Table of Contents

The Indian crypto community has grown exponentially ever since the Supreme Court lifted the banking ban on digital currencies and the ongoing Bitcoin bull run. The gap between 1 BTC to INR continues to increase in value.

In the process of educating ourselves about Bitcoin and other cryptocurrencies, we have all asked how the Indian rupee (a fiat currency) is different from Bitcoins. To understand this, one needs to understand what Bitcoin is and what it brings to the table.

What is Bitcoin?

A Bitcoin is a digital currency that is not issued by any government organization or a private institution. It is backed by powerful technology known as the “blockchain,” which makes the process trustless and prevents a single party from taking control over the process. Relative to fiat, Bitcoins provide a more secure, privacy-oriented, and cheaper way of transaction.

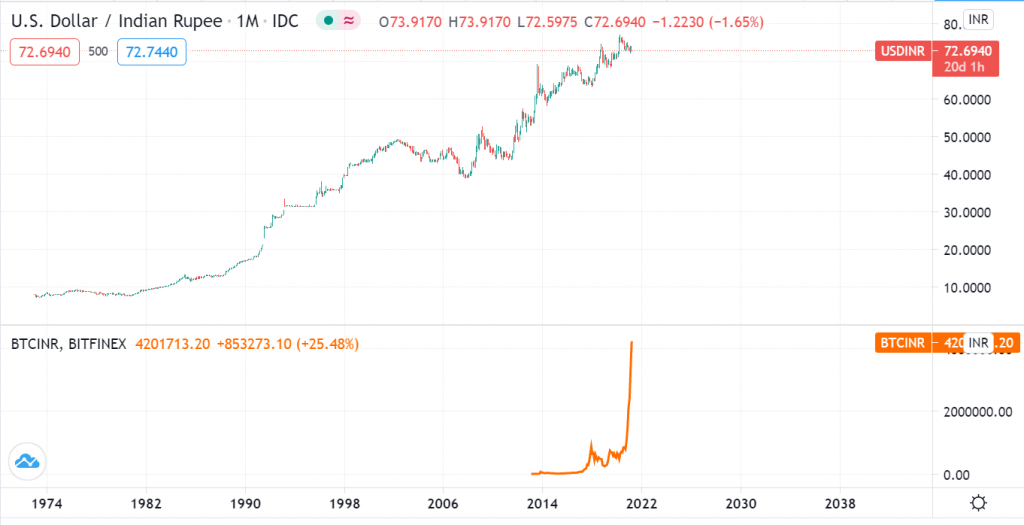

The markets decide the value of the Indian rupee, Bitcoin, or any other asset. The constant rise of Bitcoin price in India over the years shows strong adoption trends of Bitcoins and other cryptocurrencies.

Get WazirX News First

INR vs. BTC – a comparison

INR vs. BTC: Governance

The biggest difference between the Indian rupee and Bitcoin is their governance. INR is issued by the Reserved Bank of India (RBI), India’s central bank and regulatory body. Like other fiat currencies, INR is centralized, and the supply could be changed according to the market demands.

On the other hand, Bitcoin is governed by the community, i.e., every decision regarding the blockchain and network will be taken by the miners. The voting process in the community follows the rule of 1 GPU: 1 vote. The supply of Bitcoin is predetermined by the algorithm, and so is the number of coins.

INR vs. BTC: usability

Billions of Indians use the Indian rupee for multiple decades; like other fiat currencies, INR is mostly used in cash for day-to-day monetary needs. People can also transfer money from bank account to bank account via IMPS, NEFT, UPI, or by debit or credit cards. The cross-border transaction, where INR is converted to any other fiat, can be proved to be very costly and hence not a good option.

Bitcoin, on the other hand, is a cheaper and dependable alternative for cross-border transactions. But the algorithm of Bitcoins restricts it for commercial purposes only; the transaction speed of Bitcoins is way lower than fiat. For instance, a MasterCard can carry out thousands of transactions per second, but Bitcoin can only carry out seven transactions per second, and if the network is busy, the price could shoot up. This leaves Bitcoin room to improve usability in day-to-day life.

INR vs. BTC: How are new currencies made?

In the case of INR, as mentioned above, RBI mints new currencies. The supply is variable according to the economic conditions of India.

Bitcoin’s transactions are supported by the community, the validators of Bitcoin transactions are known as miners, and they have to solve complex mathematical problems with the help of the computation power of their hardware. In return for their computation efforts, the algorithm rewards the miners with new Bitcoins, thus adding new Bitcoins to the supply. To further increase the demand, the supply of Bitcoin is fixed to 21 million. This process determines the Bitcoin price in INR, or any other currency for that matter.

INR vs. BTC: volatility

Since the whole country uses INR, it is important that it not be volatile. Due to this stable nature, you will find pairs like BTC to INR on Indian crypto exchanges. Traders can still trade INR on forex markets but less profitable than Bitcoin and other cryptocurrencies.

Bitcoin is volatile in nature, so volatile that it sometimes makes moves worth lakhs of rupees in a matter of hours. But this volatile nature of Bitcoin helped it increase its value from less than INR 50 to more than INR 40 Lakhs.

INR vs. BTC: currency model

The value of INR depends on inflation, forex demand, economic conditions, and many other factors. Even though the RBI can’t directly influence INR’s forex value, it can alter the supply by minting more or less amount, potentially influencing the buying and selling power.

