, issuance of tokens, will be taxed between 14.5-53%

Portugal Crypto users calculate Crypto taxes with the FIFO(first in, first out) method which means the total profits are calculated based on tokens which are bought first.

If users stop being a resident of Portugal, they pay a 28% exit tax.

Individuals and businesses that buy, sell, or hold cryptocurrencies in Portugal must report their transactions to the PTA. They must also include any gains or losses from cryptocurrency transactions in their annual tax returns.

In addition to capital gains tax, individuals and businesses may also be subject to VAT (Value Added Tax) on their cryptocurrency transactions. The PTA considers cryptocurrency transactions as a supply of goods or services, and VAT is applied accordingly.

It is important to note that cryptocurrency transactions may also be subject to anti-money laundering (AML) and know-your-customer (KYC) regulations in Portugal. Individuals and businesses must comply with these regulations when conducting cryptocurrency transactions.

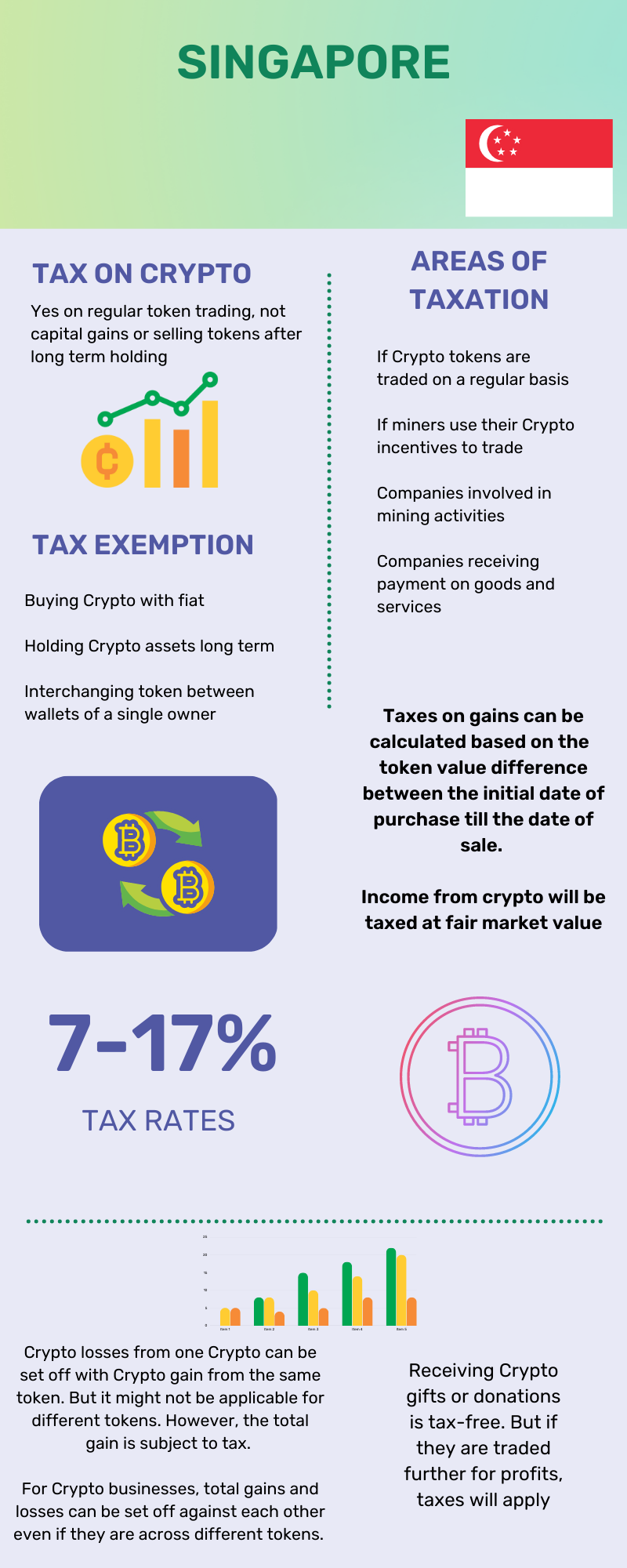

Singapore

In Singapore, cryptocurrency is treated as goods and is subject to Goods and Services Tax (GST) when used to purchase goods and services. However, capital gains earned on the sale of cryptocurrency is not currently taxed.

In Singapore, cryptocurrency transactions are subject to tax similar to other forms of income. The Inland Revenue Authority of Singapore (IRAS) has issued guidelines for individuals and businesses on reporting and paying taxes on cryptocurrency transactions.

Trading Crypto, mining Crypto and buying goods and services with Crypto are taxable. Income tax is applied at fair market value while capital gains are taxed by simply subtracting the cost basis of tokens from selling price.

It’s worth noting that these are general guidelines and tax laws may change over time in the respective countries. Hence it is recommended to consult a tax professional for more specific tax advice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.

Disclaimer: Cryptocurrency is not a legal tender and is currently unregulated. Kindly ensure that you undertake sufficient risk assessment when trading cryptocurrencies as they are often subject to high price volatility. The information provided in this section doesn't represent any investment advice or WazirX's official position. WazirX reserves the right in its sole discretion to amend or change this blog post at any time and for any reasons without prior notice.