Bitcoin comes into the category of the deflationary model of cryptocurrencies; this is because the mining reward is halved after every 210,000 blocks are mining. Also, the supply of Bitcoins has an upper market cap of 21 million. Due to these demand and supply rules, the price of BTC to INR is always on the rise.

INR vs. BTC: investment

INR and other fiats are generally safer than cryptocurrencies and require skills for good returns. Forex markets are generally not volatile and are made for scalping. They are certainly not profitable as the BTC markets.

Even though cryptocurrencies are volatile, they can bring you significant returns if you play your cards right. The above chart shows the exponential growth of BTC over the years in the monthly time frame.

Want to invest in Bitcoins from India? WazirX has got you covered with hundreds of cryptocurrencies from BTC to INR pairs. Sign up on WazirX right now.

Further Reading:

How to trade in cryptocurrency in INR?

6 Things to Consider Before Investing in Bitcoin

4 Things to Consider Before Investing in Cryptocurrencies

Frequently Asked Questions

How Does Bitcoin Technology Work?

The blockchain is the foundation of Bitcoin. It is a decentralized, distributed ledger that tracks the provenance of digital assets. The data on a blockchain can't be changed by design, making it a real disruptor in industries like payments, cybersecurity, and healthcare.

Who Created Bitcoin?

Bitcoin is the first application of the concept of "cryptocurrency," first articulated in 1998 on the cypherpunks mailing list by Wei Dai, who proposed a new form of money that relies on cryptography rather than a central authority to manage its creation and transactions. Satoshi Nakamoto published the initial Bitcoin specification and proof of concept on the cryptography mailing list in 2009. Satoshi exited the project in late 2010, with little information about himself available. Since then, the community has evolved, with numerous people working on Bitcoin. Satoshi's anonymity has sparked unfounded fears, many of which may be traced back to a misunderstanding of Bitcoin's open-source nature.

What Are The Chances Of Bitcoin Crashing?

Two Yale University economists (Yukun Liu and Aleh Tsyvinski) produced research titled "Risks and Returns of Cryptocurrency" in 2018. They looked at the possibility of Bitcoin crashing to zero in a single day. The authors discovered that the chances of an undefined tragedy crashing Bitcoin to zero ranged from 0 percent to 1.3 percent and was around 0.4 percent at the time of publishing, using Bitcoin's history returns to determine its risk-neutral disaster probability. Others claim that because Bitcoin has no intrinsic value, it will inevitably crash to zero. On the other hand, Bitcoin advocates argue that the currency is backed by customer confidence and mathematics.

What Is The Meaning Of Bitcoin?

Bitcoin is a type of cryptocurrency that was first introduced in January 2009. It is invented based on the key concepts and notions presented in a whitepaper by Satoshi Nakamoto, a mysterious and pseudonymous figure. The name of the individual or people who invented technology is yet unknown. Bitcoin promises reduced transaction fees than existing online payment methods, and a decentralized authority controls it, unlike government-issued currencies.

How Bitcoin Works?

Bitcoin is based on the blockchain, a distributed digital ledger. As the name implies, blockchain is a connected database made up of blocks that hold information about each transaction, such as the date and time, total value, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological sequence, forming a digital chain of blocks. Blockchain is decentralized, meaning a centralized institution does not own it

How Many Bitcoins Will Ever Be Created?

The source code of Bitcoin stipulates that it must have a restricted and finite quantity. As a result, only 21 million Bitcoins will ever be generated. These Bitcoins are added to the Bitcoin supply at a predetermined rate of one block every ten minutes on average. The supply of Bitcoins will be depleted once miners have unlocked this number of Bitcoins. It's possible, however, that the protocol for Bitcoin will be altered to allow for a higher supply.

Is Bitcoin A Good Investment For The Future?

Some investors are afraid of the risks or devastation, but others are very eager to pursue the possibility of profit from a Bitcoin investment. A Bitcoin investment is similar to stock investing, except it can be more volatile.

How Can I Get Bitcoin?

To begin, go to the WazirX website and register. After that, you will receive a verification email. The link received by verification mail will only be available for a few seconds, so make sure you click it as quickly as possible. This will successfully verify your email address. The following step is to set up security, so choose the best solution for you. After you've set up the security, you'll be given the option of continuing with or without completing the KYC process. Following that, you'll be sent to the Funds & Transfers section, where you can begin depositing Bitcoins into your wallet. You may also use INR to fund your WazirX Bitcoin wallet and then use it to purchase Bitcoin.

How Does Bitcoin Work?

The blockchain, a distributed digital ledger, is what Bitcoin is based on. As the name suggests, blockchain is a linked database made up of blocks that store information about each transaction, such as the date and time, total amount, buyer and seller, and a unique identifier for each exchange. Entries are linked in chronological order to form a digital blockchain. Entries are linked in chronological order to form a digital blockchain. Blockchain is decentralized, which means any central authority does not control it.

Is Bitcoin Cash A Good Investment?

Bitcoin Cash is a hard fork of Bitcoin formed in 2017 to address Bitcoin's scalability and challenges. Bitcoin Cash seeks to make global transactions faster, cheaper, and more secure. Bitcoin Cash is now accepted by thousands of online and offline businesses all over the world. Studied correctly, Bitcoin Cash may be an investment worthy of consideration.

Disclaimer: Click Here to read the Disclaimer.

Disclaimer: Click Here to read the Disclaimer.